Fanfare please—Our economists are about to announce what is going to happen in the future.

Next week, Mark Schniepp from California Forecast will give us his prediction on 2015 real estate in Ventura County. It was funny, when I googled his company I typed in “California Forecast” with a space between the words. Up came a screen of the weather forecast with the words “PARTLY CLOUDY”. I hope Mark’s news is better than that. CaliforniaForecast

At the C.A.R. meeting in October, Leslie Appleton-Young will give her forecast for the California State real estate market. When I was a new agent with Dilbeck, my manager, Millie Gordon, trained us to be ready for the question we are often asked: “How is the real estate market doing?” Her advice was not to say “It’s OK”, but to answer “Last week I was with Leslie Appleton-Young, C.A.R.’s chief economist, and she forecasts the market to …….. Yep, that sounds much better, more professional, more believable. That’s why Dilbeck will be having Leslie Appleton-Young visit us to present her forecast on Wednesday, October 22. If you are a Dilbeck sales partner, please mark down this not-to-be-missed event. If you are not, let me know and I will see if there is room for you to join us.

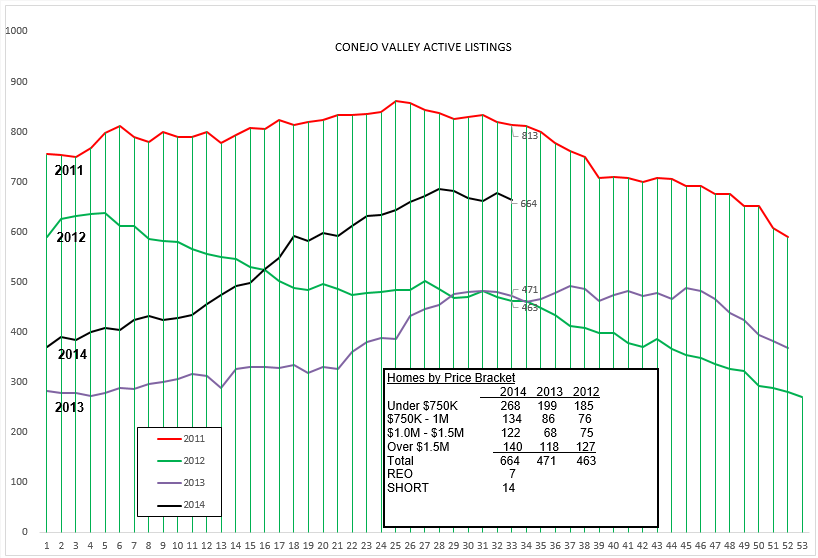

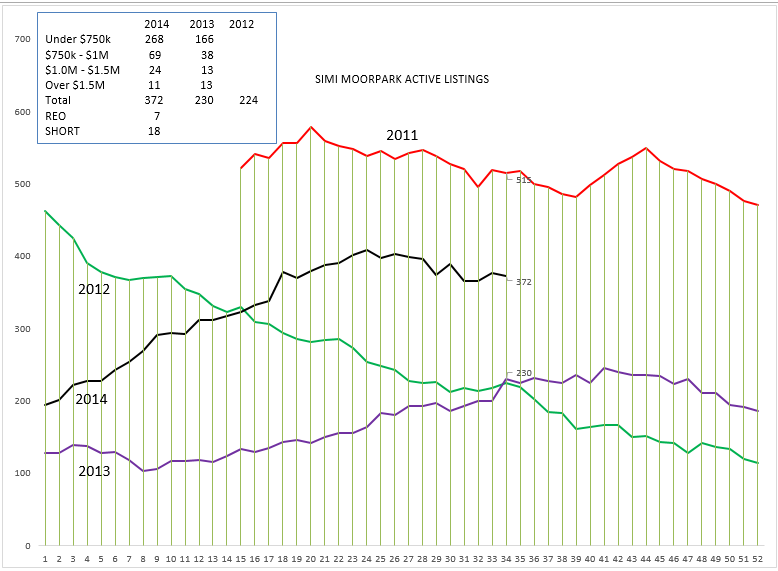

And how are things going locally? Last year, the feeling was that we could sell more homes if only we had more inventory. Let’s see how the inventory has grown from the preceding two years.

The inventory in both valleys has been growing, not too much, but certainly more than last year. The inventory is beginning it’s fall decline, heading into the end-of-year holidays. Seems pretty normal.

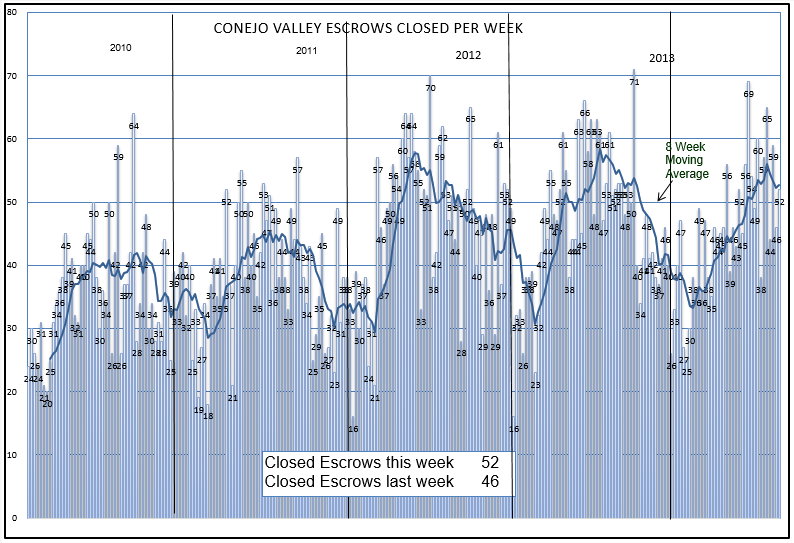

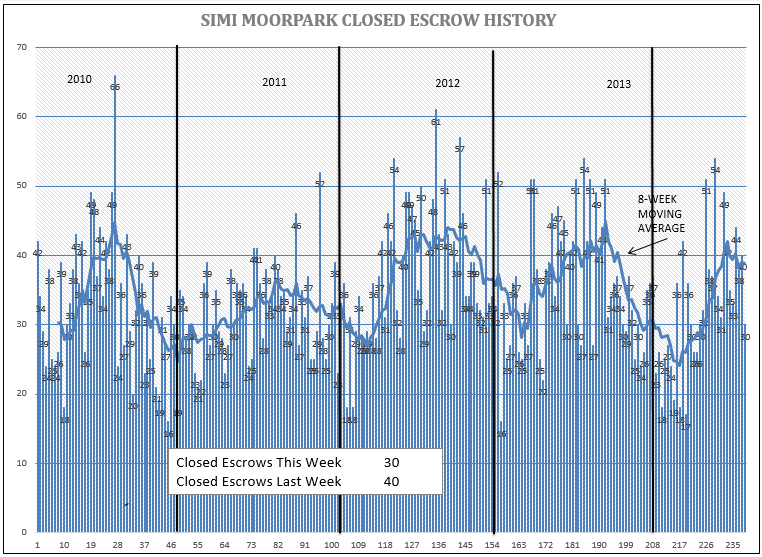

The other side of supply-demand is demand, expressed by closed escrows. The graphs for this year are typical of the last few years, with sales also beginning the expected fall decline.

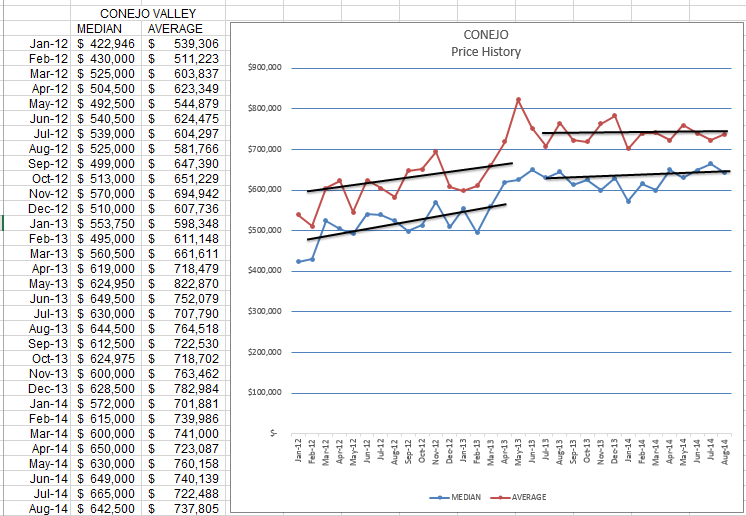

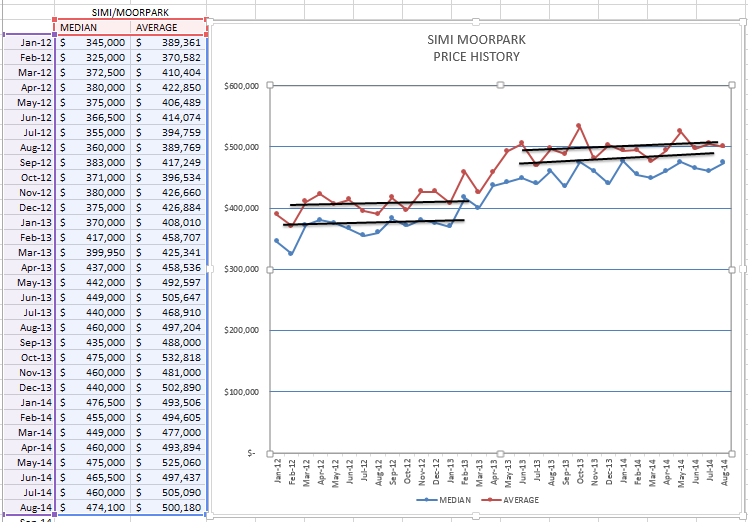

The final part of the supply-demand-price relationship involves price. In the graphs below, you can see prices have been keeping pace with inflation, up 2-3%. A lot of people want the prices to go up significantly. Those are called sellers. A lot of people want the prices to stay the same, or even recede. Those are called buyers. Until they buy, then they want the prices to climb.

The market continues to be excellent if the property is excellent. Homes sell quickly if they are perfect, and the lower the pricing segment the more rapid the sale. There are still some properties experiencing multiple offers, but it is the exception rather than the rule.

Let’s take a look at the graph of prices. Prices are often reported as if they can be computed to the fourth decimal point. But when you look at the variation month-to-month, you realize that there has to be some flexibility in the reported price. They don’t really go up and down each month. Pricing is more a range than it is a point.

The last 15 months have been the same for both Conejo and Simi valleys, but the period prior to that differed widely. Simi/Moorpark had a much larger quantity of short sales and REOs, and my belief is the troubled properties were the reason why prices did not rise as much compared to Conejo. But recent history shows a very strong market for the lower priced market, therefore Simi/Moorpark has been stronger, while Conejo has had a wet blanket tossed on it by the higher priced home inventory. Nothing to rave about in either area. but not much to complain about either. The market is good, not as good as last year, but good.

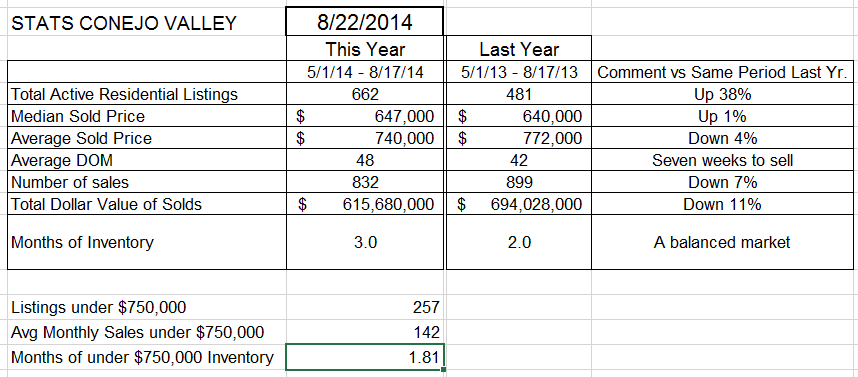

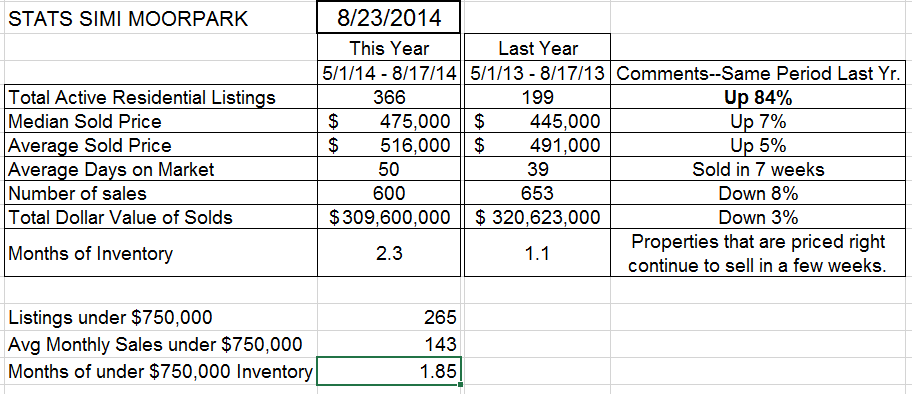

Finally, let’s look at the statistics for both areas. The price comparisons are for only a 3-month period, June through August for 2013 and 2014. I think this gives us a better idea of how prices have been changing. We could compare the last three months against the preceding three months, but that would remove seasonality from the comparison. Nothing is perfect, but by comparing only three months we have removed the averaging effect of the entire year comparison.

So what is your elevator speech, or your standing-in-line-at-the-supermarket-checkout speech, when you get the question “How is the real estate market doing?”

Prices continue to keep up with inflation. The inventory of unsold homes represents 2-3 months worth of sales, which in our area remains a decent, balanced inventory. Sales are 7-8% below last year, but more importantly that has not impacted prices. We live in a very desirable place, and the investment in our homes remains sound. Sellers are doing particularly well if their home has been updated. They are enjoying living in the update home, and sellers are doing well with higher prices and faster sales. I recommend you keep your home and your investment in good shape. If you are interested in knowing what your home is worth, give me your email address and I will send you some current information. If you are interested in what improvements give the best return on investment, I can send you that too.

Have a prosperous week.

Chuck Lech