We are heading into fall, and the market is behaving as expected.

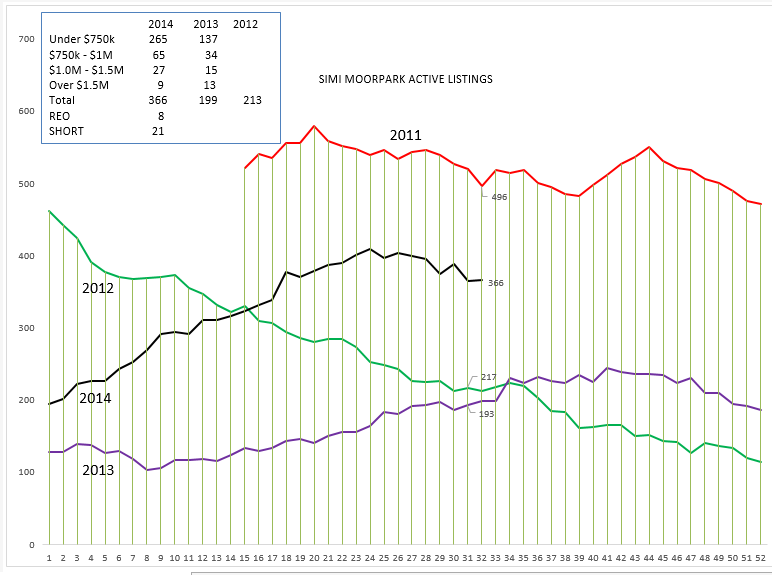

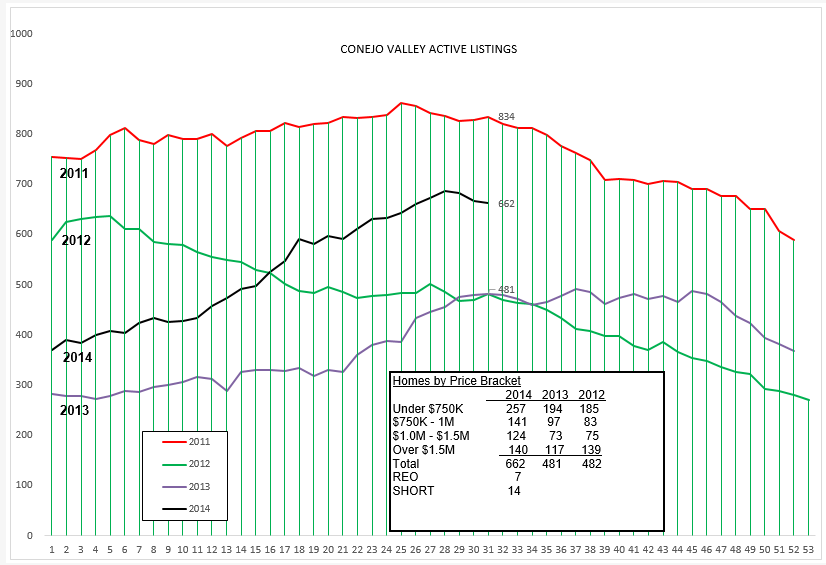

What do we expect? First, the inventory should start tapering downwards. Summer is about to be over.

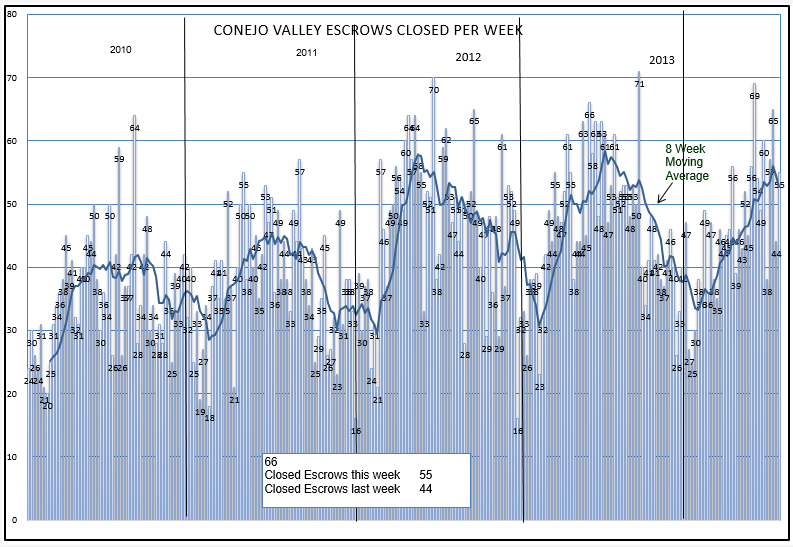

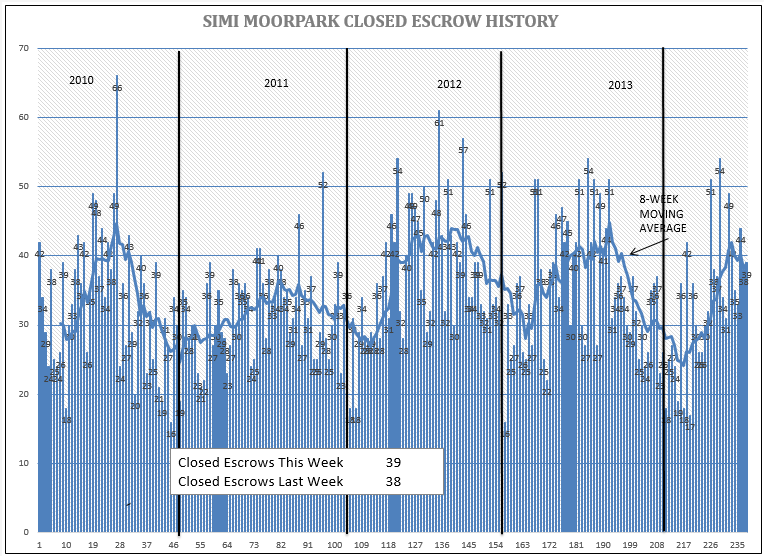

As you can see, both areas are behaving exactly the same. No surprises. I have gotten to where I don’t like surprises.

Now for the sales figures, closed escrows. Exactly the same story, we have hit the peak for the year, and activity is slowing down.

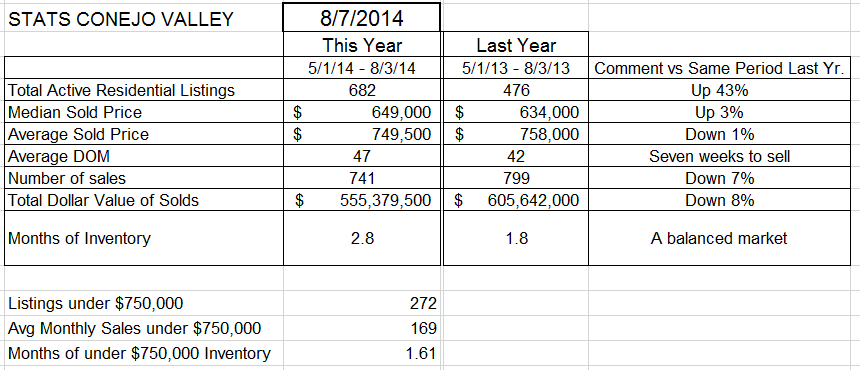

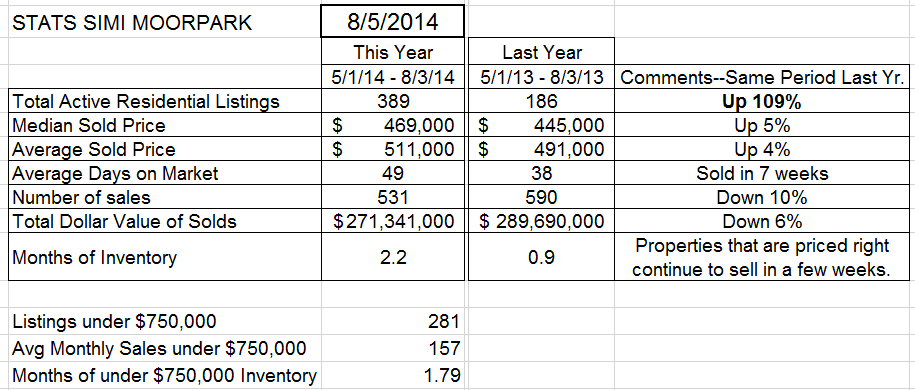

And finally let’s take a look at the statistics. The statistics are not based on a full year-to-date comparison, but on a comparison of the almost four months from 5/1 to 8/17, comparing these four months of 2014 to 2o13.

The inventory is up significantly in both valleys, 43% higher in Conejo and 109% higher in Simi/Moorpark. Please notice that Simi/Moorpark only had 186 active listings at this time last year, a figure that is less than one month’s worth of sales., the picture of a seller’s market.

Median prices are up, 3-5%. But volume is down, 7-10%.

Both valleys have a reasonable inventory. For our area, I consider three months a balanced market, favoring neither buyer nor seller.

Mortgage rates continue to be at historic lows, although lenders are being much tighter in their requirements. We are seeing the first inkling of 1099 buyers again being able to qualify for mortgages. Lending restrictions have been difficult for W-2 buyers, loans almost non-existent for 1099 buyers. The loans now available are hard money loans, but this does represent some easing.

All eyes in the financial world were focused at the talk around the campsites in Jackson Hole, Wyoming last week. That by itself makes you scratch your head in wonder. The economic story remains centered around jobs. Here in the Conejo Valley, it is about job cuts at Amgen. Across the country, unemployment rates are consistently declining, but at this point there has not been the shortage of workers that results in wage increases. Jobs need to be more stable, consumer confidence needs to rise, and that will come when wages finally increase and workers will feel they have some power, or at least some stability. Buying a home requires that feeling of stability, of a promising future. We still have a ways to go, but things continue to get better.

What to tell your clients? This remains a great place to live, a great place to raise a family, with good schools and excellent recreational opportunities. The Amgen announcement is a shoe waiting to drop. Announcements have been made, but all are awaiting the tap on the shoulder to see if they are involved. Uncertainty produces paralysis, and that is affecting our market. There is no urgency to buy, there is a wait-and-see attitude. Once things proceed, once the decisions are announced, all can get back to a feeling of being back in control of their future. Consider this lull to be a short term lull caused by uncertainty. The sky is not falling, but many are putting off the decision to buy for a couple of months until things shake out.

And don’t forget, it’s August. Forget all the news, every August we go through some hand-wringing. Things continue to get better.

Have a prosperous week.

Chuck