This is a special edition, with interesting and good information on the economy, but no housing charts.

This week, I have been attending the Leading Real Estate Companies of the World conference in Las Vegas. I am doing my best to make sure the Las Vegas economy is healthy.

One of our speakers was Marci Rossell, former chief economist for CNBC. Her talk was on her 2015 economic forecast.

She termed 2015 as the Year of Normalization of Economic Policy. We have been experiencing near-zero interest rates from the Fed for close to 6 years. In addition, we have had two sessions of Quantitative Easing. She described Quantitative Easing as the Federal Reserve spraying money all over the economy. We usually call that printing money.

QE-2 ended in October. The Fed had been buying about a TRILLION dollars a year of bonds, mainly mortgage-backed securities. Her question—did anyone notice anything when QE-2 ended in October? No? Good, then they got it right.

Her forecast is that interest rates will probably go up soon, but that we should not really be concerned. If interest rates go up because the economy is doing very well and they have to cool it off, that would be a good thing.

She opined that if you thought interest rates were driving the housing market, it should be skyrocketing. We have had very low interest rates for years, and the housing market does not seem to care. What if rates go up? If they do, it will be because people are fully employed, because people feel very positively about their future, because they are getting raises because employers have to raise wages to get the good workers they want. The housing market relies primarily on the economy, and people’s perception of the economy, not on interest rates.

She thinks that 2015 will see the employment rate find the normal range of 5 – 5-1/2%. Competition for workers will cause an increase in wages. When workers get raises, they tend to spend more money. One day, that may cause some inflation, and the Fed will raise interest rates. That is the normalization of economic policy.

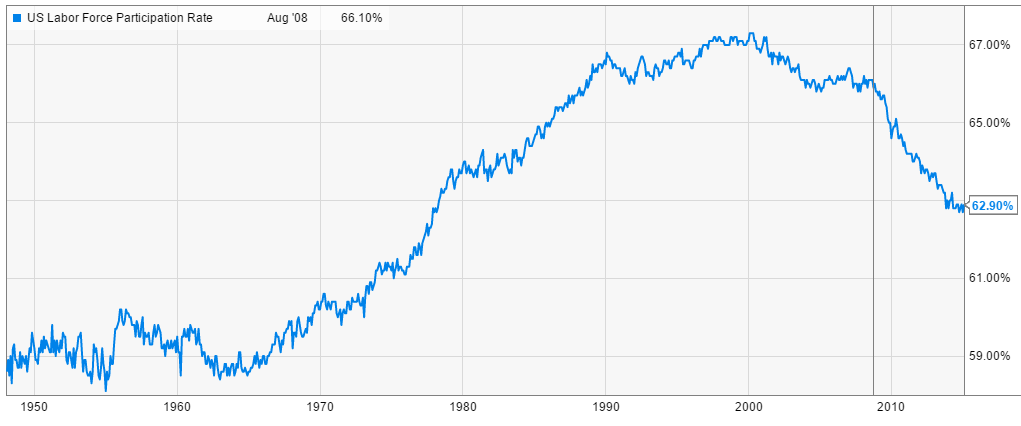

Sometimes with so many jobs being created, we expect to see the unemployment rate go down, and instead it goes up slightly. That is because the strong job market is attracting the long-term (longer than six months) unemployed, discouraged workers, and part-time workers. Last year more than 800,000 of these workers went back to work. That is good for the economy, it provides the economy with workers spending money to grow the economy, and it alleviates government payments to these unemployed. The number of unemployed has come down, from 3.6 million to 2.8 million. And the participation rate has stabilized and begun to rise.

OIL PRICES

Historically, oil prices went up when the economy was strong, and decreased when the economy was weak. Prices were based on demand.

As of 1973, all that changed with the advent of OPEC. OPEC controlled supply, not demand, and their control of supply is the reason oil prices got up to $120 a barrel. They were in control, by withholding supply.

Until last year. OPEC is no longer in control of supply. The U.S. is now the world’s largest oil producer. Why did prices recede to $50 per barrel? That’s because many of the new wells are economically viable around that point, $50-$60 per barrel. As prices went down, those wells were shut down. They were not destroyed, they were not set on fire, they were merely shut down. As prices go above $60 a barrel, they will start back up. Currently the U.S. inventory of oil at the refineries as substantially higher than needed. That is why prices declined. Inventory grew. Demand went down. We are back to demand-influenced oil prices, no longer controlled by suppliers.

What has been the effect? It has put money back into the pockets of all Americans, and historically American spending money is the primary driver of our economy.

Overall she gave a very good look at the economy, and some of the important factors. Worth sharing, which is why her comments are summarized here.

Have an awesome week.

Chuck