Just when you think the inventory can’t get any lower, it does.

Just when you think prices have topped out, they haven’t.

Covid continues to be a problem, but real estate continues to be unaffected, except positively.

INVENTORY

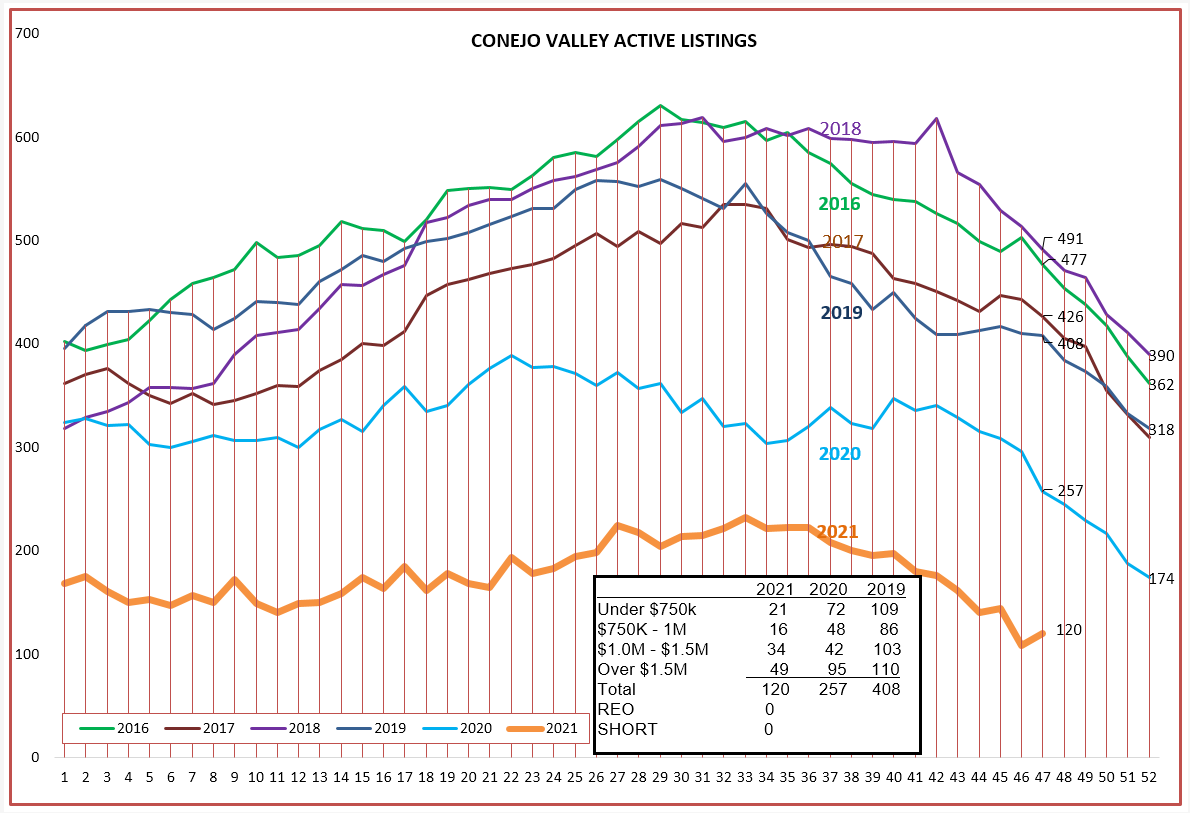

Conejo inventory is trending towards double digit numbers. I don’t have records to show if this is the first time in history, but certainly it is for the past few years. It is reminiscent of the Great Toilet Paper Shortage of 2020. The shelves are empty. However, in 2020, people were concerned about TP shortages and were stocking up to beat the hoarders. In 2021, people are not stocking up on housing due a perceived shortage. There really is a shortage, there has been for years. The state is pushing cities to build more housing. This shortage will eventually be resolved, but it is not a quick turnaround.

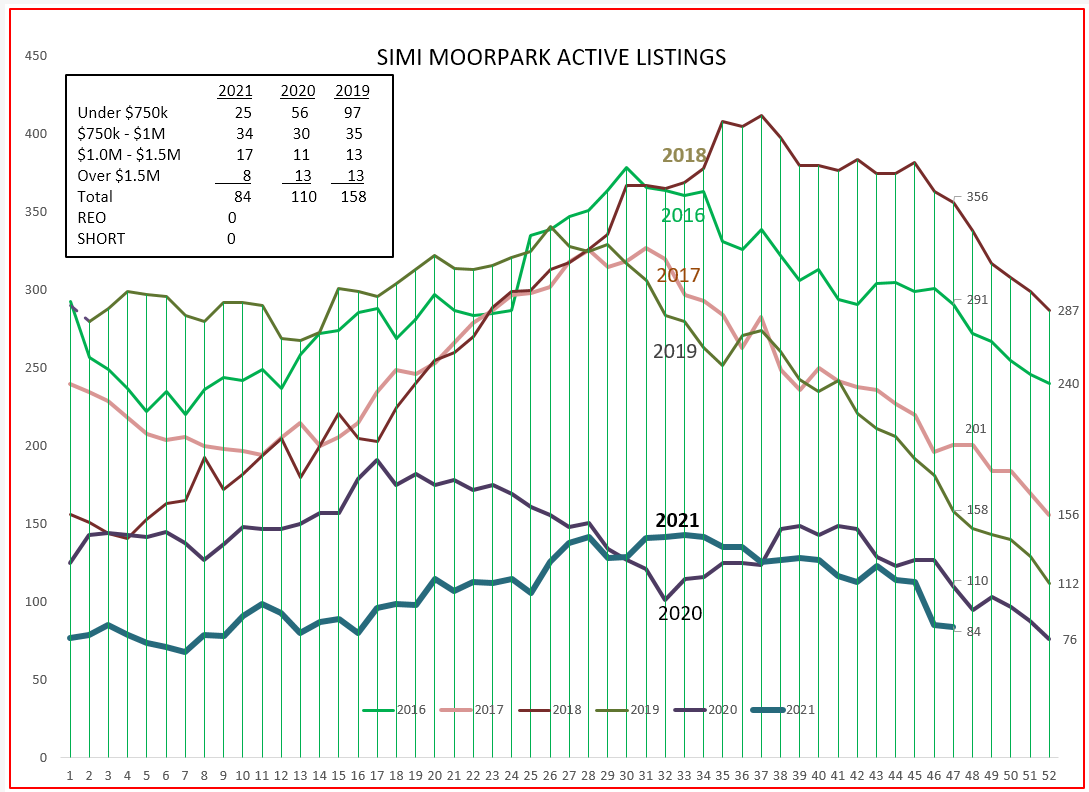

Simi Valley/Moorpark inventory is already in double digits, a level also reached at the end of last year. As you will see in the next few charts, the reason is continuing high demand.

SALES (INDICATIVE OF DEMAND)

A few years ago, as a birthday present, my wife presented me with a racing car experience at an auto raceway. The car was fully outfitted for racing, with five-point seat belts, rollover cage, racing tires, and a growling high-performance engine. I was outfitted with a NOMEX fire-retardant suit. There was one addition—a governor. It prevented the engine from exceeding a set RPM, and the car from exceeding a speed of 145 mph. As the engine hit that governed speed, it prevented further acceleration. Our market today has a governor also. It is called Available Inventory.

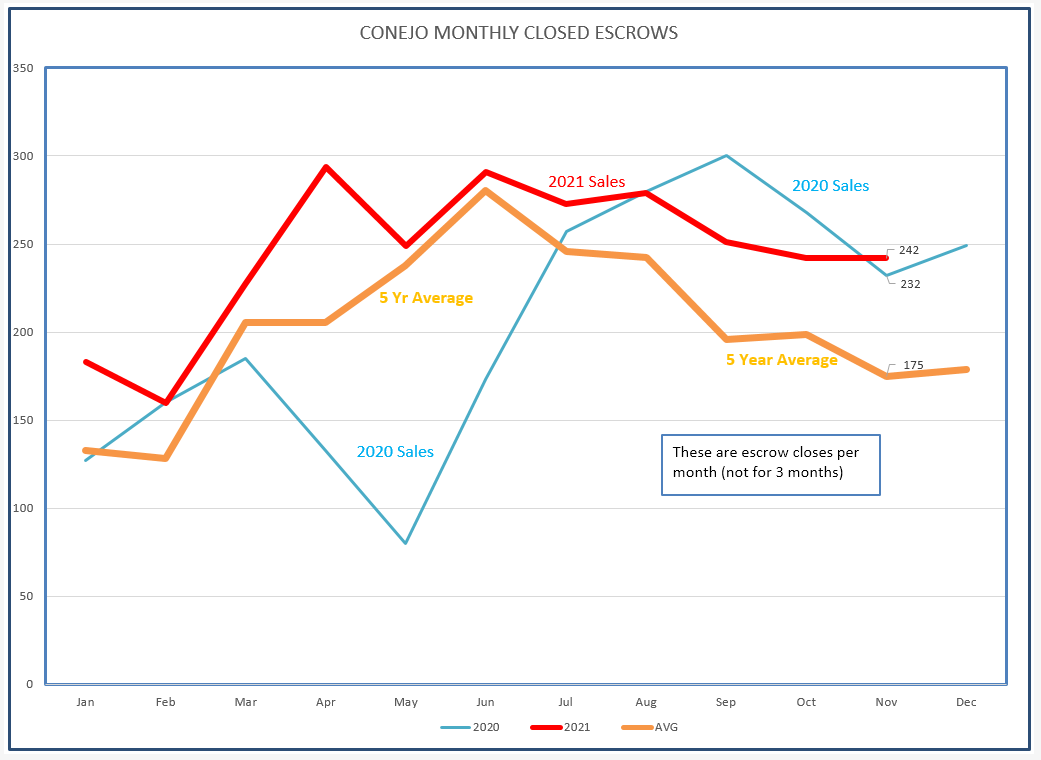

Conejo sales in 2021 were beginning to pattern the 5-year average, what we might call a normal market. With mortgage rates inching up, and prices significantly higher than 2020, a slowdown was expected. Expected, but not realized. Demand, as expressed by sales, remains high. Lack of Inventory remains a governor.

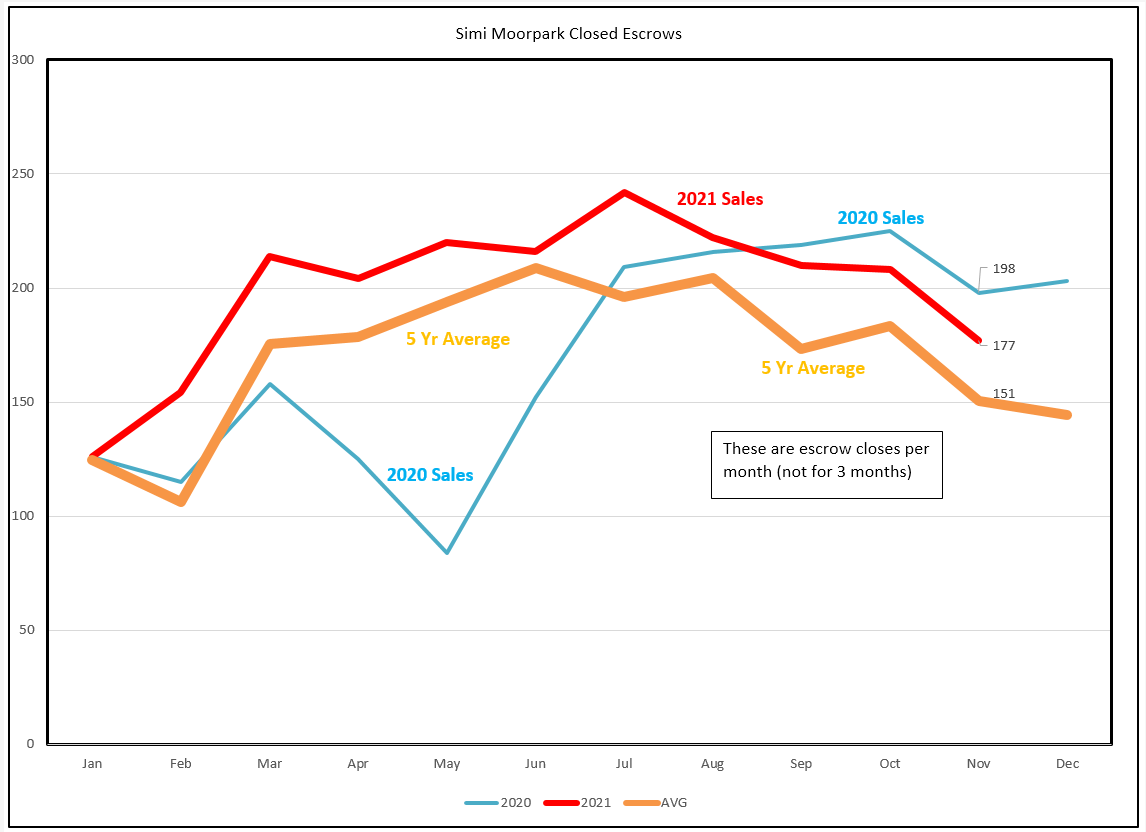

Simi/Moorpark sales are more closely following the 5-year average, but still higher by about 25 more homes per month.

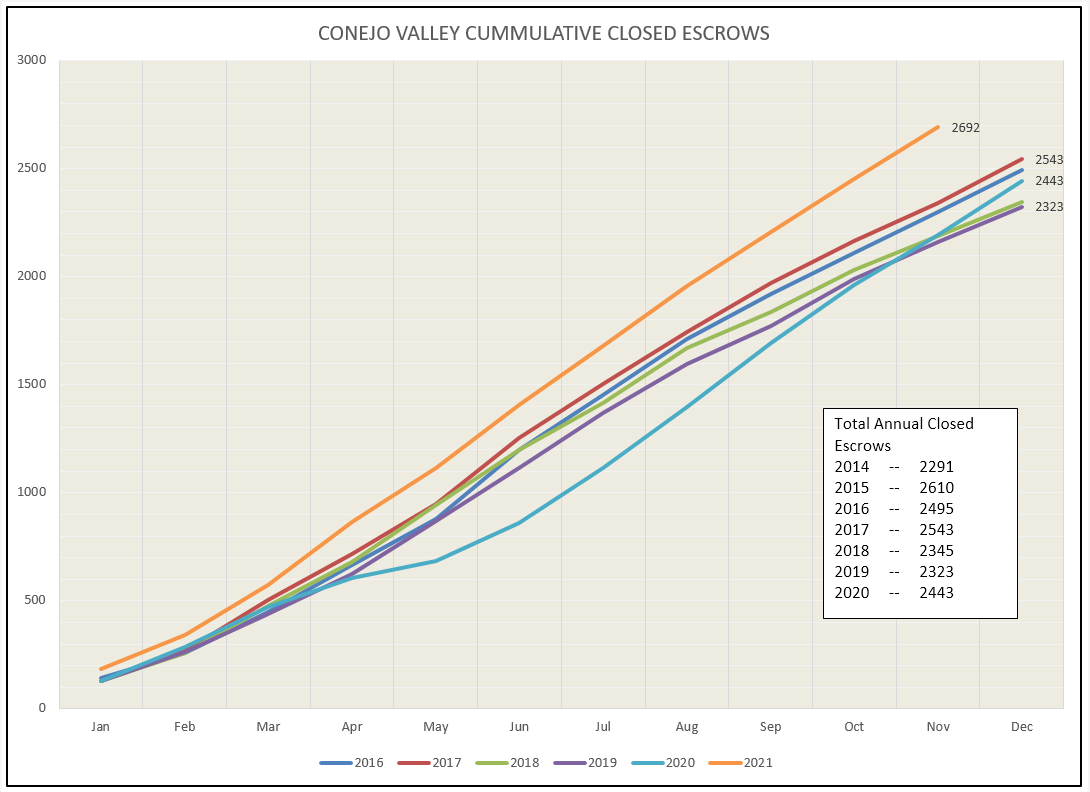

CUMMULATIVE SALES

Conejo Cummulative Sales figures create a picture of how sales have been trending this year versus the past five years. We have exceeded the recently recorded high numbers and continue to rise, and expand the difference between the normal years and this year. I would like to say we are working in a new normal, but cannot make that announcement yet.

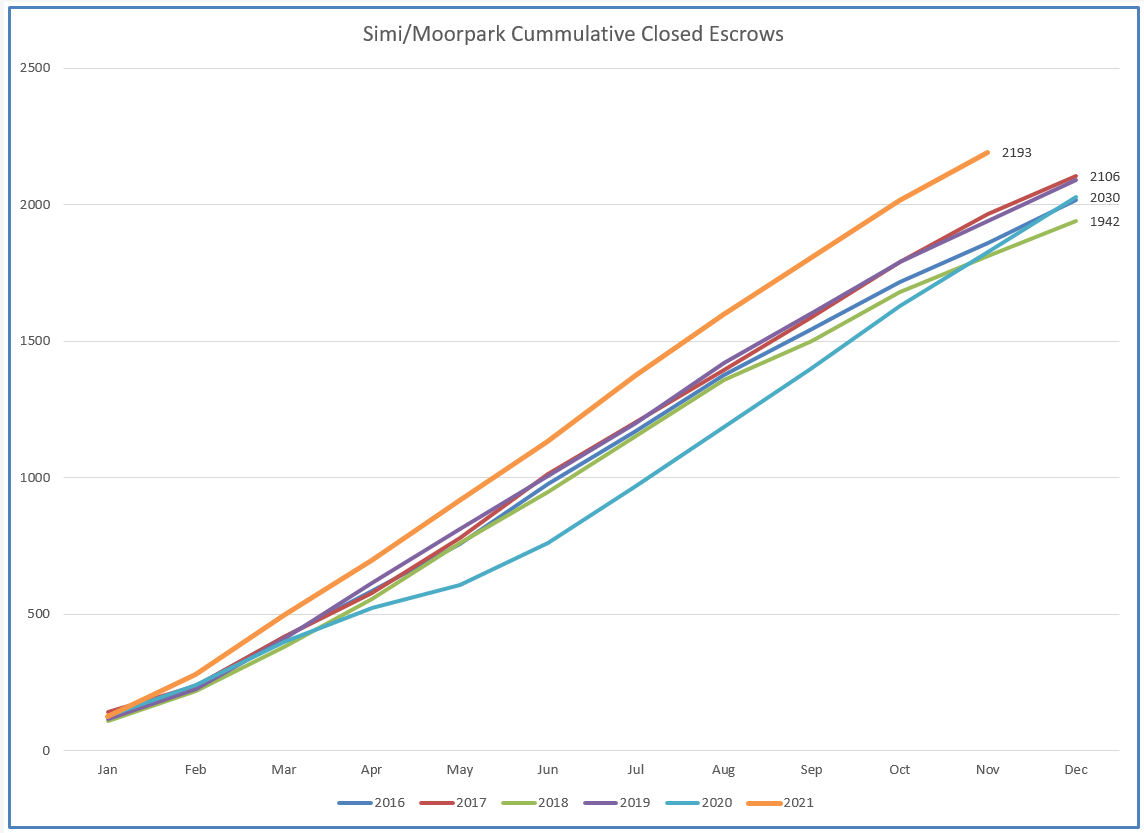

Simi/Moorpark Cummulative Sales continue the same trend, with the difference between the years growing. One can only imagine what this graph would look like if our sales were not restricted by low inventory.

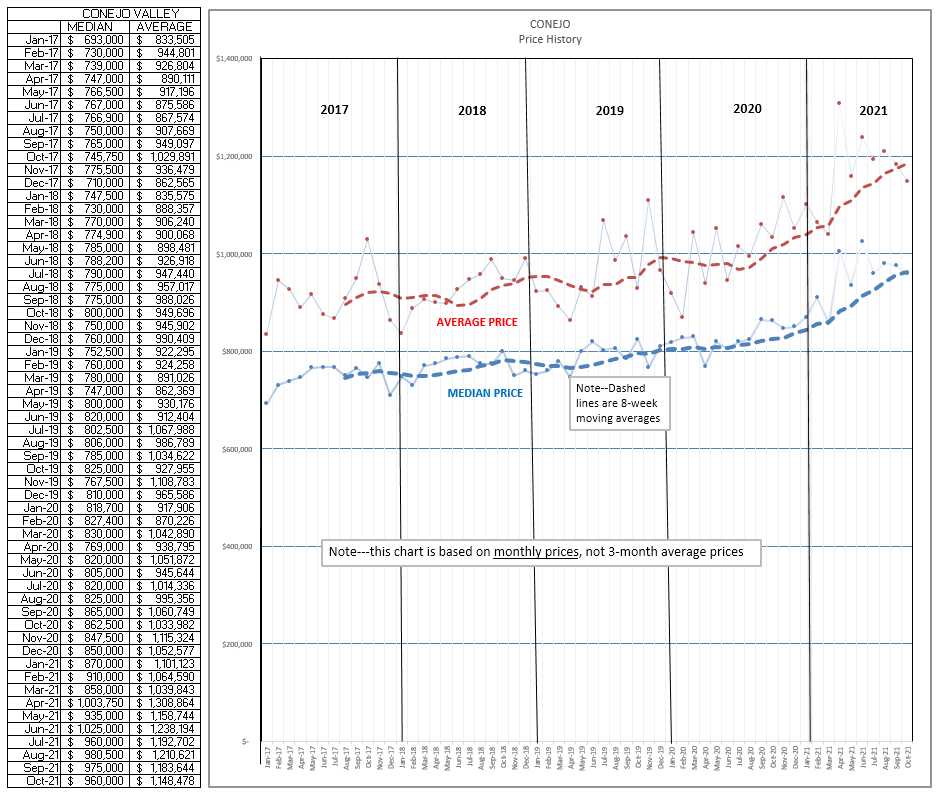

PRICES

Conejo prices are hitting that governor. Average prices, highly affected by the percentage of high value homes, have actually declined over the past four months. I won’t call this a lack of demand for high value homes, but more like that percentage of the total returning to a normal level. The median price exceeded $1 million in a couple of months, but now seems to be settling back into the mid-$900,000 level. This time of year usually records a slight decrease in prices, except for the 2020 experience.

Simi/Moorpark prices continue their upward trend, assisted by the strength in high value home sales. Median home price hit the $800,000 level this year, but has since dropped back to the high $700,000 level. As can be seen on the chart, this time of year usually experiences a leveling of prices, except for 2020.

OUR STATISTICAL CHARTS

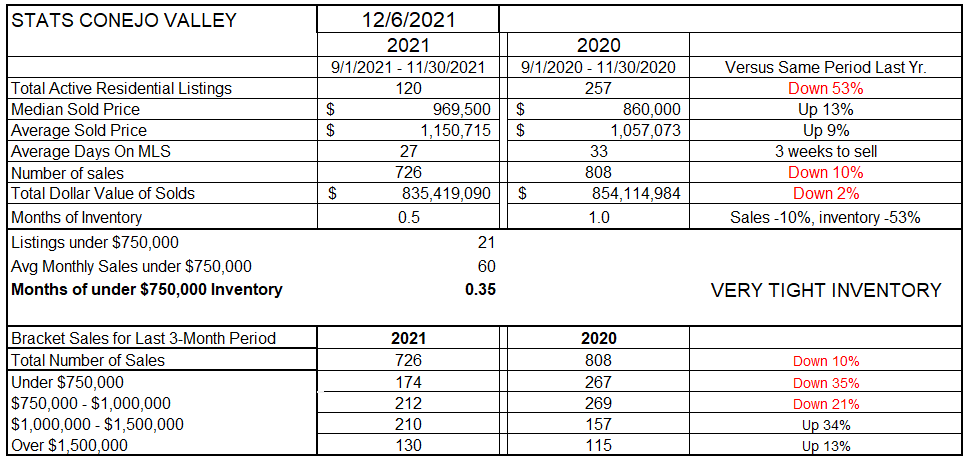

As discussed, inventory down significantly down 53% from 2020. Inventory today only represents two weeks of sales based on current sales levels. Homes priced below $750,000—only 21, representing a little more than a week of inventory.

Compared to 2020, the 3-month average number of sales is down 10%. Prices for the period (3-month average prices) are up 13% for the median price, but a lesser 9% for the high-value-influenced average price. Due to the increase in home prices, the number of sales compared to 2020 are down for homes priced under $1 million, but sales numbers for homes priced above $1 million are significantly higher, 34% and 13%. The high value category of homes sales is still strong, but not as strong as it was in 2020.

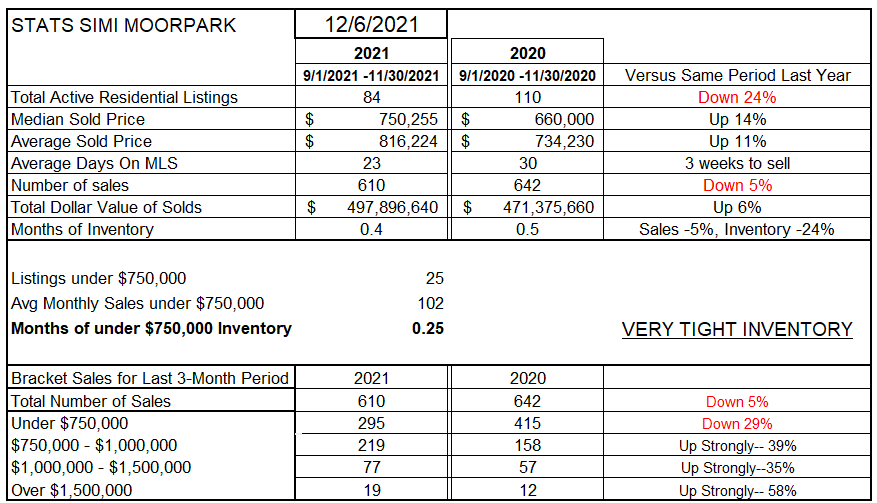

Simi/Moorpark inventory is down 24% from 2020, but 2019 was actually the year inventory dropped to such a low level, and 2020 was an entire year of low inventory experience, as was 2021. Inventory today represents only two weeks of sales based on current sales levels. Homes priced below $750,000—only 25 listings—sell in a week. Homes priced below $750,000 used to be the bread-and-butter level of home sales in Simi/Moorpark. The median price has now moved above $750,000, which is the reason the bottom of this chart shows the number of under-$750,000 homes as 29% lower sales than last year. The average price in Simi/Moorpark has jumped into the next level, homes priced between $750,000 and $1 million. Sales in that category are up 39%, as are homes in the next two price categories.

However, compared to 2020, the 3-month average number of sales is down 5%. Prices for the period (3-month average prices) are up 14% for the median price, but a lesser 11% for the high-value-influenced average price. Buyers that want to move to Conejo are looking at $975,000 for a median priced home, while that median priced home in Simi/Moorpark is approaching $800,000.

What is the Forecast?

We have looked at the past. What of the future? Thanks to my friend Tim Freund, who shared this FORTUNE magazine article, I don’t have to guess what will be happening next year. Seven high-priced economists have nailed it down.

The forecast is for prices to rise 13.6% ((Zillow and Goldman Sachs).

Or rise 3% (Redfin).

Or drop 2.5% (Mortgage Bankers Association).

Or rise between 7.0% and 7.9%( Fannie Mae and Freddie Mac).

Or rise 1.9% (Core Logic).

I still like CAR’s forecast, prices increasing 5.2%.

What do you think?

Enjoy your holidays. Be careful and safe. Stay healthy. Don’t get sick. Next year will be a another year to remember.

Chuck