Anybody out there want to list their home for sale?

Guaranteed to get a good price and attract lots of buyers.

We have been working with low inventories for the past few years. Many of us thought it could not get worse. Well, it has.

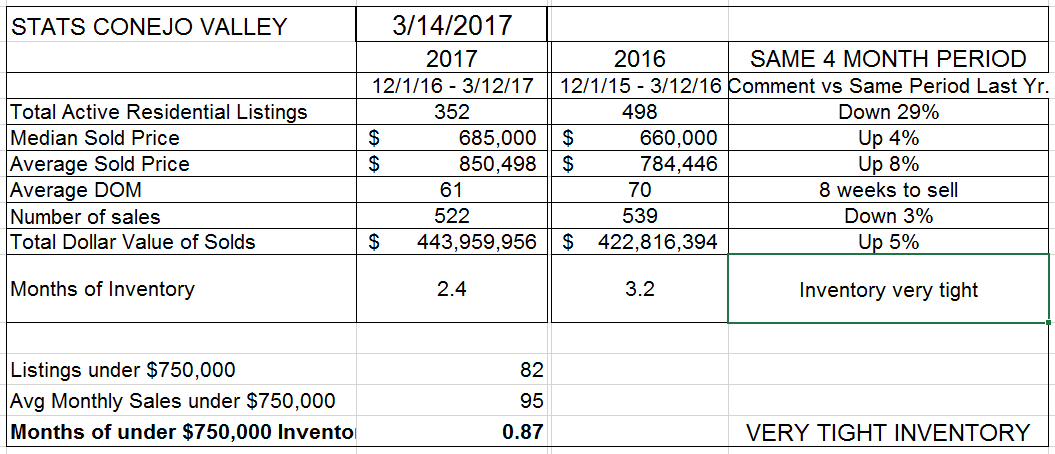

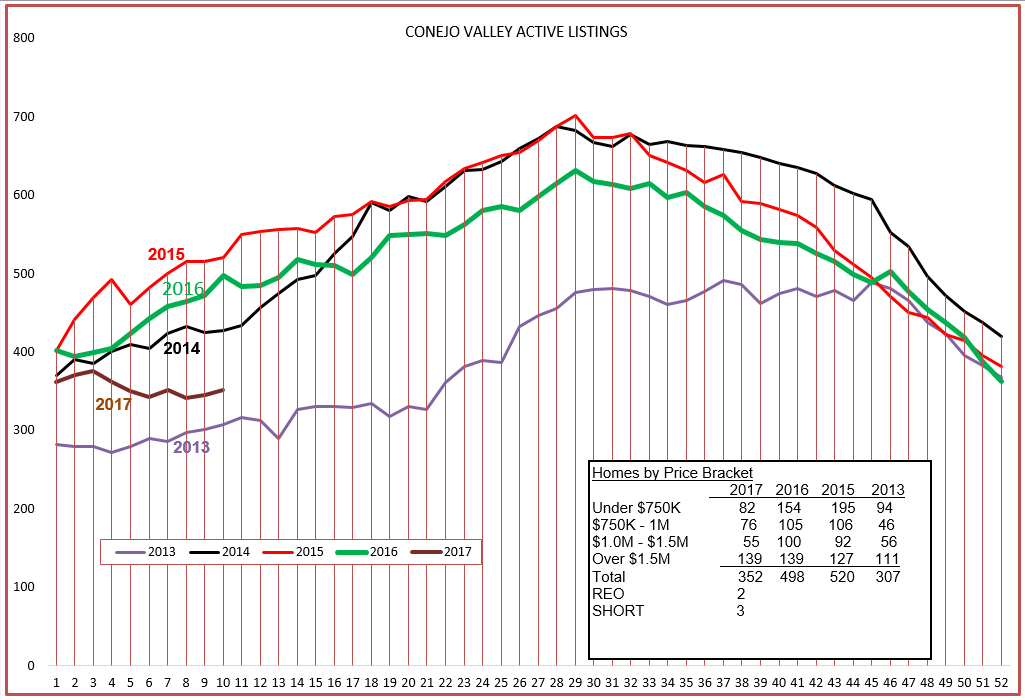

Check out the statistics below. Our inventory last year was low, our inventory this year is 29% lower. This is primarily the reason why the number of sales is down 3%. We don’t have enough inventory to fill the demand. When demand exceeds supply, we expect prices to increase. They are, but this chart does not yet tell the whole story. It compares the past 3-1/2 months with the same time period last year. Median Prices up 4%, Average Prices up 8%. And the months of inventory remains a little over 2 months. Except for homes priced below $750,000. That inventory would last less than a month. Hand to mouth inventory.

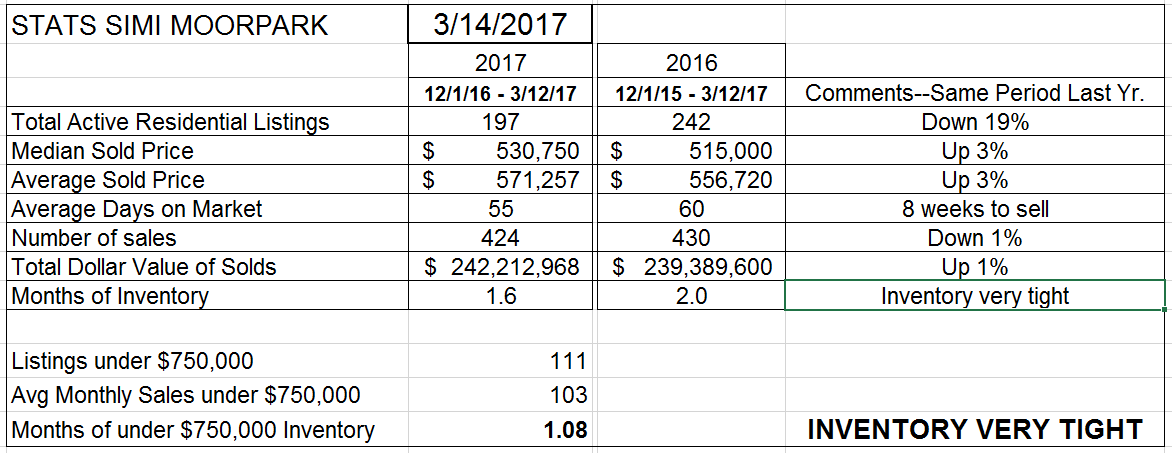

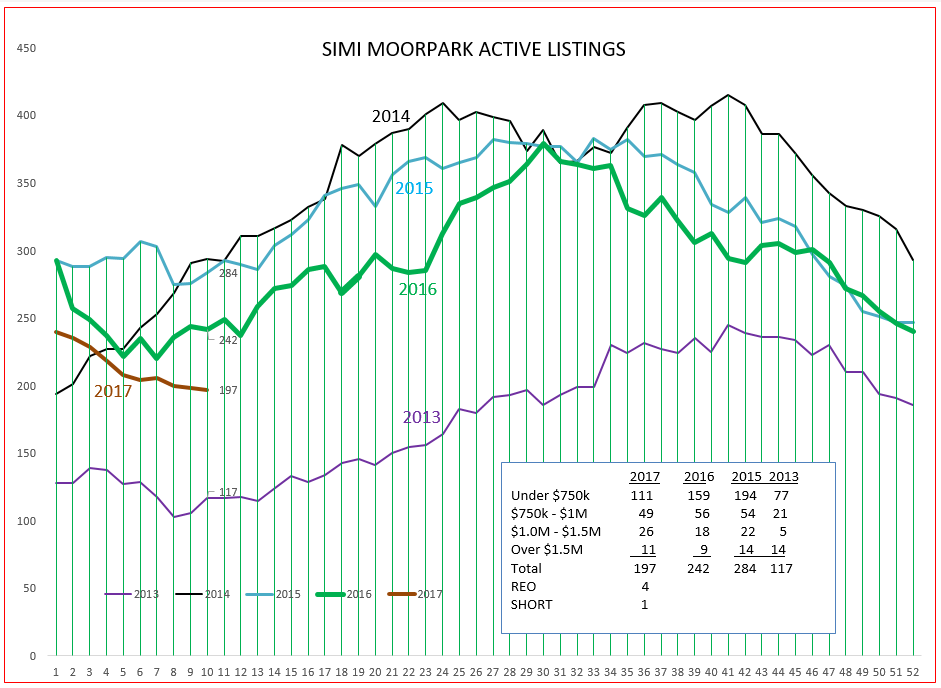

Simi Valley and Moorpark have similar stories. Simi/Moorpark inventory last year was low, this year our inventory is 19% lower. The number of sales is down 1%, and again we don’t have enough inventory to fill the demand. When demand exceeds supply, we expect prices to increase. They are, but this chart does not tell the whole story. It compares the past 3-1/2 months with the same time period last year. Median Prices up 3%, Average Prices up 3%. And the months of inventory is only 1.6 months.. Since the majority of homes sold in Simi Valley and Moorpark are priced below $750,000, the months of inventory under $750,000 is a little over a month.

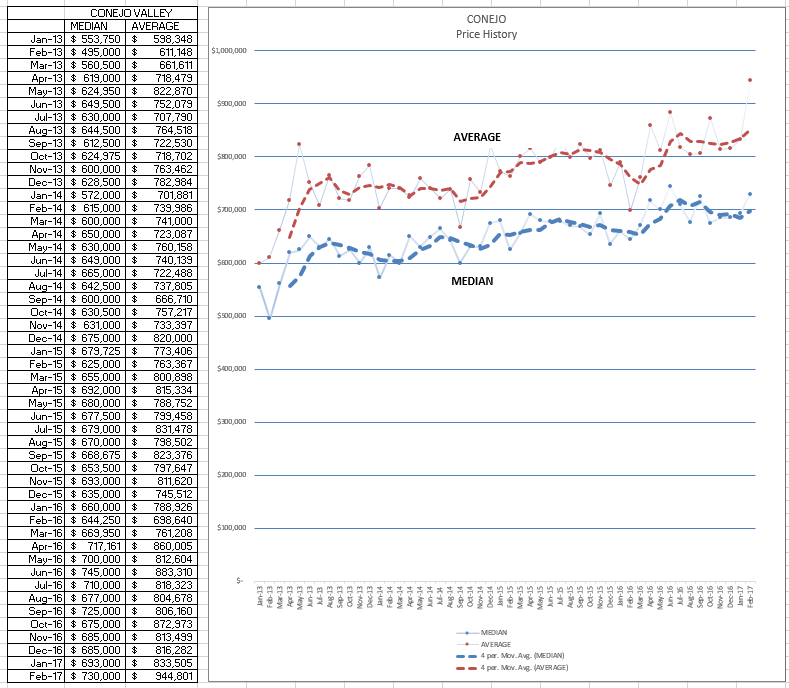

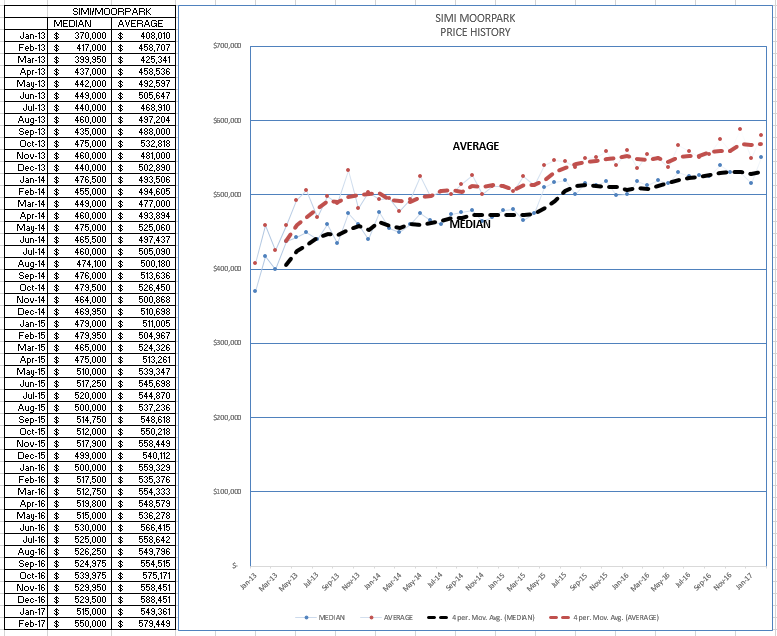

These factors tell us that a significant price rise should be in the works. Keep in mind that all statistics represent averages, over some period of time. When we look at increases over a longer period of time, in this case 3-1/2 months, the increases are less noticeable and averaging brings the numbers down. Let’s look at the actual pricing numbers for only the month of February to see if we can get a better hint of what is happening. In these charts, the monthly figures for each individual month are used, without averaging over a longer period of time. The averaging is taken into account through the graphing (red and blue lines), but the individual points, and the individual prices to the left of the graph, show a surprising rise.

For Conejo, the median price jumped 5% month to month, and the average price jumped 13% month to month. I usually don’t pay a great deal of attention to month to month changes, preferring to use a longer time period to see if the trend continues. However, the market today is very short of inventory, and multiple offers have become the norm, so it takes a little more analysis to determine what is really happening.

For Simi Valley and Moorpark, the median price jumped 7% month to month, and the average price jumped 5% month to month.

We are seeing major pressure to increase prices. This comes from many market forces.

Interest rates remain very low, but interest rates have increased recently and tomorrow the FED will announce another bump in the FED rate. This will eventually affect the 10-year bond and mortgage rates. The forecast held by many is for three rate bumps this year. Some buyers who were sitting on the fence are scrambling to lock in those low rates, knowing they will not last.

Consumer confidence hit a 15-year high in February, from 111.6 in January to 114.8 in February (Conference Board). That’s the highest level since 2001.

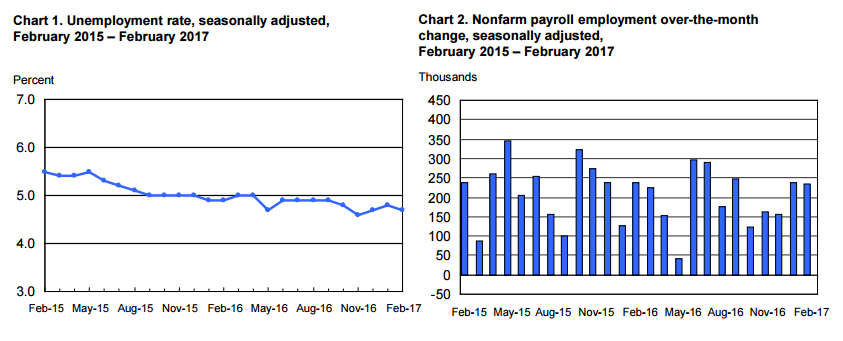

The unemployment rate is at 4.7 percent and declining, job growth has been consistently growing, and salaries are increasing. Companies are increasingly having difficulty finding workers.

Let’s look at the inventory charts, and compare the inventory figures to 2013, the last year of extremely low inventory and strong price increases.

Both graph show the same thing, low inventories approaching the levels last seen in 2013.

At this point, many economists enumerate their list of disclaimers, highlighting all the outlying factors that could quickly change their forecast. Luckily, I am not a real economist so I don’t have to do that. I can give you my honest opinion and not worry about being proven wrong.

What we have is a very strong market, and the results would be even stronger if we only had more homes listed to sell.

Have a fabulous month.

Chuck