I want to share a secret with you.

It is not difficult to do an economic forecast.

You just have to keep a few key rules in mind.

First, do your forecasting as close as possible to the period of time you are forecasting. So for 2014, you can be very accurate by doing the forecast in December of 2014. If you have good and voluminous history, you will automatically have a good forecast, because history will equal forecast.

The safest bet is to operate like Case-Shiller. Theirs is not a forecast, but an index. It is always a few months in arrears, and it is always accurate. Like reporting yesterday’s rainfall. Accurate, but not as useful as a forecast for planning your future.

Second, a good forecaster should have an enormous quantity of first-rate data to analyze. If you don’t have a large staff to help you, and a PhD in economics, steal everything you can from the people who do.

See? Simple. That’s why you hear me mention Leslie Appleton-Young so much. She deserves much of the credit for any forecasting I do. And she goes way out on that limb to forecast a year in advance. It is a lot easier to be wrong when you take that kind of chance.

I thought of Leslie because her forecast was for 2014 to be reasonably good. In 2013 we had a shortage of inventory. Demand was high, so it was logical to think we would have a better year because we had more to sell. Things did not start out that way. The first part of the year was disappointing. However, the end of the year is turning out very promising. Mark Dilbeck directed us to work hard through the end of the year, to FINISH STRONG. That seems to be what the market is doing.

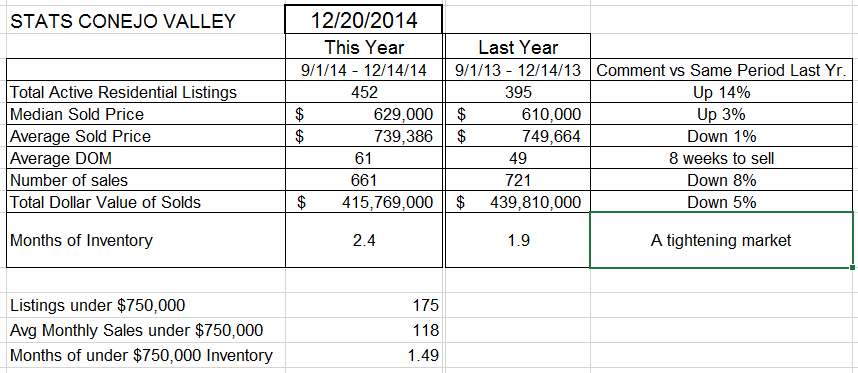

The market has been under-performing expectations for most of this year. To see changes in market behavior, my statistics only measure a period of 3-4 months, currently from September 1 through the middle of December. Using this date range, we can compare the same quarter last year with this year and judge how we are doing without averaging in the under-performing first half of the year. And the current trend is good.

For the first half of this year, the inventory ran up strongly, prices were lower compared to the previous year, and total sales were down by double digits. Not good according to the forecast.

Let’s see the story they are now telling us.

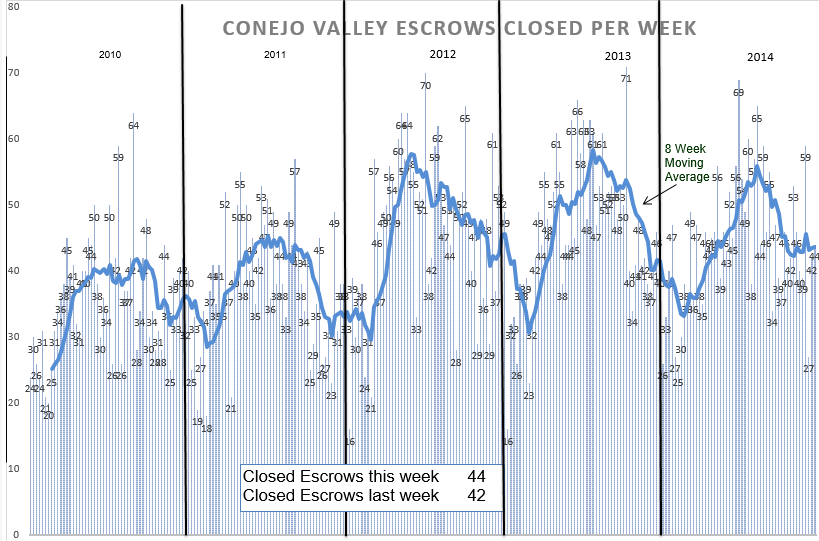

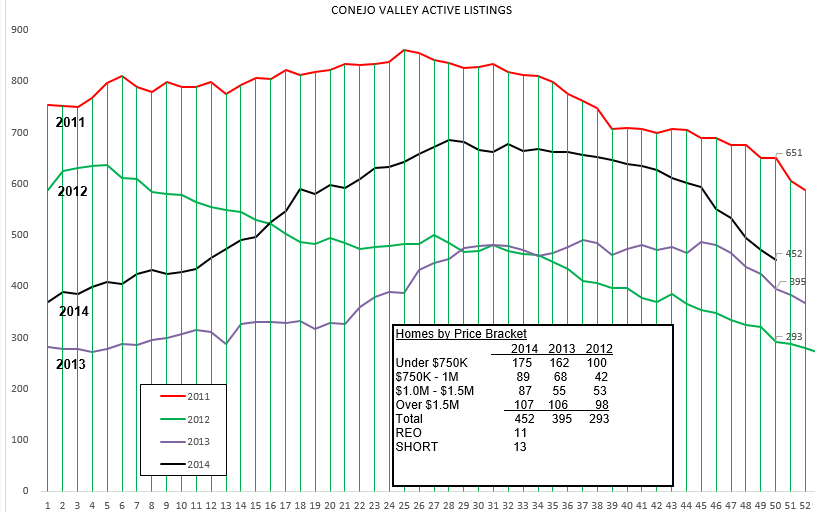

Comparing this information with the statistics from the first half of this year, inventory is up moderately, the median sold price has actually increased, and the number of sales and dollar value of sales have turned around, although are not yet positive. Perhaps the most important change is the tightening of the inventory. Conejo had cloudy skies throughout the year due to the instability caused by the Amgen layoff announcement, and yet another layoff has been announced. But the market is bouncing back. Sales are strong, and inventory is lower, resulting in a lower Months-of-Inventory number. The number of homes priced below $750,000 is extremely low.

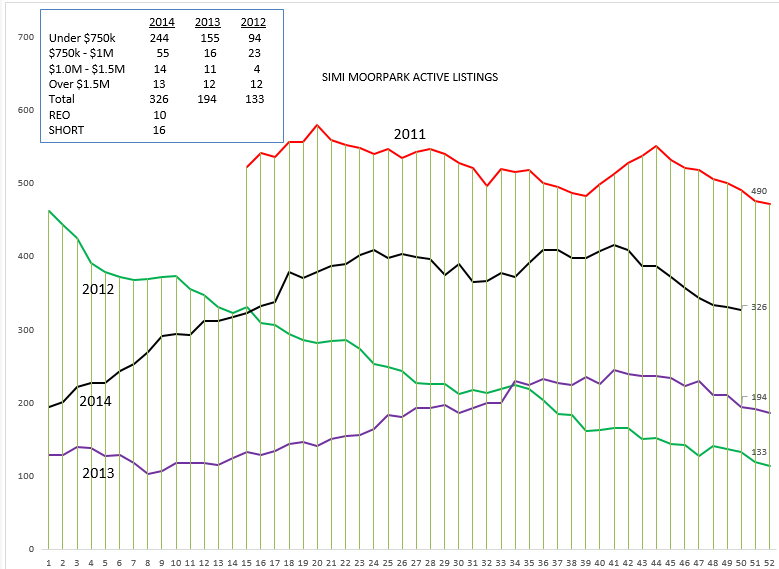

From the two charts above, it is very apparent that the inventory level is behaving as expected for this time of year, dropping towards the levels of 2012 and 2013, extremely low levels. Sales have been strong to close out the year, hitting a level of support that refuses to dip.

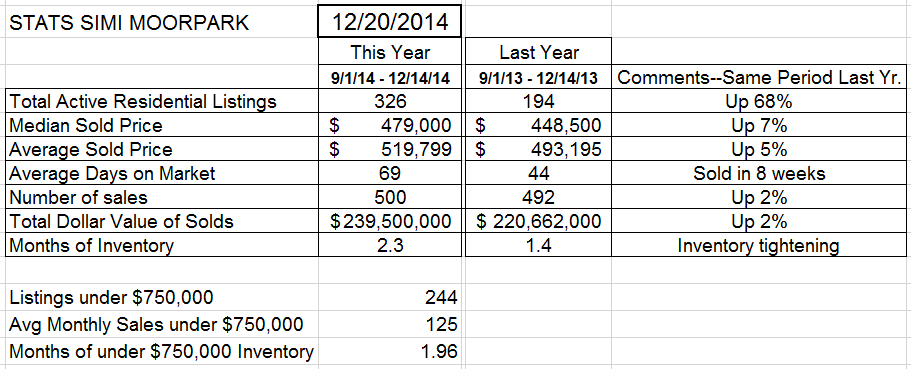

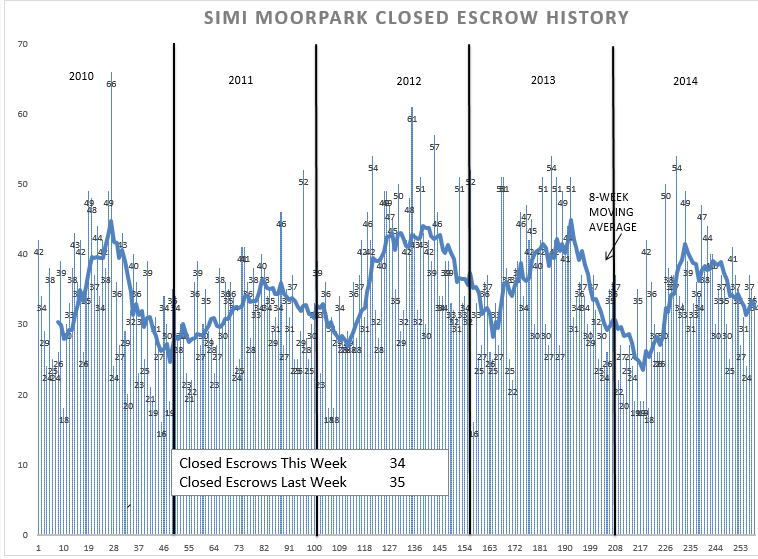

Simi/Moorpark is similar to Conejo, but is not suffering under the Amgen pall. Inventory has increased by a larger percentage, but the previous year’s inventory in Simi/Moorpark was ridiculously low, causing the percentage growth to calculate as higher. Simi/Moorpark sales have also finished the year strong, while inventory has dipped and months of inventory are now at a level that supports price increases. Both areas are transitioning into sellers markets. This is supported by comments from our sales partners, who can’t find properties for their buyers.

Simi Moorpark sales spent the first part of this year in the doldrums, then awakened. Inventory increased while sales lagged. Price increases have already been taking place. A welcome change indeed.

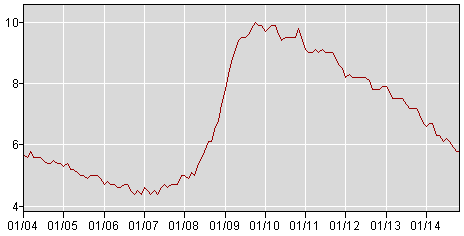

Why haven’t more people jumped into the market to buy? Two areas of concern were unemployment and job creation, both areas now doing very well. Below is the US unemployment rate history.

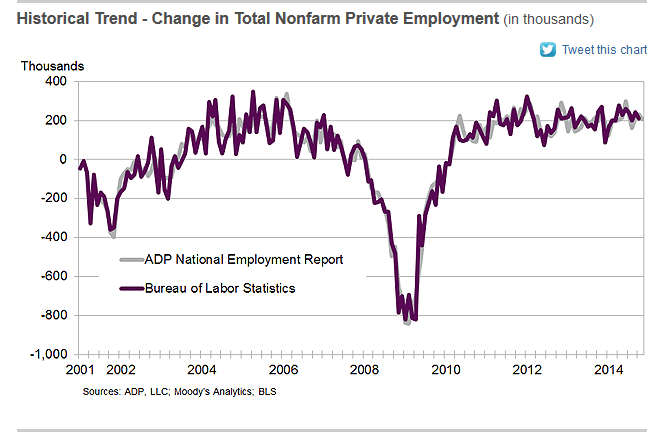

Job growth has been taking place strongly and consistently.

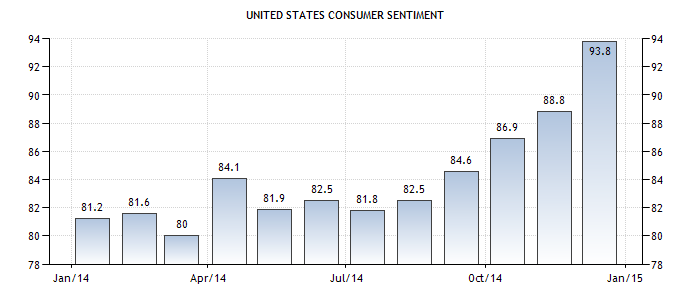

Another important area for housing is consumer confidence. Before buying a home, consumers need to feel confident about their jobs, about their future. When they are confident about the future, they feel stronger about making major long-term commitments, such as buying a home.

United States Consumer Sentiment 1952-2014

The Thomson Reuters/University of Michigan’s preliminary reading on the overall index of consumer sentiment came in at 93.8 in December of 2014, from 88.8 in November of 2014. Consumer Confidence in the United States averaged 85.06 from 1952 until 2014, reaching an all time high of 111.40 in January of 2000 and a record low of 51.70 in May of 1980. Consumer Confidence in the United States is reported by the Thomson Reuters/University of Michigan.

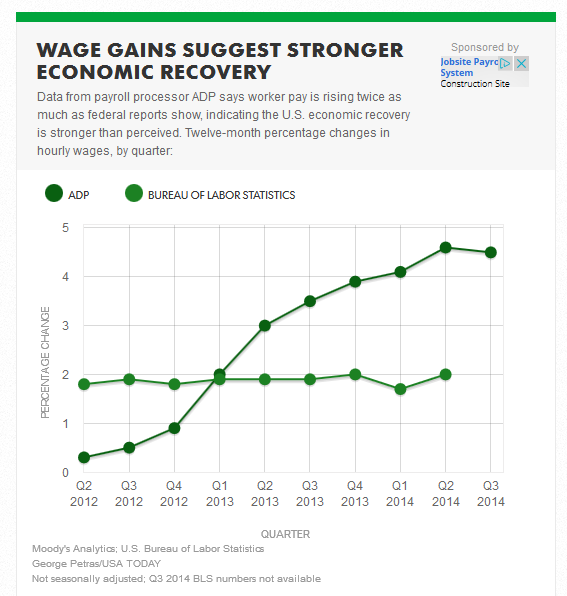

With confidence about the future, we are only missing one major element to lead more consumers to purchase housing. Consumers need to see growth in their salaries. Government figures show wage gains of 2% per year since 2012, but ADP figures show gains significantly higher.

The FED has been stoking the fires of inflation since 2008. The currently perceived result is that the economy has been saved from a depression. That is great news. But just like all the brush on our local mountains, there is ample fuel for a wildfire in our future. The FED will then act as fireman, dousing the fire with interest rate increases.

We are now in the sweet spot. Housing inventory is low. Mortgage rates are low. Consumer confidence and wages are climbing. People who lost their homes to short sales now see their credit allowing them to once again become homeowners. Rentals are extremely tight, rents are rising rapidly. Renters are considering locking in their “rent” by purchasing homes with 30-year fixed rate mortgages. Energy prices, particularly gasoline and diesel, have dropped significantly, keeping more cash in consumer pockets for other uses.

Strong forces. What is keeping the housing market from taking off? Qualifying for mortgages has been stringent, with FHA continuing to be the primary financing source for down payments below 20%.

But that too may change. Fannie and Freddie are bringing out mortgages with down payments as low as 3%.

After so many years of thinking that pessimism was realism, it is exciting to thing about the future being bright.

Guaranteed? Never. Too many factors to consider.

Probable? You bet.

You should be spending these next two weeks calling absolutely everyone you know. Remind them you are in the real estate business, remind them you care about them and want to say hello. It is time to wish everyone a happy new year. It should be a good one.

Chuck