The Fed is threatening to raise interest rates. That is really good news.

You see, if the Fed feels they have to raise interest rates because the economy is doing really well, that is good news.

For years we have heard that unemployment numbers are inaccurate because so many people have left the workplace, have given up.

Now we hear that the unemployment numbers would be even lower if it were not for the people that have left the workplace coming back in and looking for jobs.

The economy is strong, not just recovering. The economy is not overheated, but overall things are good.

Today let’s look at the unemployment rate trends.

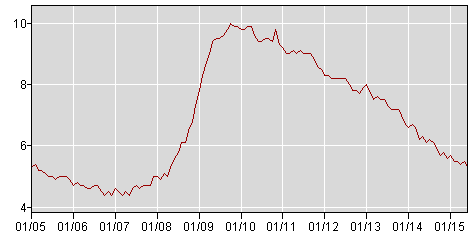

U.S UNEMPLOYMENT RATE PERCENT

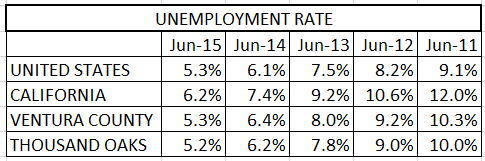

Unemployment is back below 6%, back to 2005 levels, a very strong economy. Basically, the unemployment rate has been cut in half over the past five years. The chart below show the unemployment rate figures for the past five years.

Besides the unemployment rate, another key factors to consider is job creation. The chart below shows job creation for the U.S. since 2005. Job creation took a major hit in the last half of 2007, coinciding with the devastation seen in the real estate market. When people lose jobs and worry about losing their jobs, the don’t buy houses.

Job creation turned positive in 2011, and since then the trend has been normal. Not overheated, not outstanding, but in this case normal is good.

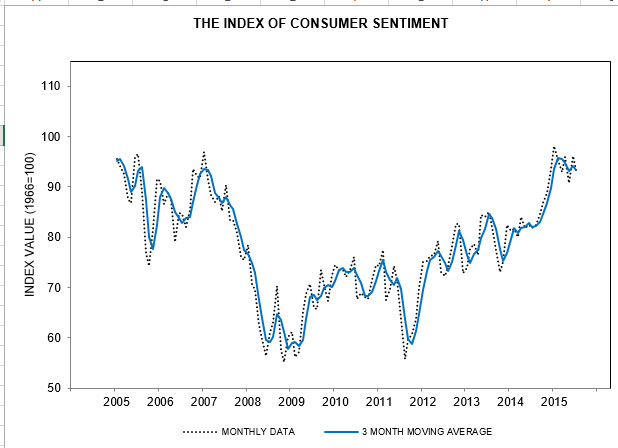

The purchase of a home relies heavily on the mental outlook of the buyer concerning their future income, their future job stability. The University of Michigan Consumer Sentiment Index has returned to the levels seem in the strong economy of 2005, see the chart below.

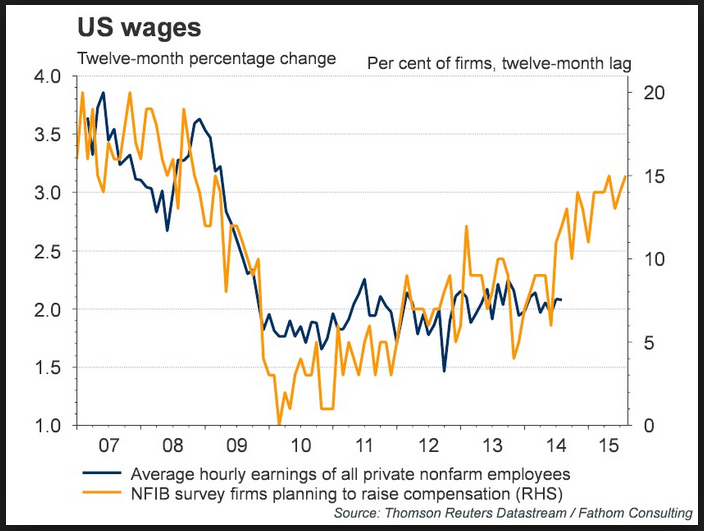

When people have jobs, they are confident about the future. That confidence is supported when wages increase. Thus far, we have not see wage increases above nominal levels. But increases are coming.

The blue chart above indicates that wage growth has been below 2% per year since 2009. The economy tanked in 2008, but due to labor contracts, wage growth showed continued strength in 2008, although the strength was declining. As these contracts ended, 2009 declined to a steady below-2% rate. Business hiring had plenty of unemployed workers to choose from. Unemployment today is half what it was in 2010, and you can see from the orange figures the increasing percentage of businesses planning to raise compensation.

Now look at the orange line in the graph above. It shows steady increases in the business survey that asks if they have plans to increase wages in the next year. Wage rate increase are coming. And that is what the Fed is watching.

The economy is strong, and the future is bright. Not get-out-the-sunglasses bright, but certainly we have passed through the end of the tunnel.

Have a prosperous week.

Chuck