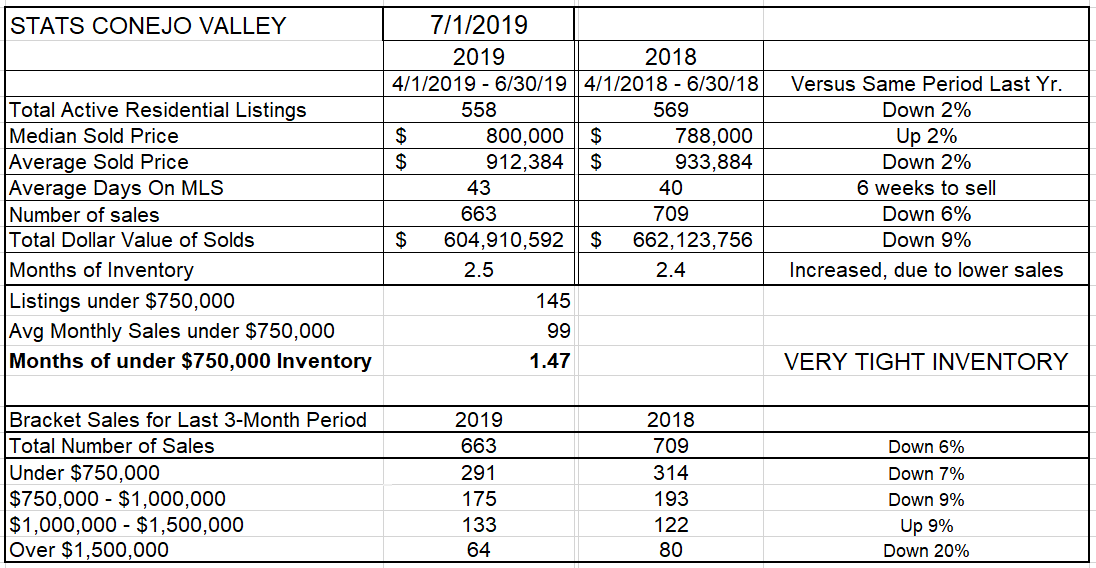

Real Estate in our valleys has experienced its own recession. Over the past year, the number of sales have been markedly lower even though prices kept stable to nominally increasing.

Now it looks like we are coming out of it. When I look back at the statistics in the early part of the year, we were experiencing double digit declines (11%) in sales. I suggest an 11% decline in sales qualifies as a real estate recession.

Currently, for the last three months, we continue to be behind, but only by 6%. We have been through the worst, and now things are relatively better. We are coming out of our industry recession, and prices never tanked.

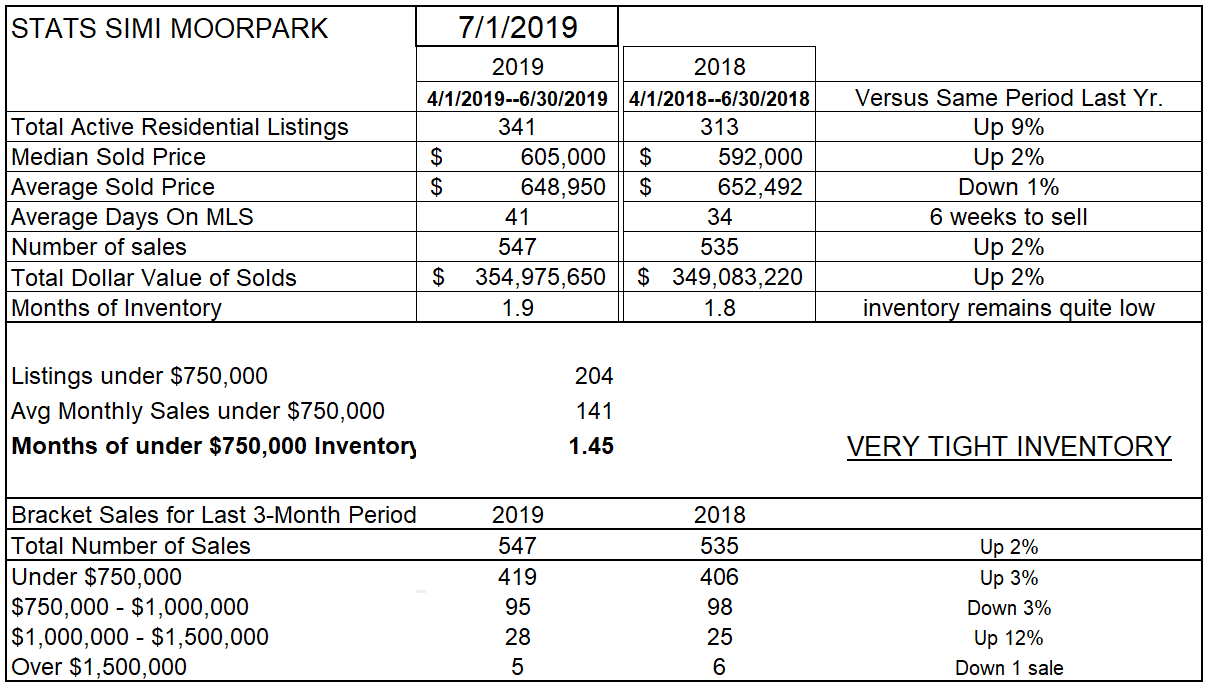

Simi Valley and Moorpark have been doing very well, thanks to the availability of inventory that was sorely missing last year. However, sales have slowed down to a more reasonable pace, and prices have peaked.

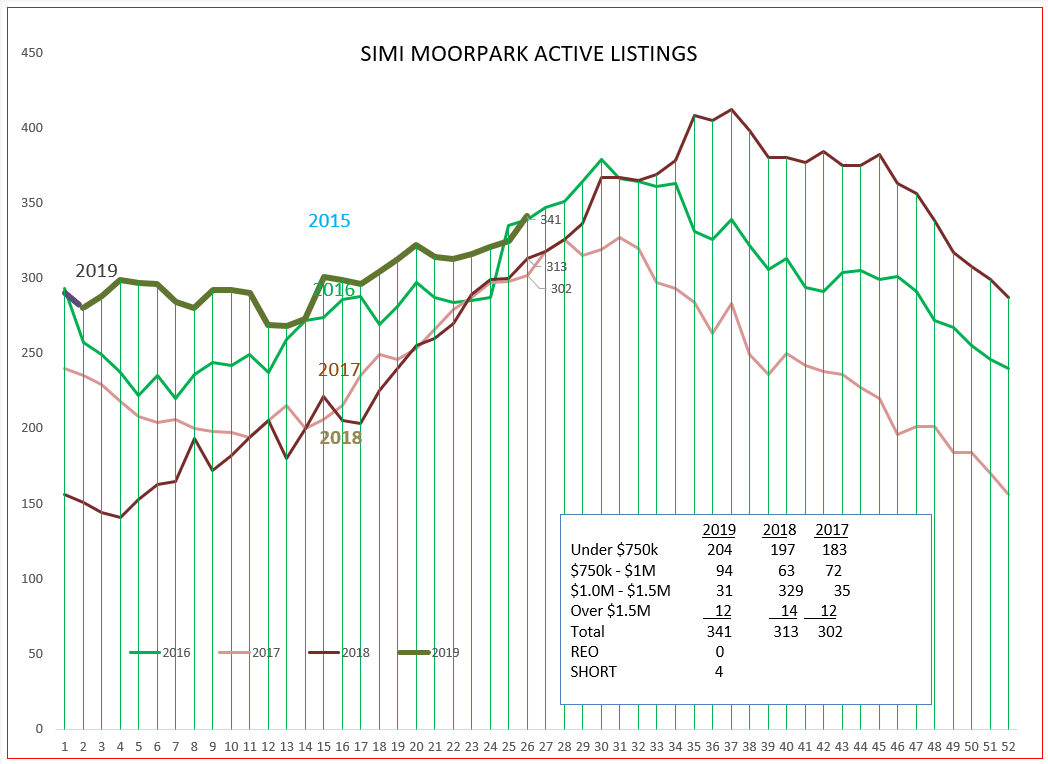

Comparing those same months for Simi Valley/Moorpark, we find the number of sales increased 2% in March and 3% in June. No recession here. Well,on second thought, maybe there was. In March a year ago, Simi/Moorpark had very little inventory, only 172 homes on the market. This year we have 341 homes, double the inventory of a year ago. The inventory shortage last year held sales lower. If the same normal inventory level was available last year as we currently have, last year would have seen much higher sales. And if sales last year were higher based on the availability of higher inventory, comparing this year would show a decrease in sales, just like Conejo. You might have to read this twice. I had to write it six times, but I believe it to be true.

So if things are getting better, why the talk of a recession?

Follow this LINK to see one of numerous articles explaining this curve and its accuracy in predicting a recession. We have experienced the longest economic recovery in history, now in its 10th year. That factor alone has economists looking over their shoulder. But when the yield curve is inverted, economists tend to look dour.

But we already did our recession. Does that mean that the next recession will be more modest for real estate? We still have fabulous interest rates, and there is talk of cuts by the FED. Inventory has not grown too strongly, another factor indicating things are going well.

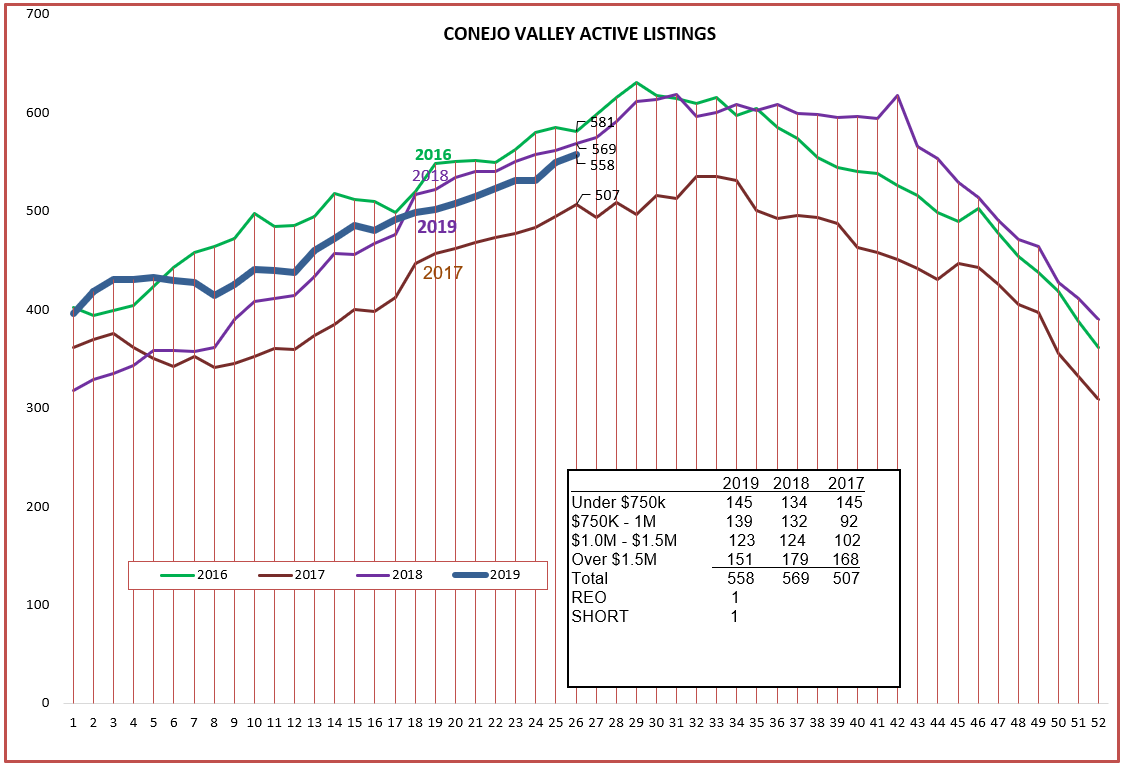

The inventory curve for Conejo is absolutely as expected. No surprises here, no note of caution.

Simi/Moorpark is not as consistent, but the inventory is certainly not growing out of control, no caution here.

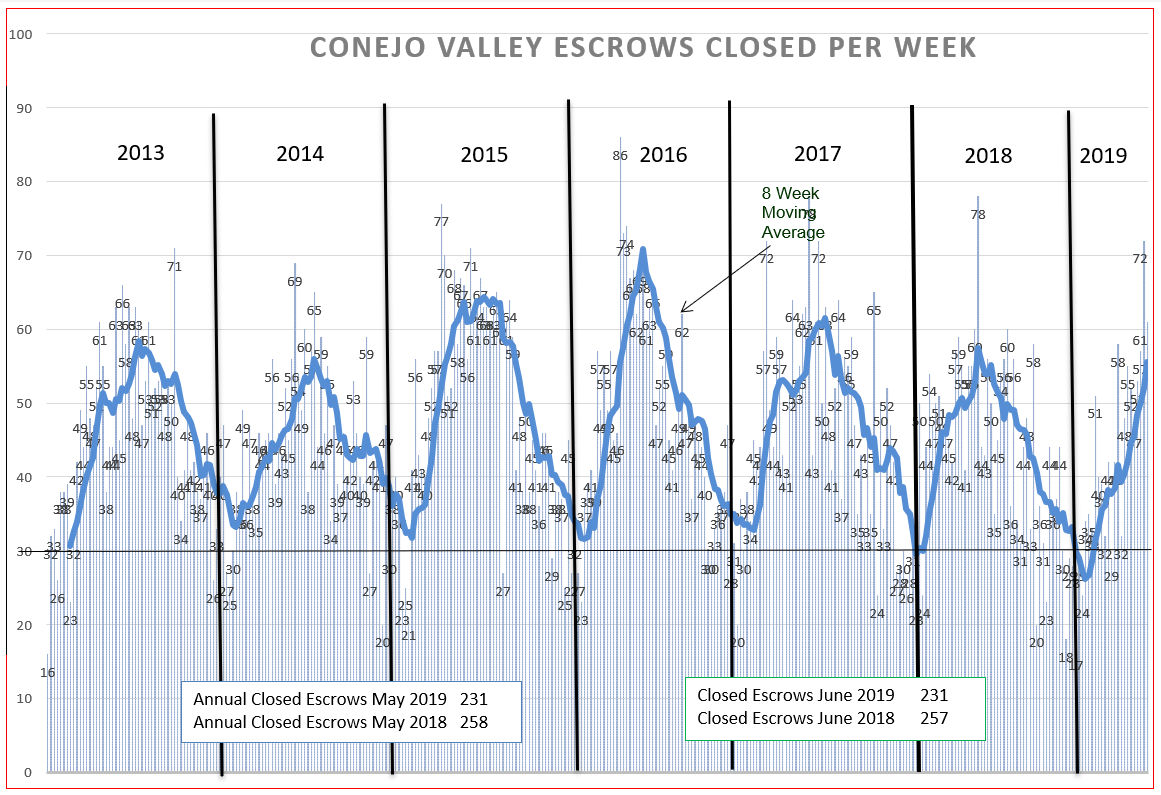

The closed escrow charts display the weakness in the first part of the year. The Conejo 8-week average dropped below the weekly average of 30, current growth shows good strength. There continues to be a monthly dip when comparing the peaks year to year, but it is not a worrisome dip. (see May and June boxes)

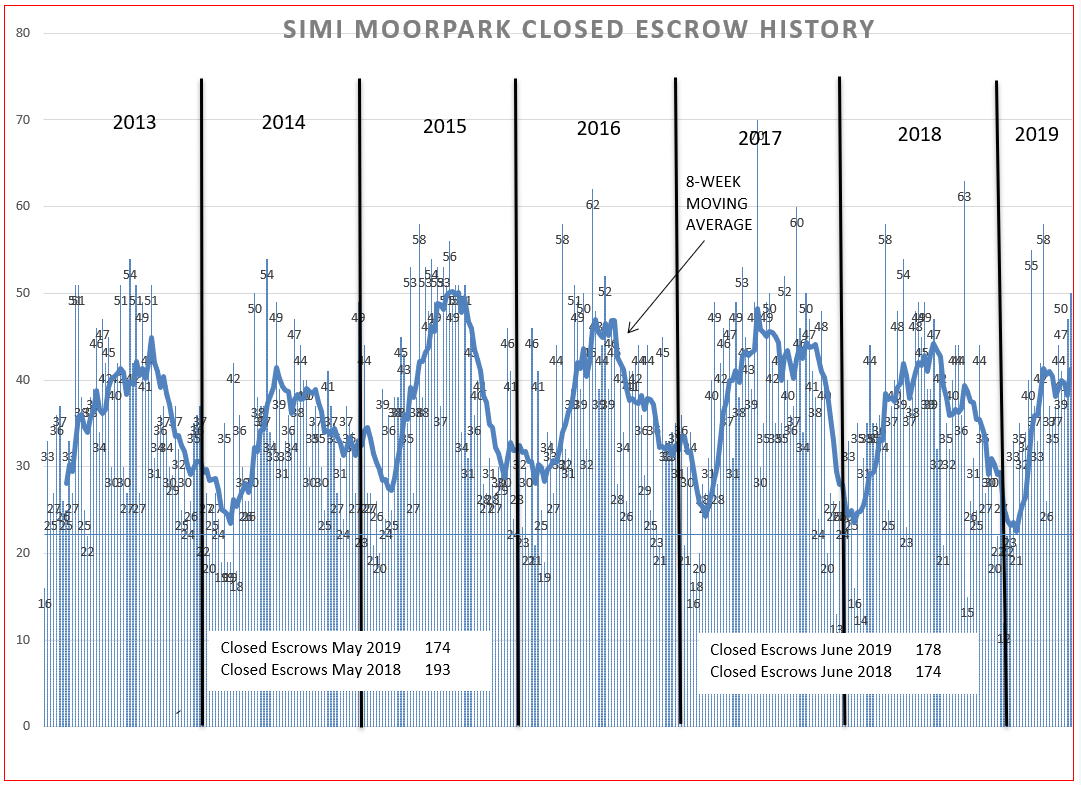

For Simi/Moorpark, the earlier strength of sales has moderated and topped out lower than the previous years, but has shown surprising strength the past few weeks. Not a bad year.

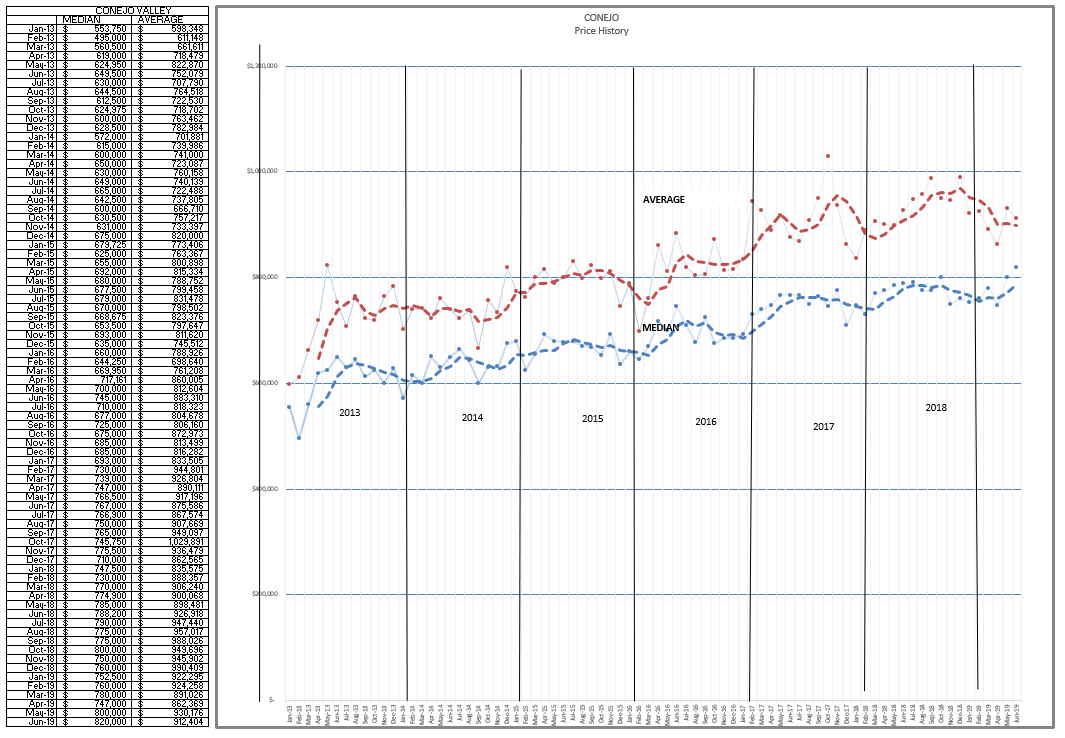

Now for pricing. Conejo is seeing the normal uptick in Median pricing as the year progresses, but the high end has not been contributing as many sales, and the Average price has come down. The space between the two lines shows the influence or lack of influence of the high priced homes.

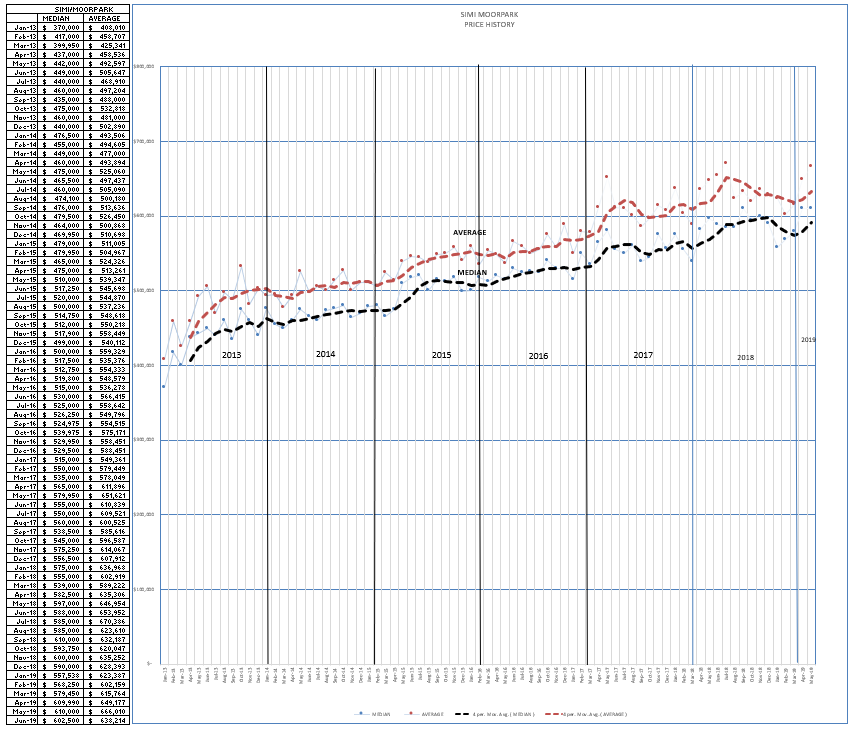

Finally, Simi/Moorpark pricing has been very strong, beginning last year and due to the very low inventory availability. The expected seasonal uptick in pricing is occurring in both Median and Average lines. The Median price in Simi/Moorpark is just north of $600,000, whereas in the Conejo it is around $800,000.

So, how is the market doing?

The market is healthy, everything seems in balance, prices have increased just slightly, inventory is at an acceptable level, and sales are normal.

But watch out for that ominous Inverted Yield Curve.

Have an excellent month.

Chuck