First, let me share a little personal news. No, you did not miss my March report. At the end of March I underwent serious surgery, and have been out of action. But I am back, healthier than ever, and look forward to continuing these reports.

The market is behaving as we expect a normal market to behave. Economic conditions are telling us that prices should be falling, sales should be down, and inventories should be climbing. Sales are down, but prices remain resilient, and inventories continue to be very low, less than 2 months worth of sales.

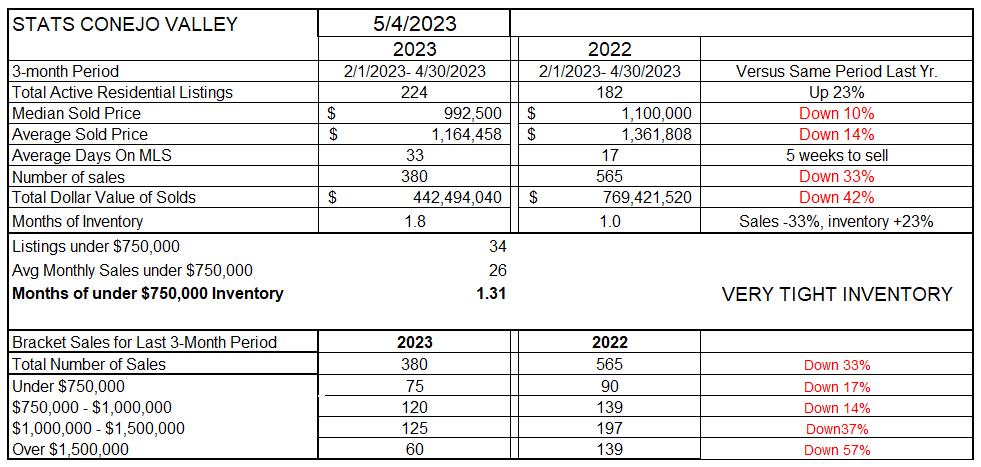

For the Conejo Valley, inventory is up 23% from the same time last year, but still low at only 224 units. The Median price is down 10% while the Average price is down 14%. As you will see in the bottom of this table, sales in the highest price range are the most impacted (down 57%).

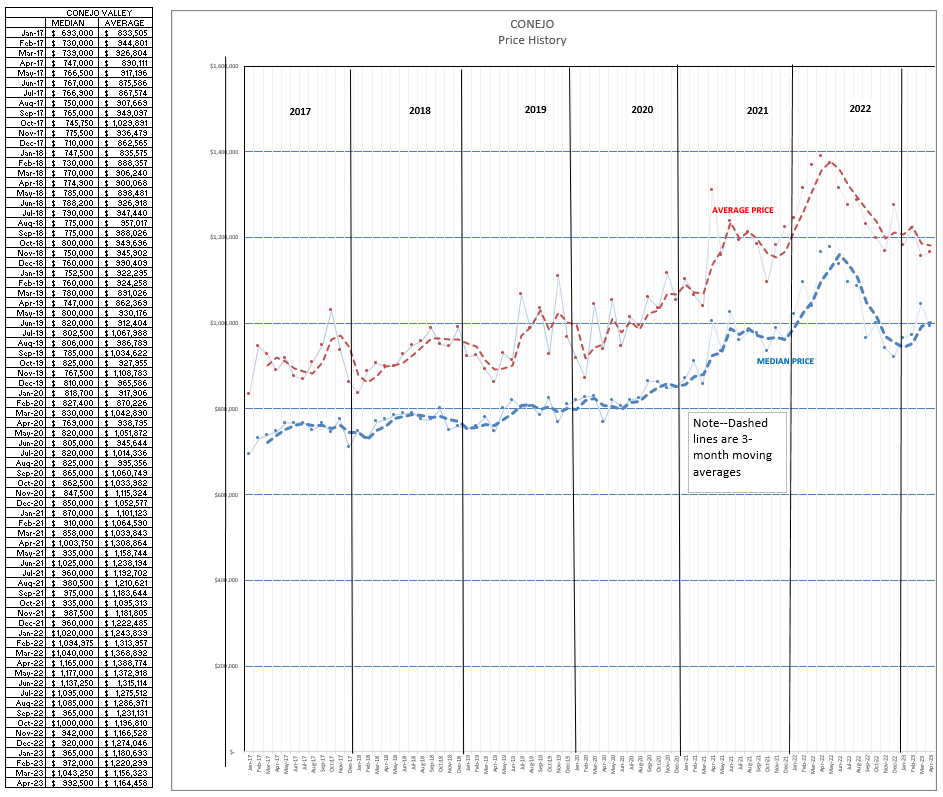

As I have been forecasting, prices look as if they have declined because the first few months of 2022 saw prices drastically increase, then fall as the year progressed. The 10% lower price is misleading. Actually, pricing is quite stable for the past few months, at a level equivalent to the beginning the 2022 year. Look at the pricing chart later in this blog.

The number of sales is down 33%, and I expect that to continue as this year progresses. Considering the doubling of mortgage interest rates from the extremely low rates in the first half of 2022, the FED has tried to get the economy into a recession, and as far as real estate is concerned they have been successful. The inventory remains historically low because homeowners are hesitant to trade away their 3% mortgages for 6% mortgages. New buyers don’t have that factor to consider, but current homeowners looking to move up are considering it.

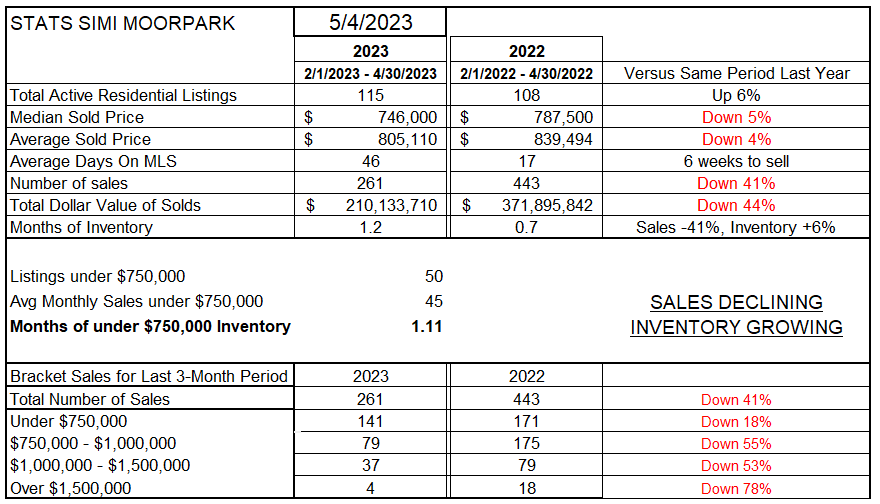

For Simi Valley and Moorpark, the numbers are a little different. This area has the majority of homes in the $800,000 area, and not as many high priced homes as Conejo. Median prices are down 5%, Average prices down 4%. The number of sales is down 41% from a year ago. Inventory is up only 6% from last year, very anemic levels. I suspect with more inventory available, the number of sales would increase. The highest price category in SImi/Moorpark is down 78%, but the overall numbers in this category are very low to begin with. Months of inventory is just over one month.

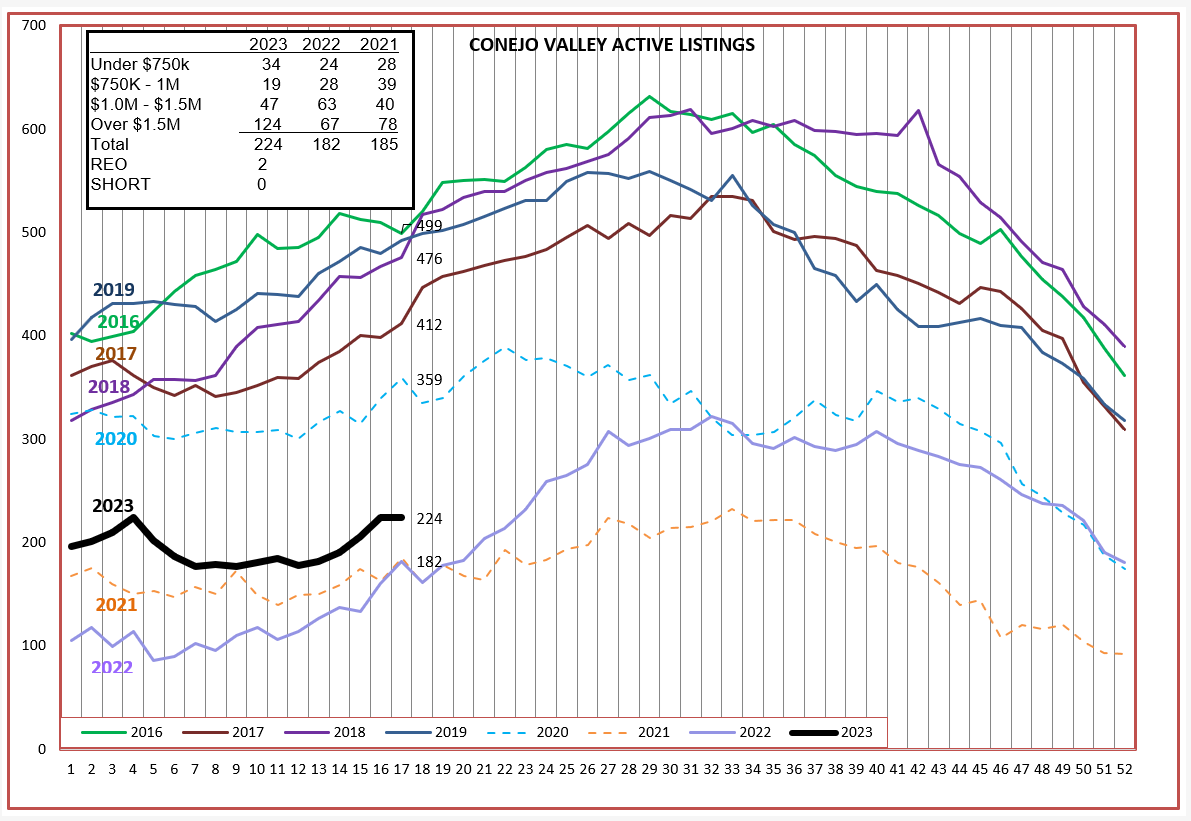

Let’s look closer at the Conejo inventory picture. Inventory is very low compared to other years, with only the years 2021 and 2022 with less inventory. The curve is showing the increase expected at this time of year, but very low numbers. Notice the inset box. The inventory of homes priced over $1,500,000 has grown dramatically, the main factor by which the inventory increased.

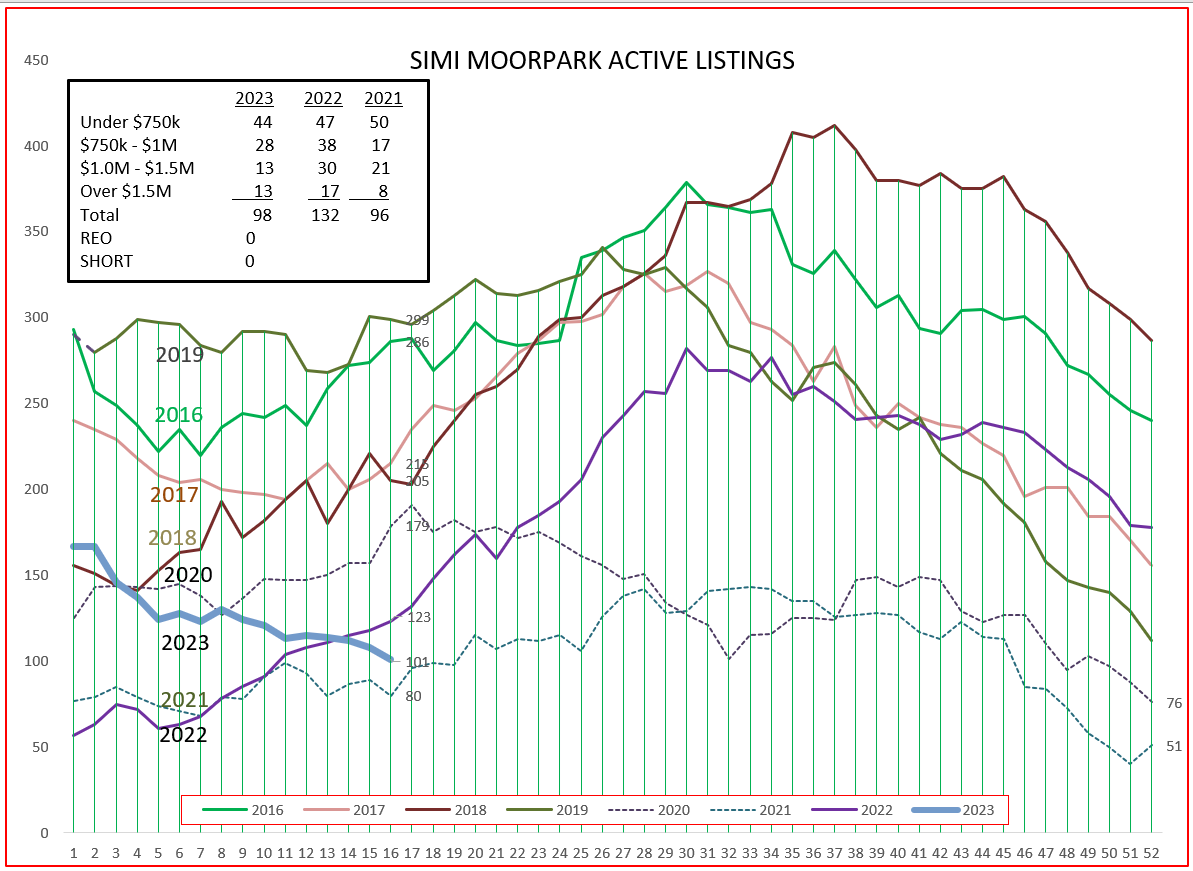

For Simi Valley/Moorpark, much the same. The inventory level is on a steep downward trend. With so few homes to list, sales are lower than last year.

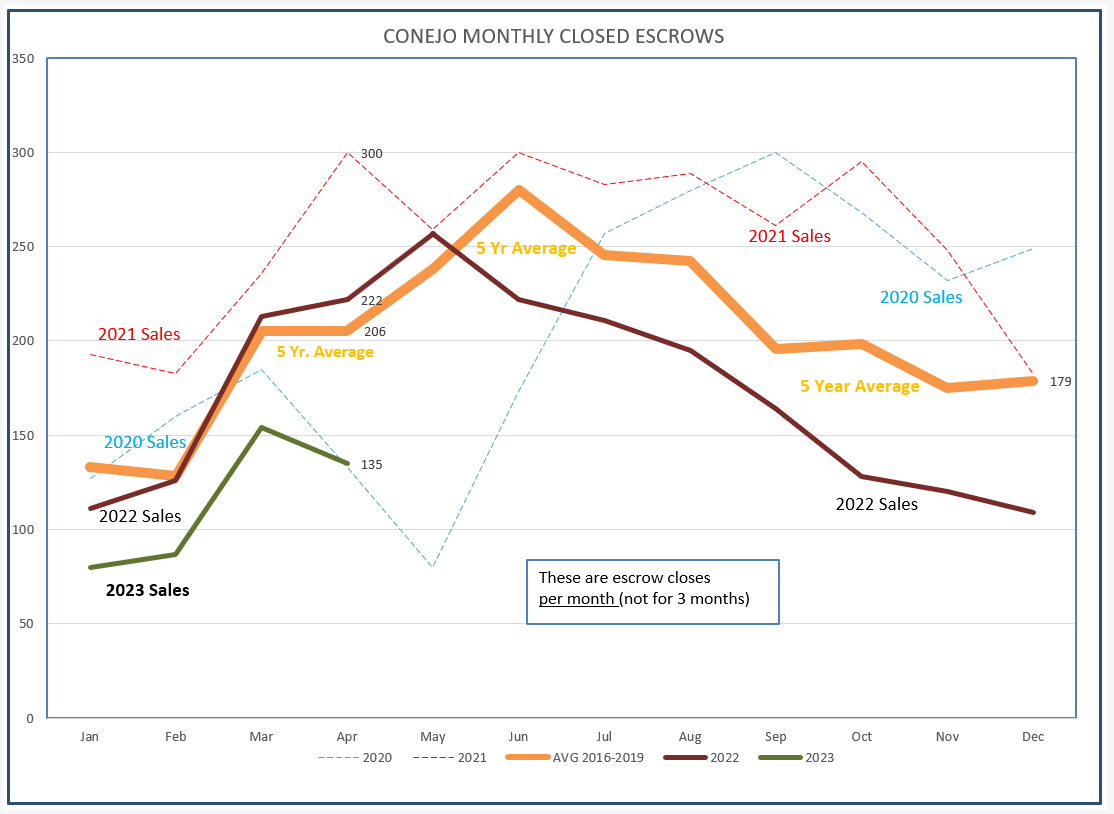

Sales in Conejo are at an extremely low level. The only lower period was April of 2022, which was the month that sales fell drastically due to the beginning of COVID.

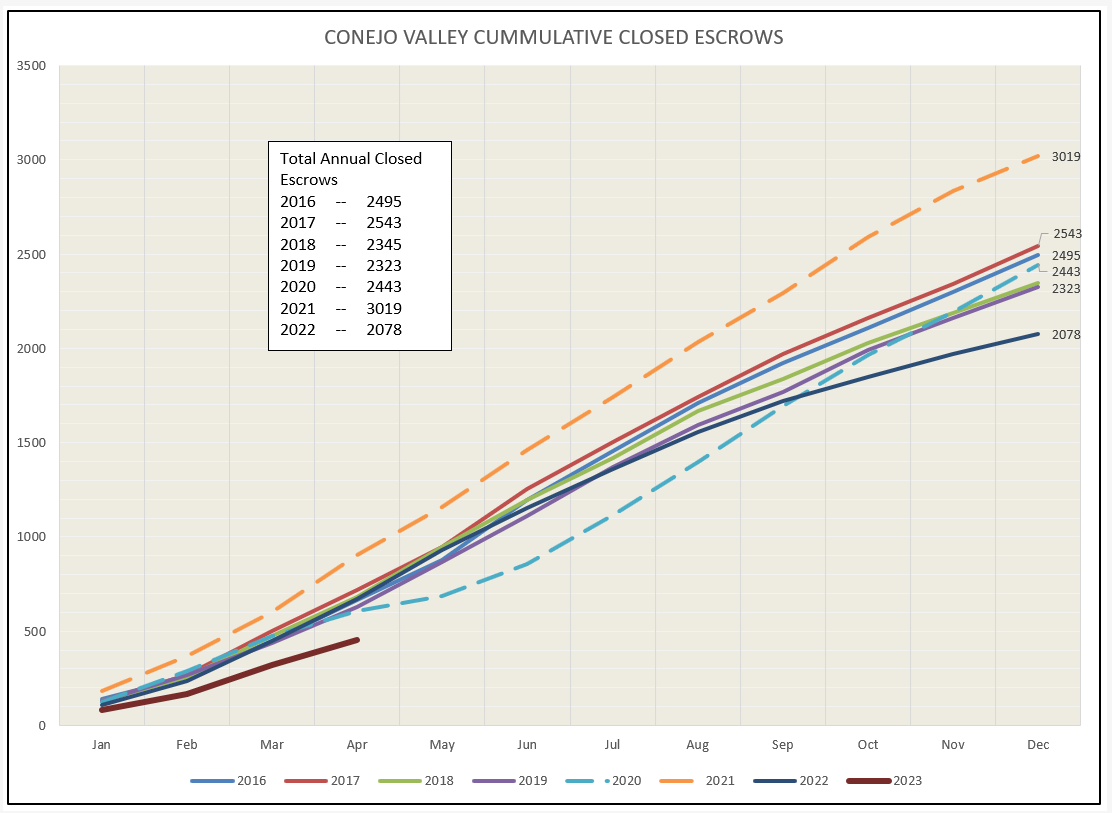

Conejo cumulative sales as the year progresses shows us the same trend, lower sales than any other year in the chart.

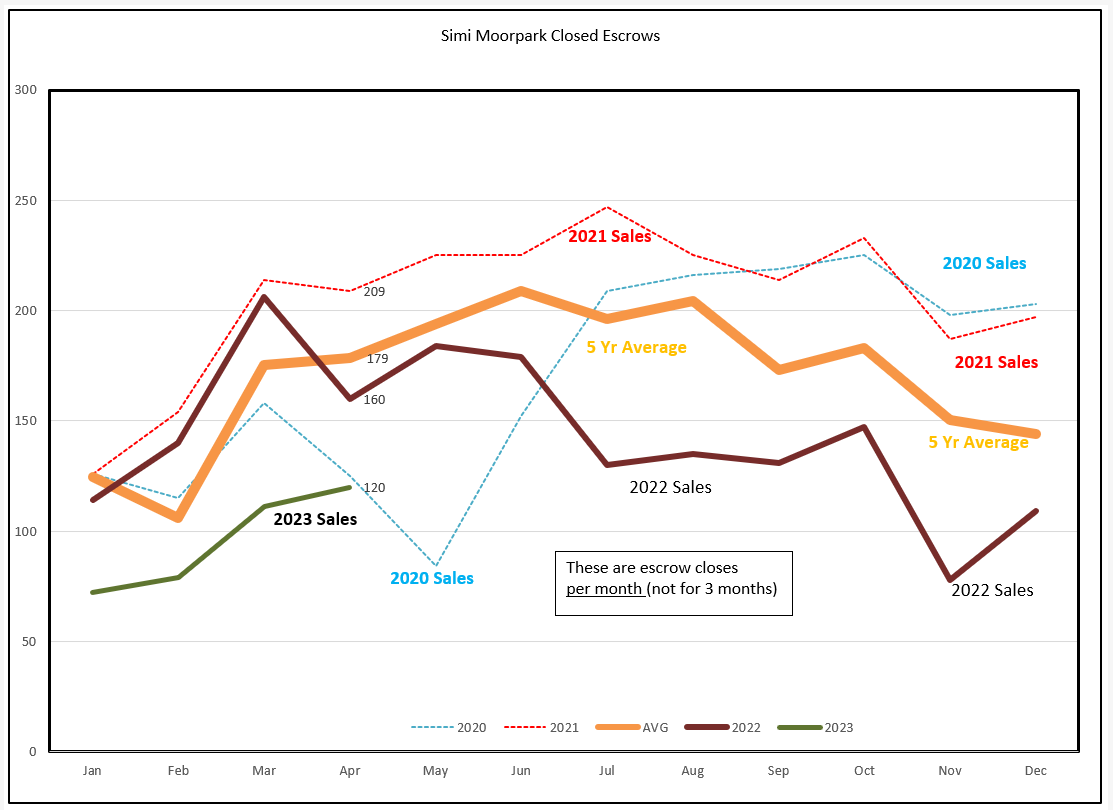

Simi Valley/Moorpark shows the same result, sales significantly below other years.

The cumulative graph for Simi/Moorpark also displays the results of much lower sales volume.

Let’s turn to pricing. As I said above, pricing during 2022 showed a steep rise in for the first part of the year, then a steep decline as the year progressed, to finish the year about equal to the pricing level that began the year. Median prices dipped to about the level seen in January 2022 and have since risen in 2023. Pricing remains strong. The Average price graph shows the weakness in the most expensive properties.

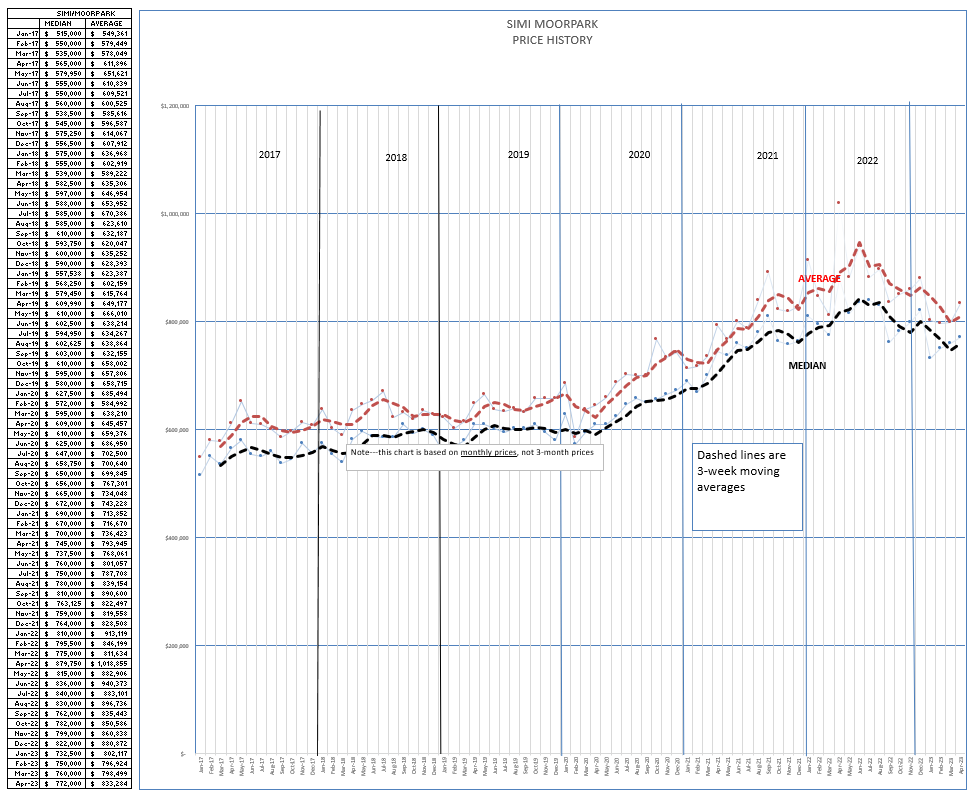

For Simi/Moorpark, much the same story. Prices rose and fell in 2022, and 2023 shows pricing strength.

For homeowners, pricing strength should make them pleased. Pricing is not at the highest level ever achieved, but the decrease seems to have all occurred in 2022. With the wild markets of 2021 and 2022, exemplified by strong overbidding, a correction was expected. Prices now seem balanced.

Sales professionals have their income more affected by volume than by price. Thankfully, prices are stable, but volume unfortunately will be much weaker this year, a year to tighten your belts. There remains strong demand, but inventory is not available. Inventory and demand and pricing are all tied together. Since pricing seems to be the most stable, lower inventory is forecasting sales to continue at a lower level, even with strong demand.

The good news is that inflation has been receding and income has been increasing. But the FED is stubborn in bringing inflation down even further, and until that happens we can expect to see the higher interest rates that are causing many buyers to hold back.

We are again able to do open houses, and realize you have to take precautions. Make sure you are careful out there. The best precaution is not to be alone, but to have a partner to help with your open house.

Be safe and stay healthy.

Chuck