I believe in the law of supply and demand (and price). That is how we tend to look at that connection, that supply and demand affect price. More accurately, these three are tied together. In this market, with prices seeming to be fixed and demand rising and falling, it seems as if inventory is the element that has been rising and falling to balance the other two factors.

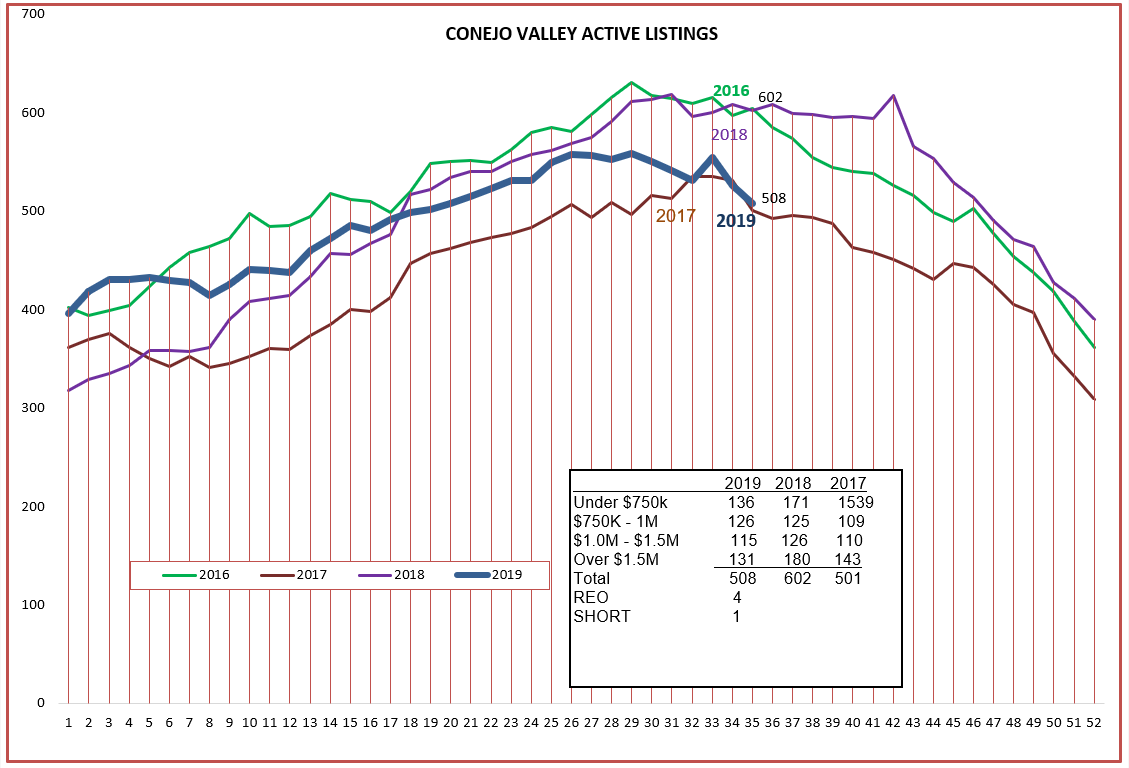

I will open this blog with the Active listings graphs because, frankly, they are the most interesting. In the recent past, we have conjectured that sales were limited by the available inventory. Looking at four years on the Conejo Valley chart, we can point to one area where this was likely true. These graphs are usually on railroad tracks, deviating only slightly. But in 2018 the inventory seemed to forget that it was supposed to decrease beginning in September, and instead kept climbing, and then resumed the expected decline in the final couple of months.

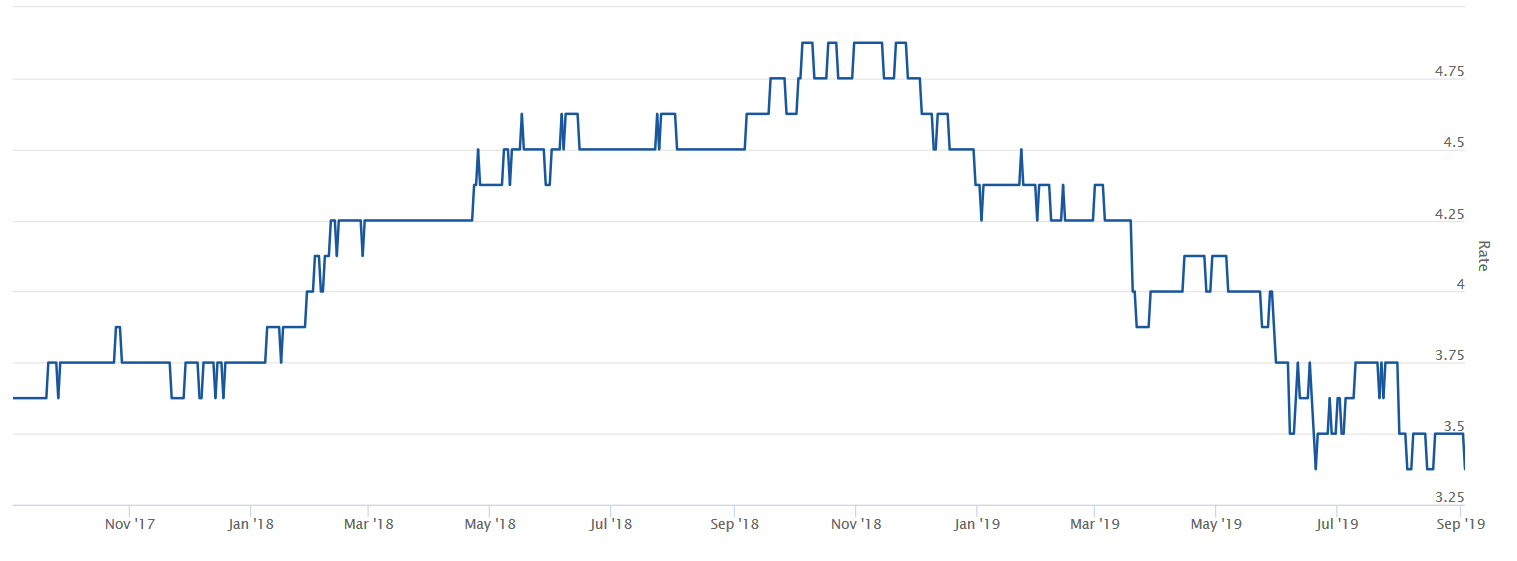

Why did the inventory decline not take the expected downturn in the latter part of 2018? We have to add in a fourth factor, mortgage rates, which affect demand. Looking at the Amerisave chart below, 30-year mortgage rates peaked in the latter half of 2018, erasing some demand. Due to that lower demand, inventory in the chart above did not begin the usual September decline. Sales dropped off and inventory grew, with the graph behaving out of character, remaining stubbornly high after Labor Day before finally falling in the final months of the year. During those final months, interest rates began to drop, and that drop both increased sales and reduced the inventory, returning the inventory to the expected curve.

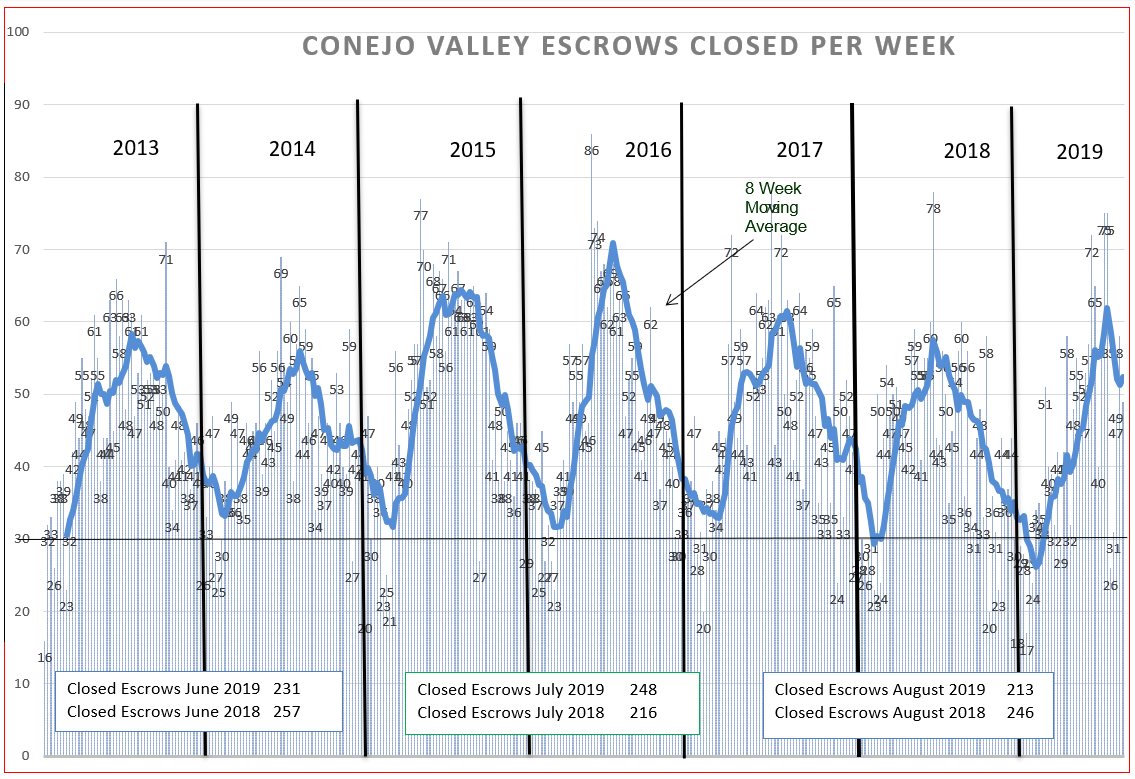

Sales, as pictured by the graph below, dropped off precipitously, finally falling to an 8-week average of less than 30 per week for the first time in 7 years. The total price to acquire a home stayed the same, but the monthly price to purchase a home rose with interest rates. The acquisition price did not change, but the monthly ownership price increased. Lack of sales caused a buildup in inventory. Then the drop in mortgage rates caused sales to recover back to normal.

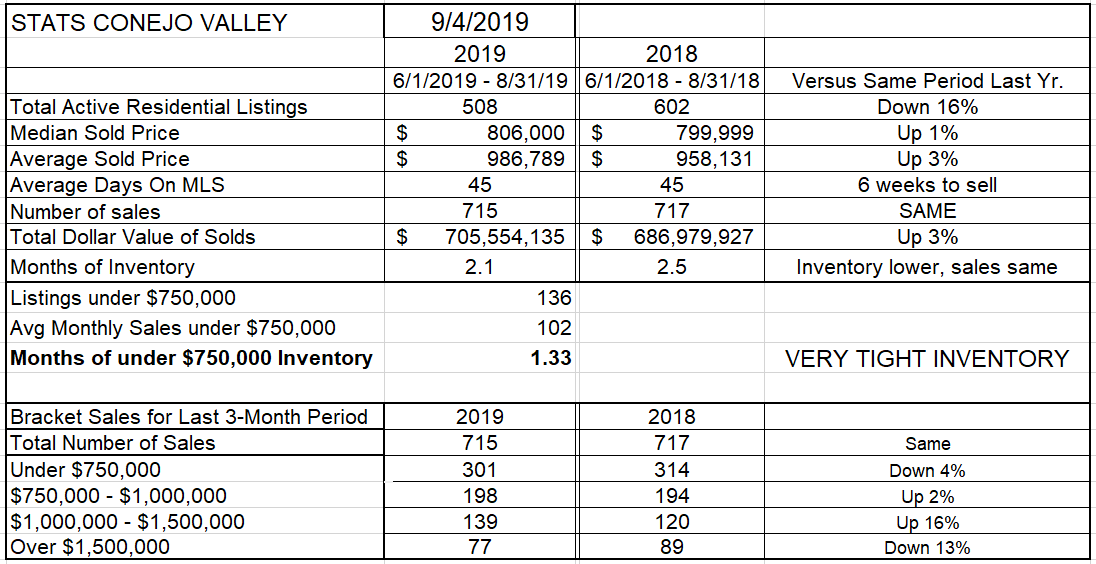

Where are we today? Conejo inventory is down 16% compared to the same period last year. Prices are up only slightly, with the Average price boosted by that $35 million sale in North Ranch. Inventory now stands at only 2.1 months worth of sales. The strongest sales area is in the $1 million to $1.5 million range, up 16% versus the same 3 months in 2018. Activity in the highest priced category (over $1.5 million) is down 13%, balancing the increased activity in homes priced between $1.0 and $1.5 million.

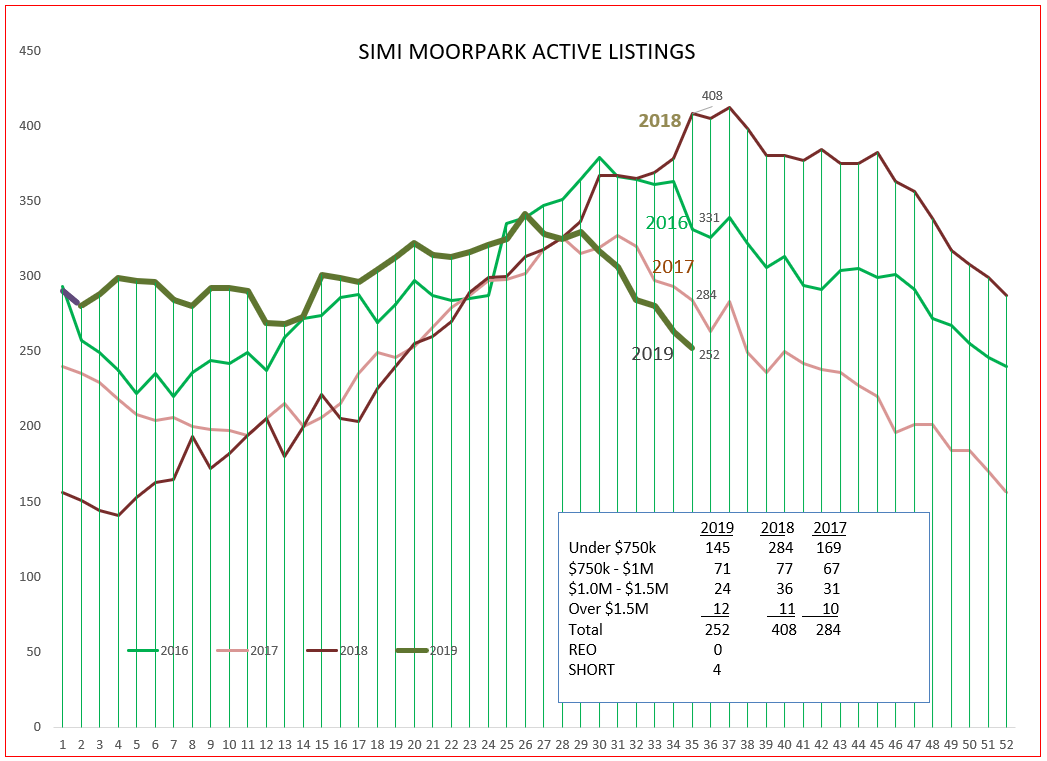

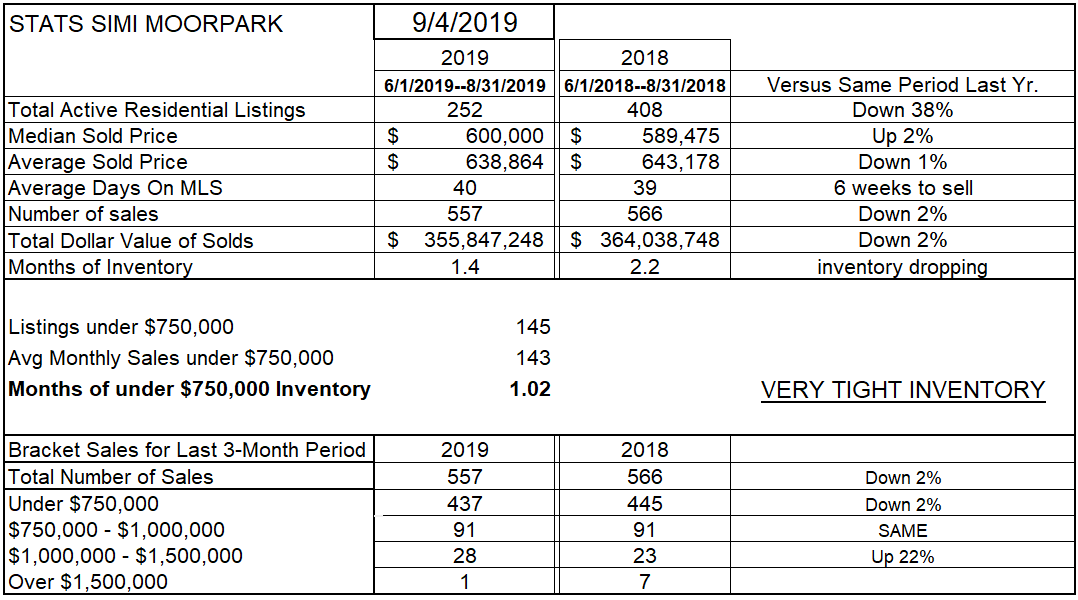

Was the story the same in Simi/Moorpark? Simi/Moorpark has homes in all price categories, but the predominant number of homes are sold in the under-$1 million groups. Simi/Moorpark inventory exhibited that same strength and bump in the latter part of 2018, similar to Conejo. However, for 2019, the inventory tells us that sales were strong in Simi/Moorpark, that more buyers were fighting over a limited quantity of homes, that the inventory did not customarily grow as summer approached. As of now, prices do not yet reflect the shortage of inventory

Reference again the graph of 30-year mortgage rates. Dropping rates in 2019 made homes more attractive to purchase, more buyers qualified due to the lower rates, prices have not risen, so we have inventory reflecting the strength in sales by first refusing to climb, and eventually falling off to the current level of only 1.4 months worth of inventory.

Compared to the same period last year, Simi/Moorpark inventory is down 38%. Prices are up only slightly, the number of sales is down just slightly, probably due to a lack of inventory, Inventory of homes priced below $750,000 represent only 1.0 month of sales. This market is poised to be hot. All the signals point to hot. And hot usually means prices going up. Why are prices not climbing strongly?

The reason seems to be in the attitude of the buyers. They have not been caught up in the pressures of the market. They seem to go looking for a home they can afford, they make an offer they can live with, and if it doesn’t work out, they take a step back to regroup. Buyers are looking for the right deal. There is no buying hysteria. They are not hesitant to back out if things don’t work out. There is no desperation, no feeling that the sellers have all the power. I think this attitude is good for the long-term health of the market. When prices are this stable, both buyers and sellers can be more certain of what their homes are worth. But I think we finally have a visual picture of what happens to the market when interest rates rise.

So, what do you say when they ask you “So, how is the market?”

The market is reasonably strong, is healthy, prices are stable to up a tad, it is a good time to shop for your next home. But watch out for interest rate disruptions. They can drastically affect what it will cost someone to buy a home. At the current level, interest rates will keep this market going. This is an excellent time to make a move.

Have a wonderful month.

Chuck