2020 was shaping up to be a really good year.

And then the virus hit.

So how did things look going through March?

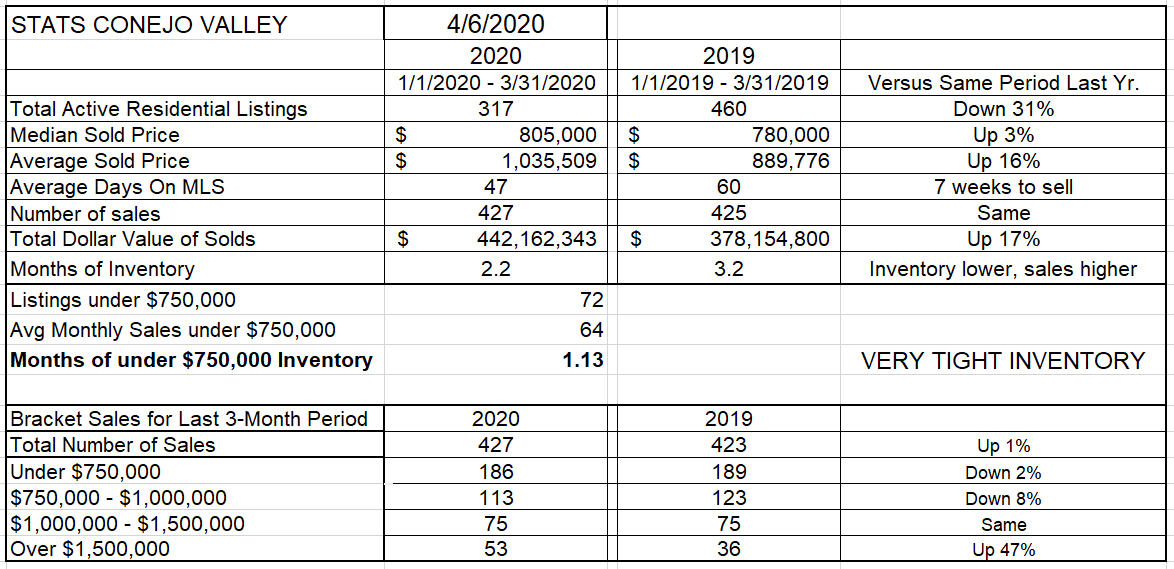

Inventory—down 31%. Sales—same as last year. Prices, reflecting the influence of high priced properties, with the Median up 3% and the Average up a whopping 16%. Months of inventory—a month less than last year, only 2.2 months worth of supply. A buyers market, reacting like a buyers market. Look at the final line in the chart below, homes priced above $1.5 million, up 47% over the same three months of last year.

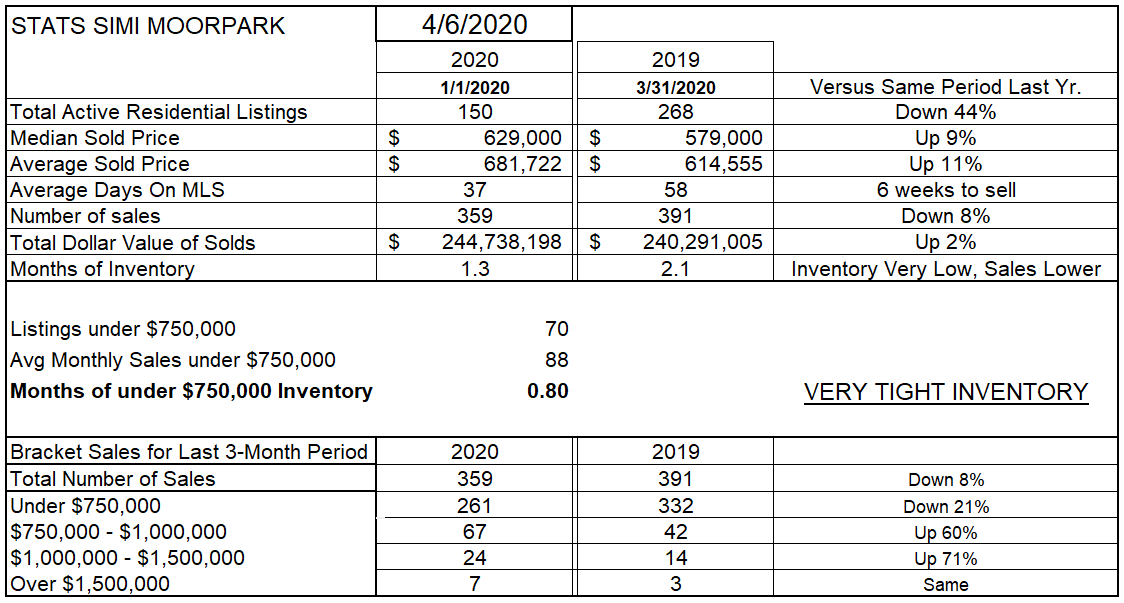

Simi Valley/Moorpark really was taking off. A true buyers market. Inventory—down 44%. The number of sales—down 8%, most likely due to a lack of inventory, down to only 150 listings, 44% lower than last year. Prices rocketing upwards, with the Median up 9% and the Average up 11%. Months of inventory— only 1.3 months worth of supply. Homes priced below $750,000, only 3 weeks worth of supply. A buyers market, reacting like a buyers market. Simi/Moorpark has always been a market strongly influenced by homes priced below $750,000, with homes higher than that a small portion of the market. Those homes priced below $750,000 showed a drop in number of sales, compared to the same three months of last year, of 21%., while the homes in the next higher price categories were up 60% and 71%. Things going great.

But that deadly virus is quickly putting an end to all this excitement. What does the future hold? Someone smarter than me has to tell you that. But it will throw a blanket over the market for some period of time. The fundamentals are strong, the foundation will be there, government incentives to buy will most likely come along. Demand will return.

Let’s see how the inventory has reacted so far. Remember, this staying at home thing is only a couple of weeks old. Homes that were in escrow were closing. But the market will feel the pressures of not being able to show homes, no open houses, doing everything remotely, and the wild swings in the mortgage market. As long-term borrowing instruments, mortgage interest rates reflect how lenders feel about the future. When the future is this cloudy, banks will not feel confident about lending unless the loans can be immediately sold to the government. Will housing prices drop? Probably. But how much? The stock market fell 30%. In days. This is very different from the last recession, one heavily involved with real estate. Real estate us usually a safe investment, safer than the stock market. It looks like real estate will follow that logic again.

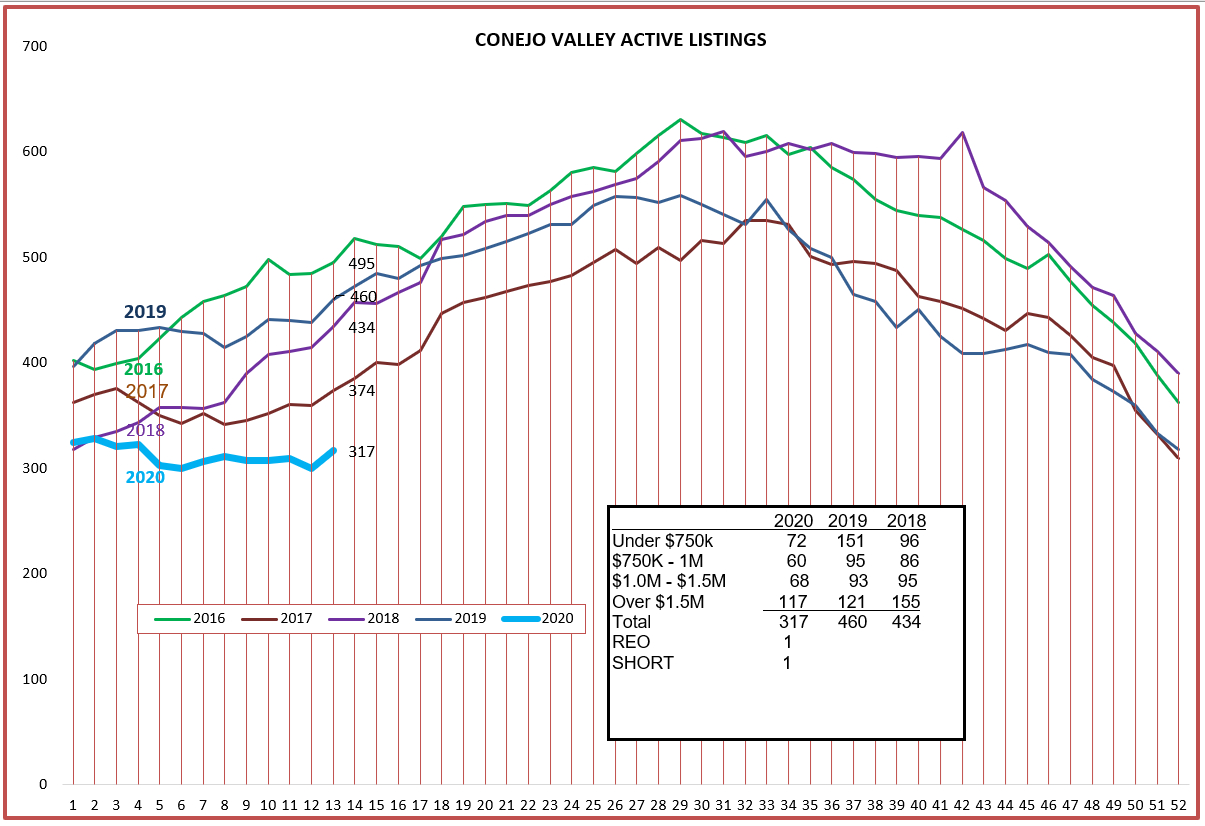

Let’s look at the inventory charts for our valleys. The Conejo inventory is the lowest in the past five years, and was not experiencing the usual upward swing as the year began. Why? Sales were strong, new listings were just keeping up with sales. Portents of a strong sales year.

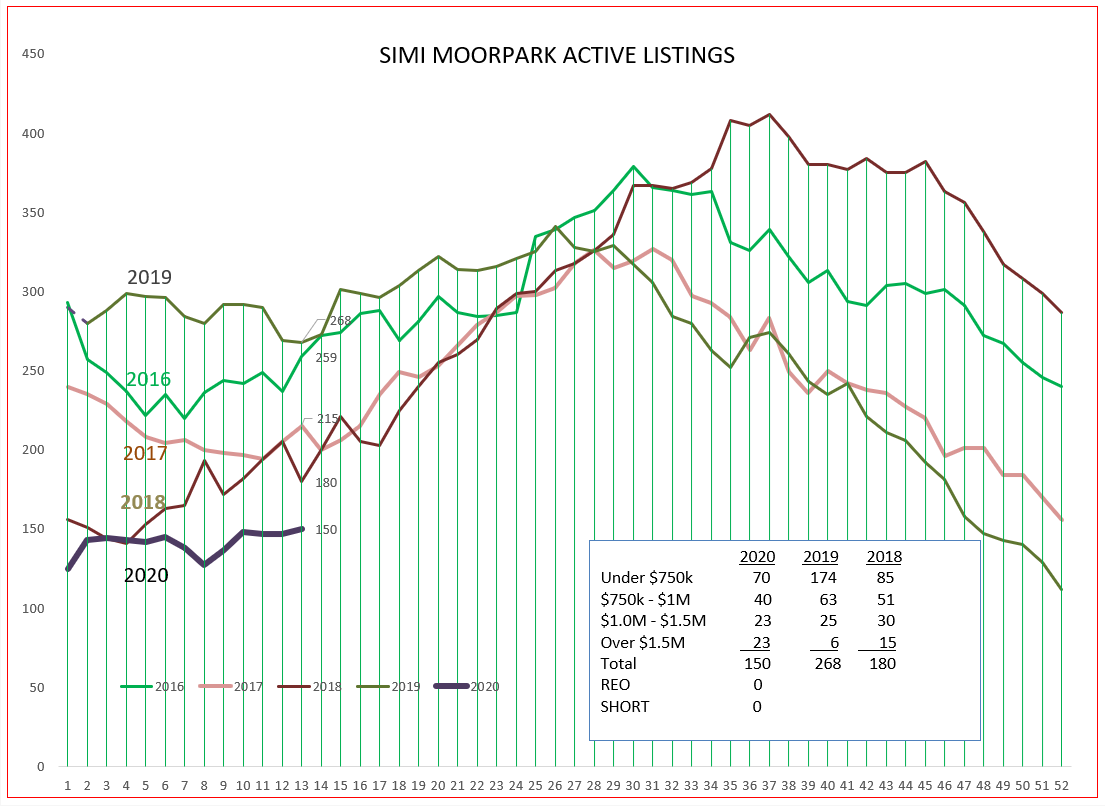

Simi Valley/Moorpark shows the same results. The inventory started out the year low and continued at that low availability. That’s why prices jumped so strongly. Pricing this past year defied explanation. Sales were strong, inventory was low, why didn’t prices go up? When we hit the beginning of this year, they finally went up, strongly.

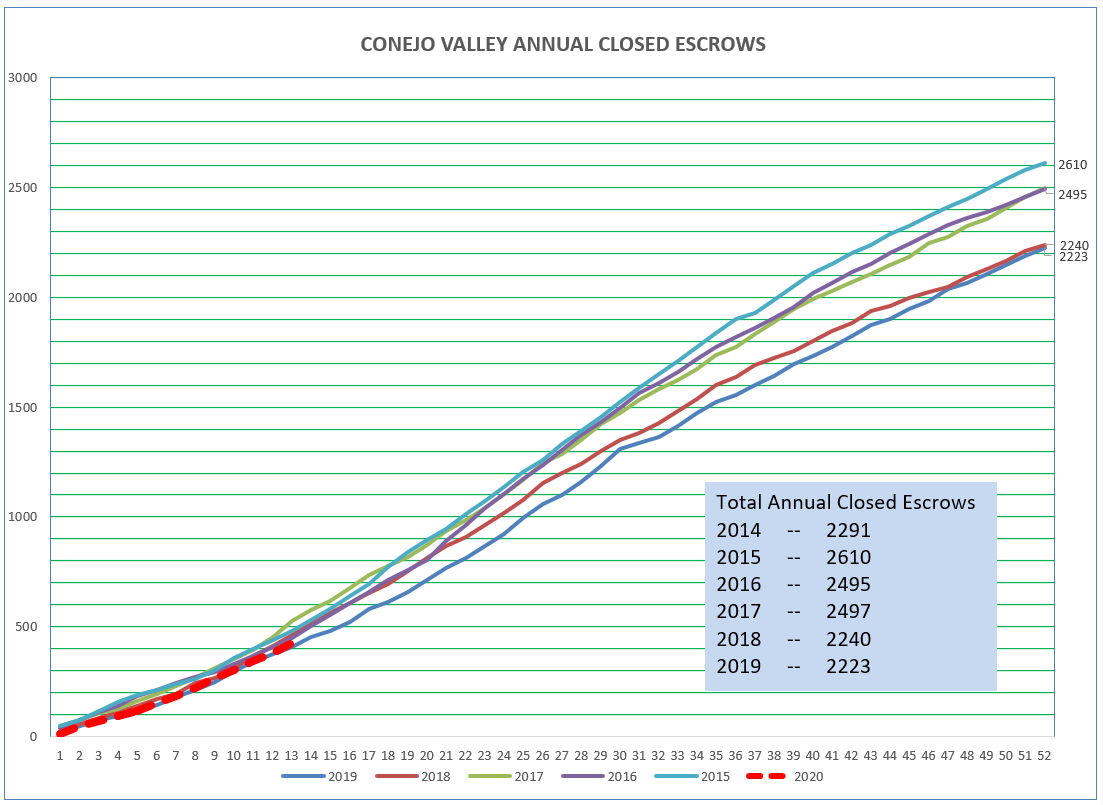

To see how the year was beginning, let’s look at the cumulative sales chart. In number of sales, we followed the experience of the past six years, maybe a little on the weak side, but basically comparable to how other years began. Of course, we should see that line behave differently in the future. No other year had this kind of experience. Escrows close 4-6 weeks after the sale begins to take place. March closed escrows tell us that sales were strong in January and February.

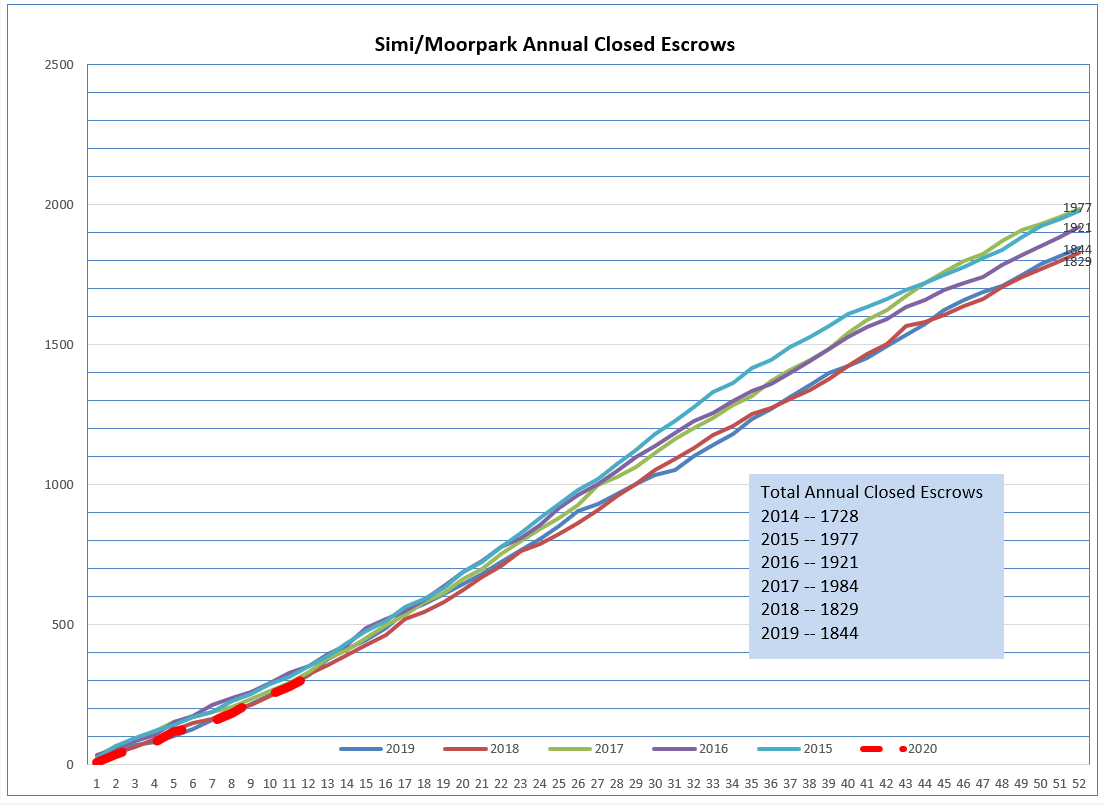

Simi Valley and Moorpark was also on the low side of historical closings, but not much. I believe things would have been much stronger if the inventory was available to sell.

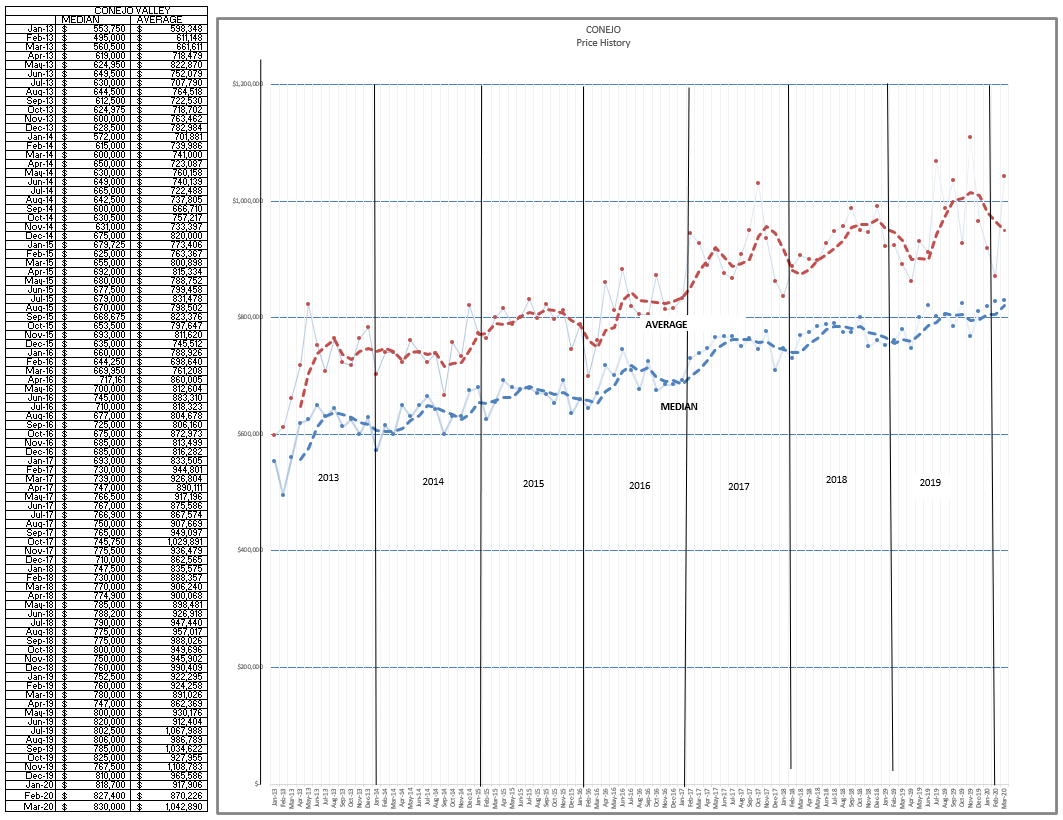

Finally, let’s look at the price charts. The Conejo Median closed price for March was $830,000, following last year’s steady experience of $800,000. The Average price is affected by the percentage of high priced homes, and that Average price vacillated between $925,000 and $1,050,000 for the past few months. The increase in high priced sales for the past three months, compared to last year, from 36 homes sold last year to 53 this year, created this range of differences between the Median and Average prices.

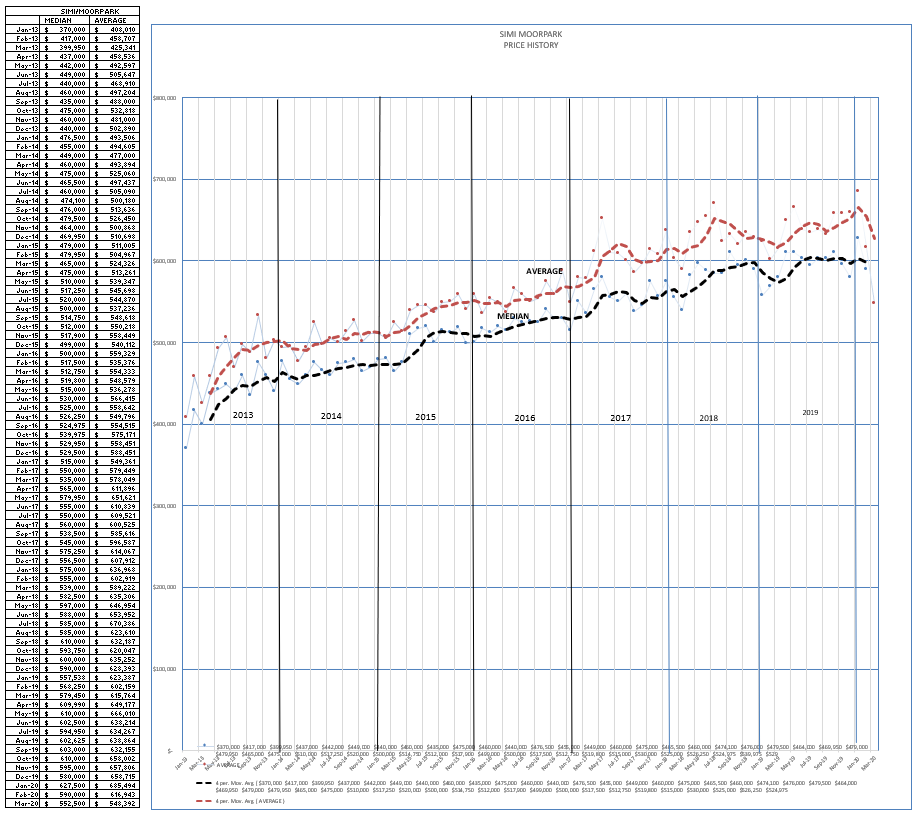

Simi Valley and Moorpark have historically seen only a little difference between Median and Average prices. But that is changing. The median price was basically stuck around $600,000. However, at the beginning of last year the Median price took a steep dip, one somewhat usual for the beginning of the year. That dip last year, compared to strong and stable pricing this year, is what influenced the strong increase in Median pricing of 9%. In addition, there were 21% fewer homes sold under $750,000, while the homes priced between $750,000 and $1,500,000 experienced increases of 60% and 71% compared to last year. Simi/Moorpark was trying to expand their sales to better compete with the price range of homes available in Conejo.

Yes, things were looking good. And then the virus hit. It hit hard. The world stopped.

For the next few weeks, I will send out updates every two weeks to show how the market is handling the new reality of doing everything while staying at home, job losses, a recession, and hopefully a quick and strong recovery.

In the meantime, stay safe. Obey the rules. Ventura County has the most strict rules in the state. While we may not be happy about the effect that has on business, we will soon be happy that Ventura County will come through this crisis losing the fewest number of lives.

God bless you all.

Chuck