There is an old joke about someone trying to hire an accountant. He asks the first what is two and two. The reply is four, and he thanks the candidate. He asks the second what is two and two. The cagey reply is it could be two, or twenty-two, and he thanks the candidate. He asks the third what is two and two. The candidate leans forth, looks around, and whispers “What do you want it to be?”

When we give forecasts, we have to be careful not to fall into the same trap. We are writing to a specific audience, and have to remind ourselves not to slant the information to tell the story we want. I feel the news media does that all the time. They love bad news, they think that is what sells. When we get much needed rain to help with our drought, they are on the lookout for mudslides. For us, it is more important to be truthful and accurate.

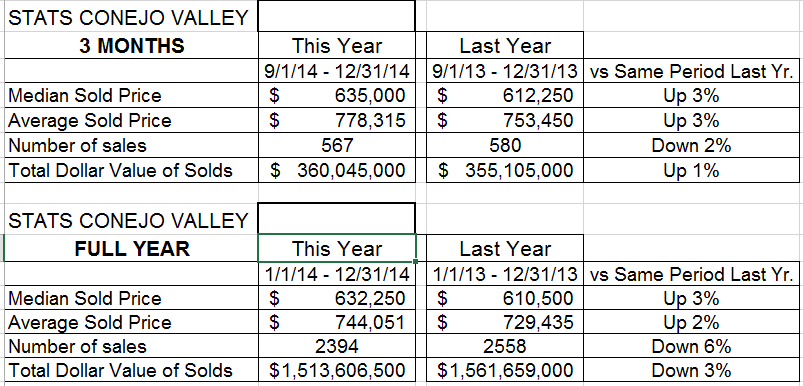

We begin our forecasts by looking at past history, and try to extrapolate the future. Most reports go back a year to compare how prices and sales are doing. I have been limiting my comparisons to only three months of this year versus the same three months of the past year. Let’s look at what that comparison tells us.

Prices have risen by 3%, both in the annual and the 3-month comparisons, but activity based on number of sales is now down only 2% versus the full year comparison of 6%. Things are getting better. The same with the total dollar of homes sold. The 3-month comparison is now a positive 1%, whereas the annual comparison is down 3%. Things are getting better. Let’s next look at Simi/Moorpark.

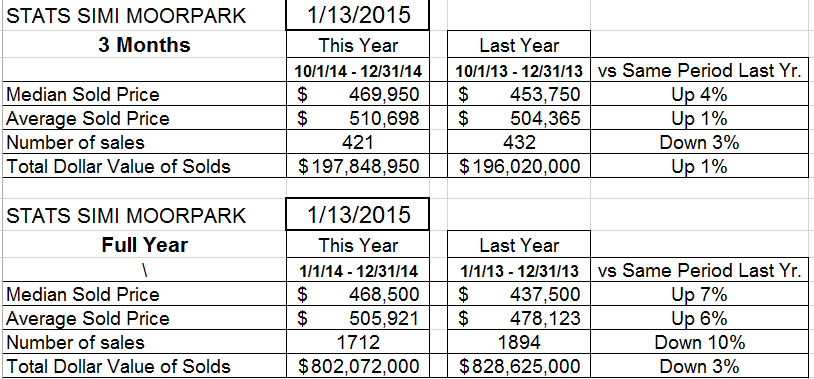

Simi/Moorpark has quieted down. Prices are up 7% for the year, but much less for the 3-month comparison. For the year the number of sales were down 10%, but for the quarter only down 3%. Things are getting better.

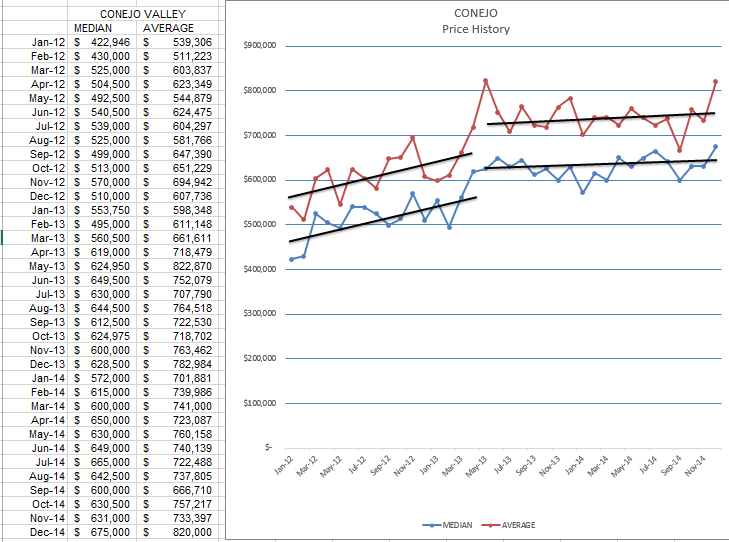

Next let’s look at the price history.

Prices increased consistently in 2012, then jumped significantly in the beginning of 2013, and since then have been following inflation at 2-3%. The same chart for Simi/Moorpark is next:

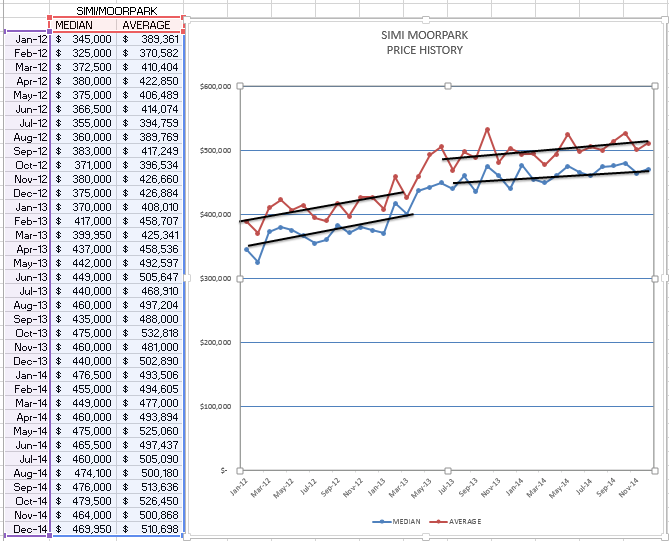

Yes, graphically the same story.

What can we expect for this year? If you really want to know, come with us to hear from Leslie Appleton-Young tomorrow morning, as she presents her C.A.R. forecast to Dilbeck.

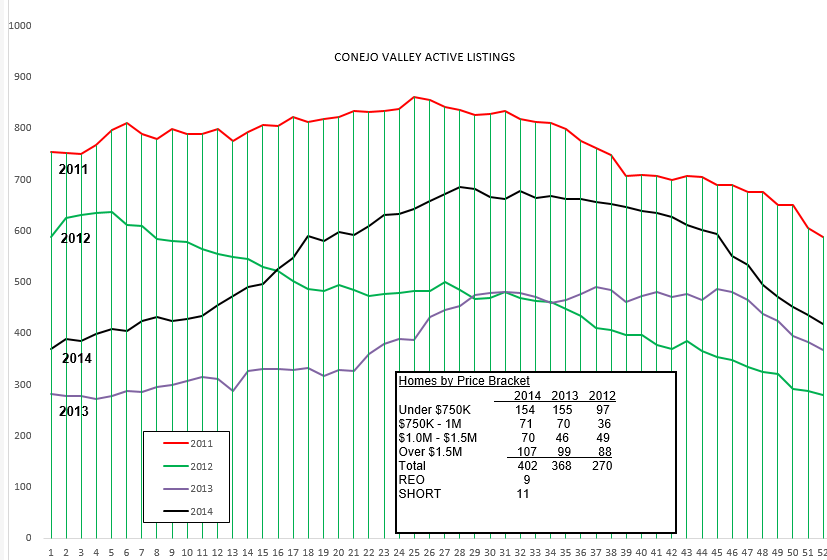

Since all real estate is local, let’s look at what the inventory figures show. Lower inventory usually means higher prices.

This is a very normal year compared to the past. 2013 was also pretty normal, but the previous years were anomalies due to the pressures of the world economic disaster beginning in 2008. Normal is good, normal is what we want, and I think normal is what we can expect for next year. Simi/Moorpark is similar.

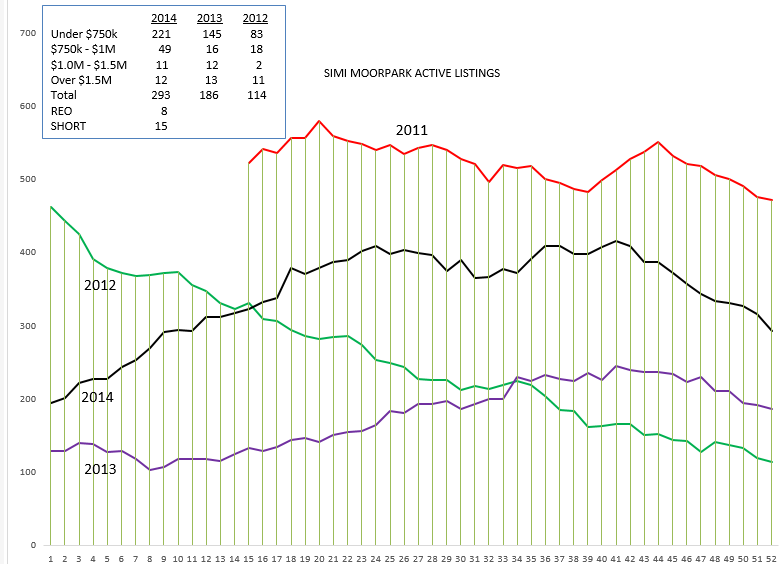

Same story, except 2013 was a year of unbelievably low inventory. But yes, back to normal.

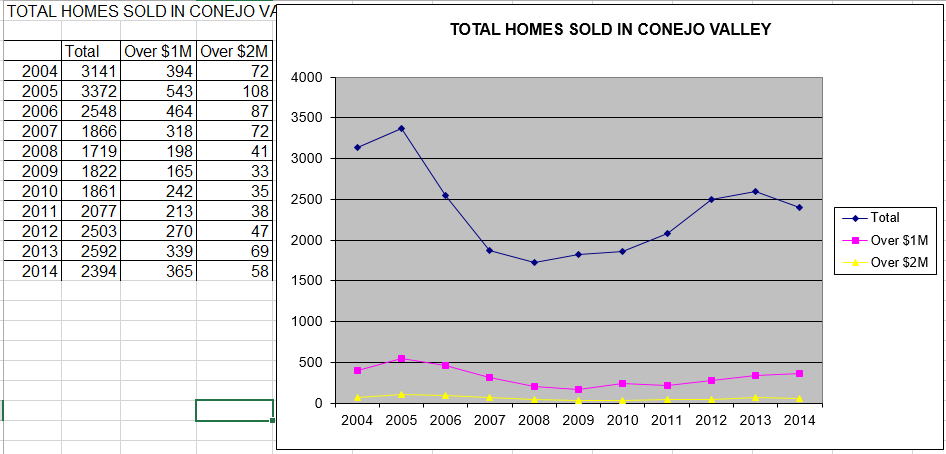

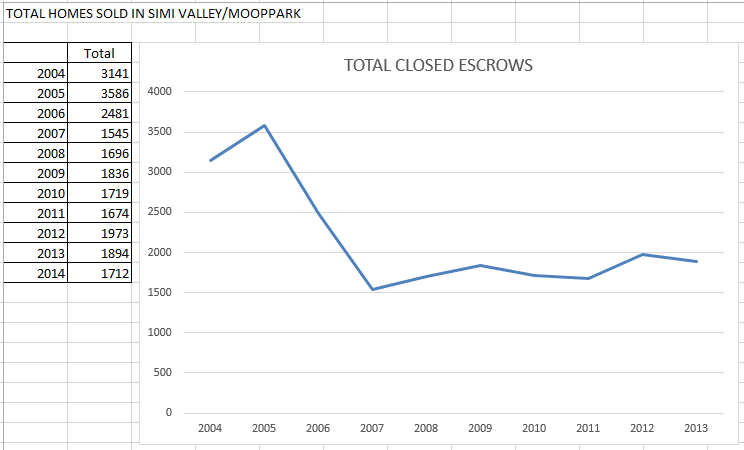

Let’s next look at the history of sales since the beginning of the strong price increases of 2003.

We can see the dip from the previous years. Simi/Moorpark shows the same dip.

Have we hit the peak? No, certainly not. We have very strong factors that will be causing home buying to be excellent in 2o15. Consumer confidence has risen strongly, unemployment has consistently decreased, and is nearing the level that will produce higher wages.

Mortgage rates remain very low, but the spectre that they will soon increase will push people to make their decision to buy. Most importantly, new housing is desperately in short supply, the number of vacant rentals is so low that it has warranted rent increases of a probable 8% over the next two years.

FHA, Fannie and Freddie all have competing programs to assist the first time homebuyer, and the people who lost their homes and have lived through their own personal credit crunch, and now have better credit because the short sales and REOs are far enough in their past so as to no longer affect their credit, are looking to move from renting a home to buying a home.

As they say in New Orleans,

Laissez les bons temps rouler.

Let the good times roll.

Make sure you work hard to get your piece of the market.

Chuck