We have been listed by the government as an essential business. We take care of people’s needs for housing. And those needs have not ceased due to the coronavirus.

Congratulations to all of you who have adapted and are able to conduct real estate business without having to be in the room.

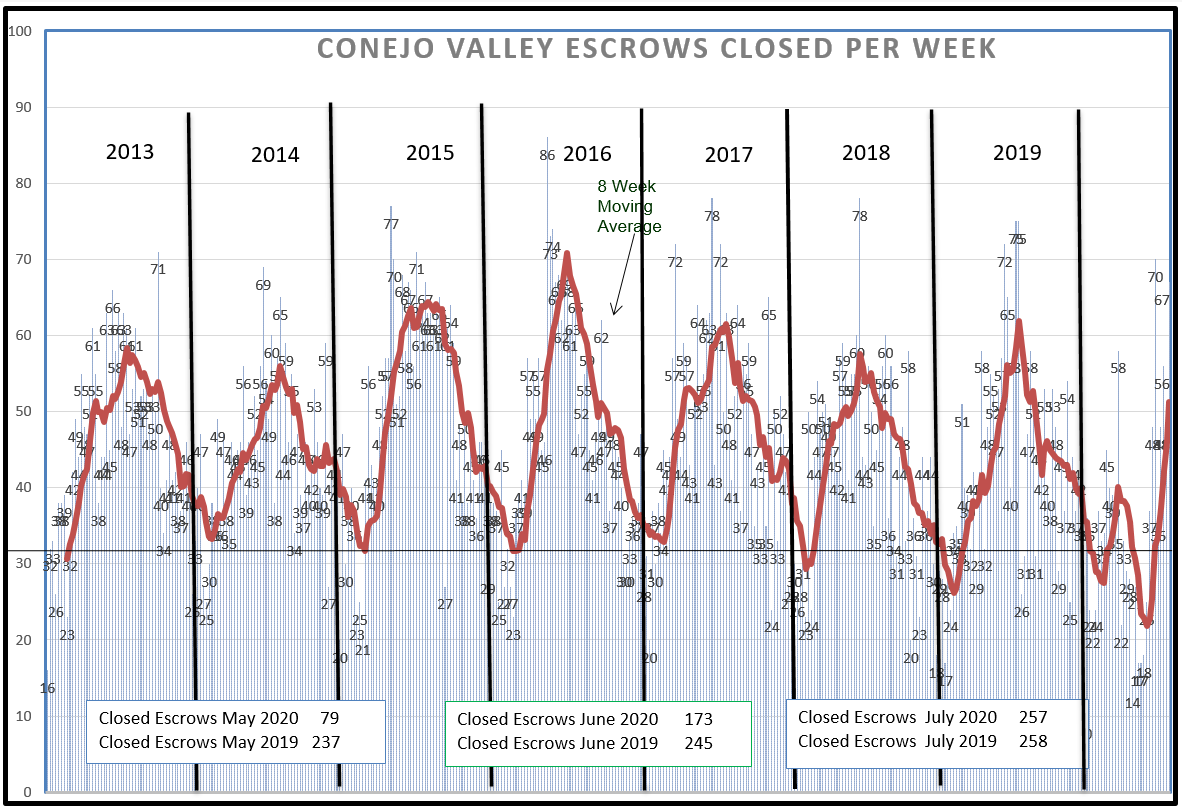

We will start off by looking at the Conejo Valley, and the chart of closed sales over time. We began the year as we usually do, with a dip in sales due to the end of year holidays. Activity was actually a little below normal,, but closely matched the experience of 2019. Then the COVID hit, and sales (closed escrows) took a major hit. However, sales activity has since recovered strongly.

How strongly? I have added a couple of boxes at the bottom of this graph that help. In May, we closed 70 escrows compared to the May 2019 number of 237. Drastic dip. June began a recovery in activity, with 173 closes as compared to 245 in June of last year. And now for a shocking surprise. The number of closed escrows in July was 257 versus 258 in 2019. The same. Certainly we are not in normal times, but we do appear to be in normal market territory.

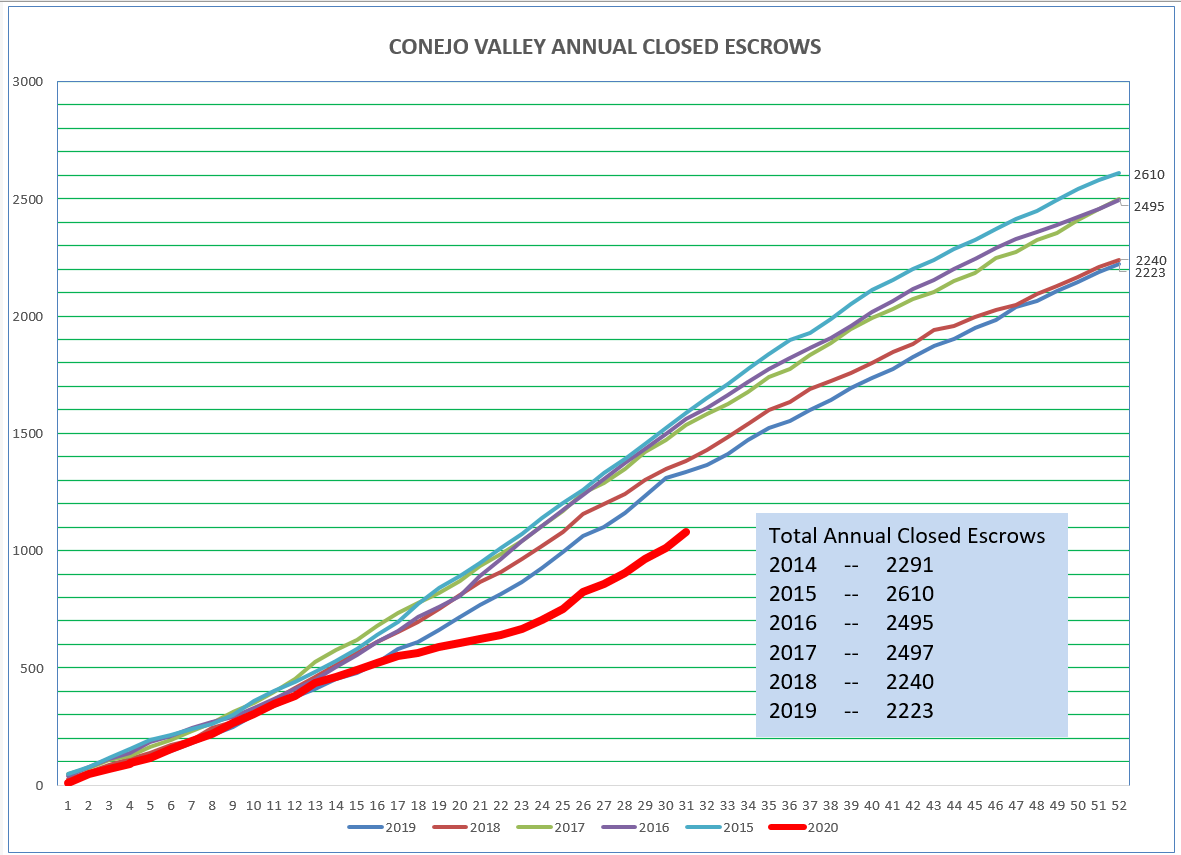

Another way to view and compare closed inventories year-to-year is below. This graph shows the total number of closed escrows as the year progresses. The slope of the graph determines whether it is behaving similarly to other years, or is behaving abnormally. For 2020, you can see escrows took a deep dive for a couple of months, but now have resumed the pace of our normal market. It may be some time, probably next year, before we make up the escrows that occurred due to the slowdown of the pandemic, but we do seem to be back on track with “normal” sales activity.

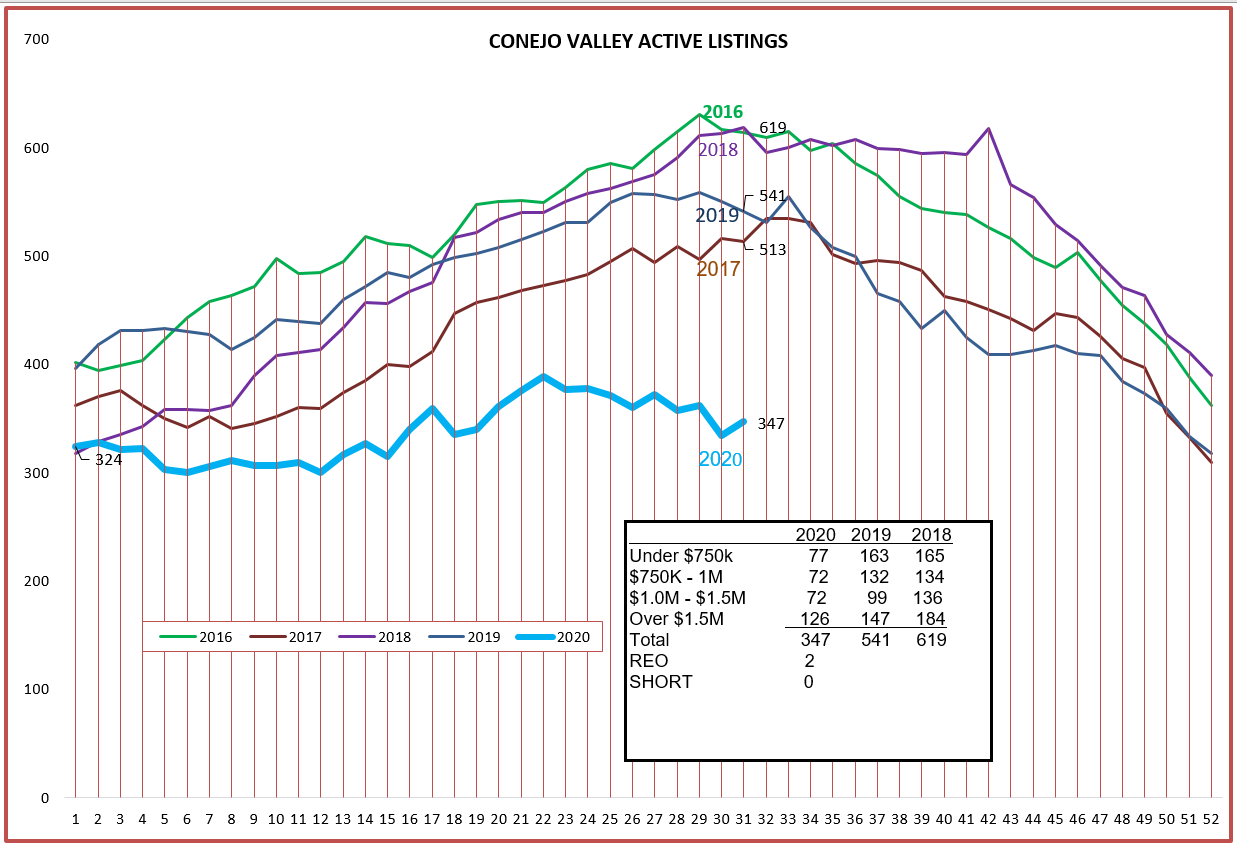

Is there enough inventory to support this sale strength? With the drastic dip in sales, did inventory climb strongly? The inventory customarily climbs as we approach the summer months, very regularly. This year, in so many ways, is irregular. The inventory currently is extremely low compared to the past four years, and is now at a level near where it started the year off. Look at the box in the chart below. The inventory in all price ranges is lower than the previous two years. Plus, thanks to government intervention preventing foreclosures and evictions, there are only two foreclosure and no short sale listings

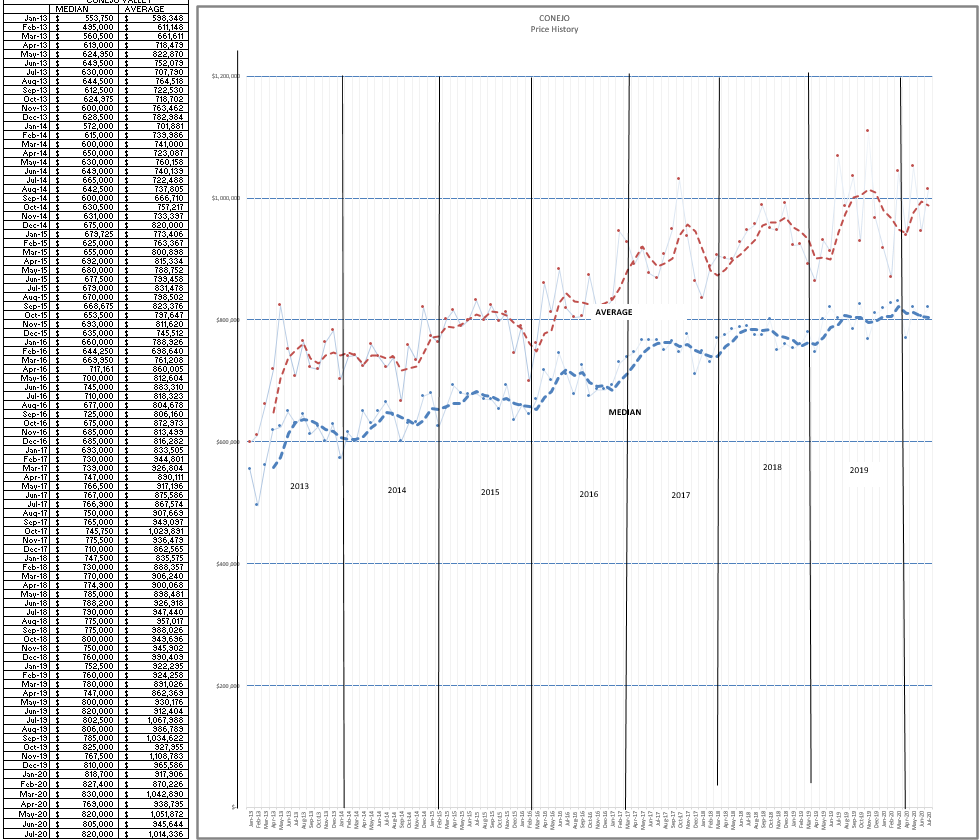

With strong sales activity and a shortage of inventory, we would expect prices to rise. However, in the middle of a pandemic, we would expect prices to fall. So which is happening?

Prices have been rising. The large bumps in the Average Price line indicates that high-value sales have been irregular. As we went into the coronavirus period in March, all mortgages became difficult to obtain, and jumbo mortgages next to impossible. The government basically prohibited foreclosures. The ancillary effect was to temporarily stop mortgage lending, as lenders were concerned that borrowers could stop paying their new loans on Day One. Time has sorted out this concern, and lending is now doing well, both with new loans and refinances. Prices are firm and rising.

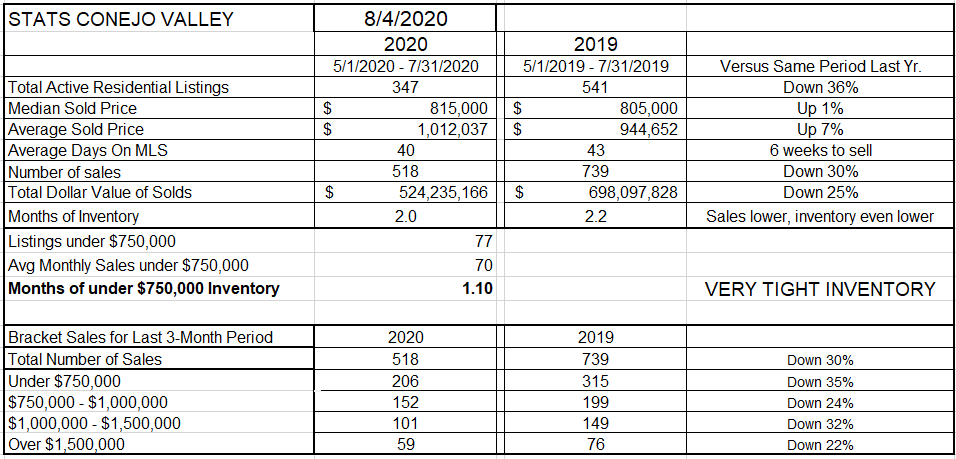

We looked at the graphs, now lets look at the numbers. Remember that I have historically used a three-month period to smooth out the daily and weekly variations in activity. For the last three months of 2020, the number of closed escrows is down 30% from 2019, But inventory is down 36%. The decrease in sales has not resulted in an increase in inventory. Prices are up, 1% for the Median and a very strong 7% for the Average. Sales of high-value properties have been much higher this year than in 2019. (Look at the bottom of this chart.) While all sales are down 30%, high-value sales are only down 22%. And the current inventory reflects only two months worth of current sales level.

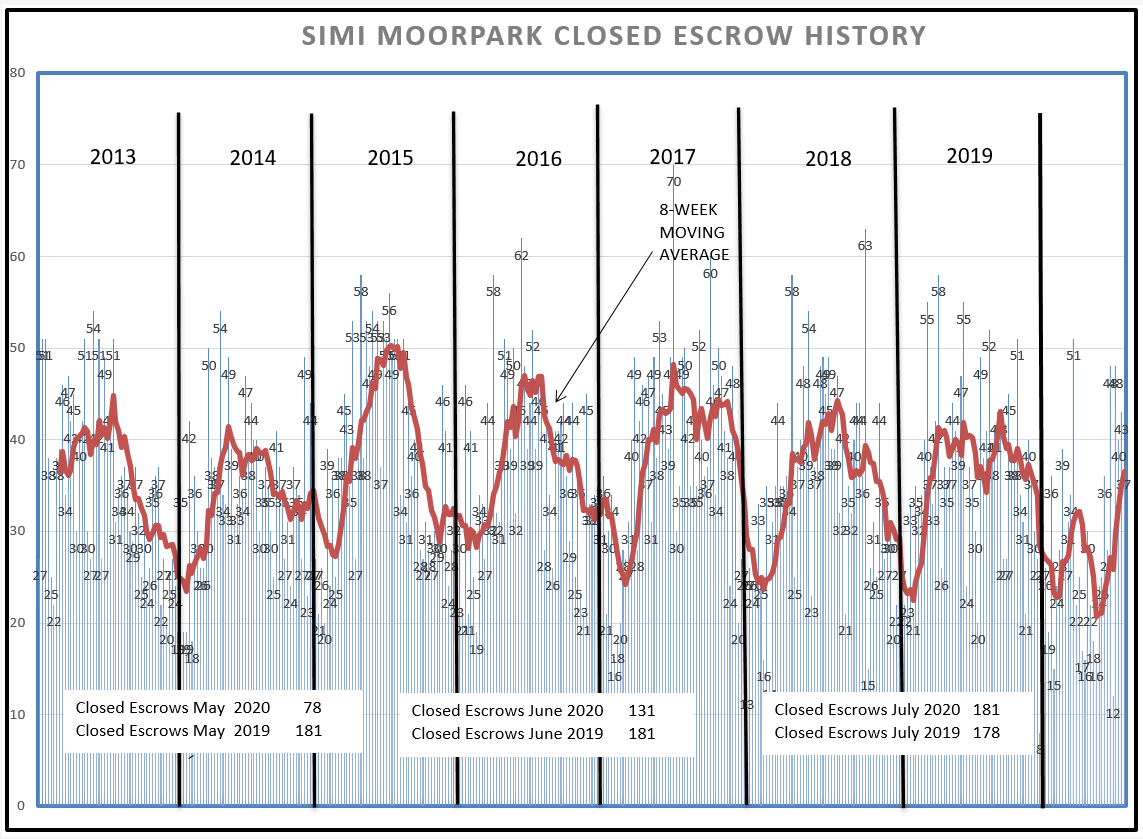

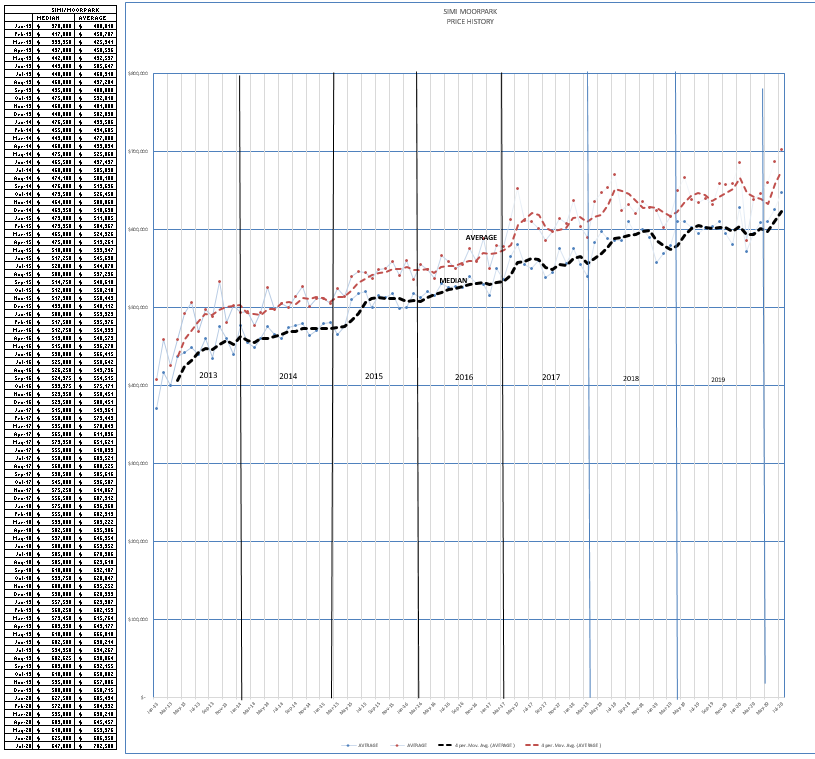

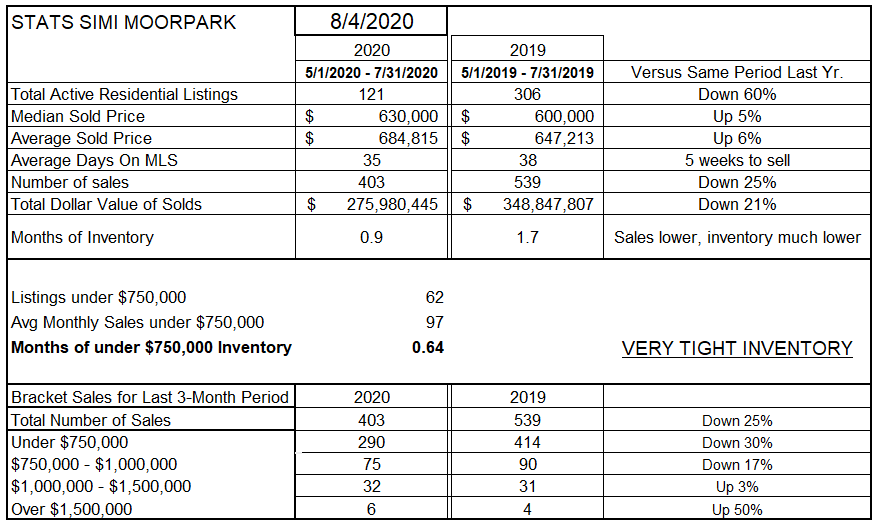

Now let’s turn to Simi Valley/Moorpark. The results are similar, and perhaps more dramatic due to the preponderance of listings below $750,000. We began the year as we usually do, with a dip in sales due to the end-of-year holidays. To begin the year, activity was actually a little below normal,, but closely matched the experience of 2019. Then the COVID hit, and sales (closed escrows) took a major hit. However, sales activity has recovered strongly.

How strongly? I have added a couple of boxes at the bottom of the chart that help. In May, we closed 78 escrows compared to the May 2019 number of 181. Drastic dip. June began a recovery in activity, with 131 closes as compared to 181 June of last year. And now for a shocking surprise. The number of closed escrows this July was 181 versus 178 in 2019. The same. Certainly we are not in normal times, but we appear to be in normal market activity.

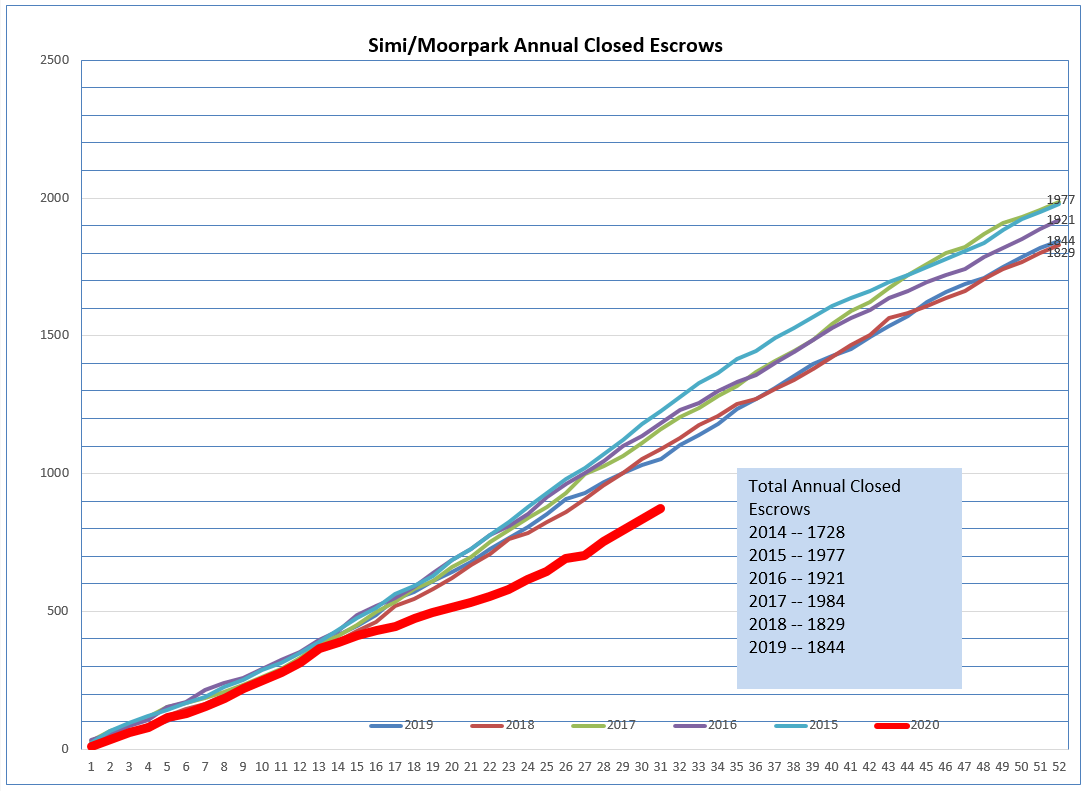

Another way to view and compare closed inventories year-to-year is below. This graph shows the total number of closed escrows as the year progresses. The slope of the graph determines whether it is behaving similarly to other years, or is behaving abnormally. For 2020, you can see escrows took a deep dive for a couple of months, and now have resumed the pace that a normal market exhibits. It may be some time, probably next year, before we make up the escrows that occurred due to the slowdown of the pandemic, but we do seem to be getting close to “normal” sales activity. If only we had a larger inventory of homes to sell, the market could be robust.

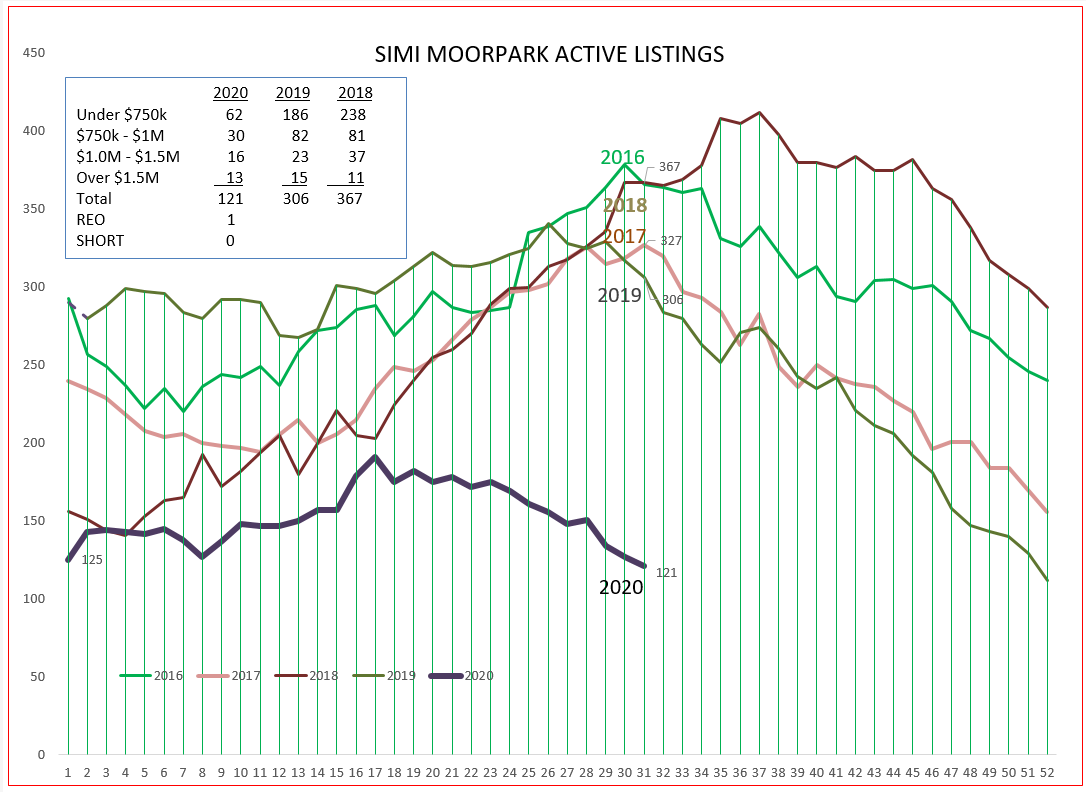

Sales are strong. Is there enough inventory to support this sale strength? With the drastic dip in sales, did inventory climb strongly? The inventory customarily climbs as we approach the summer months. This year, in so many ways, is irregular. The inventory currently is extremely low compared to the past four years, and is now at a level below where it started off this year. Look at the box in the graph below. The inventory in all price ranges is significantly lower than the previous two years. Plus, due to government intervention preventing foreclosures and evictions, there is only one REO listing, and no short sale listings.

With strong sales activity and a shortage of inventory, we would expect prices to rise. However, in the middle of a pandemic, we would expect prices to fall. So what is happening?

Prices are firm and rising. Due to the larger number of homes under $750,000 in Simi/Moopark versus Conejo, Simi/Moorpark properties have been flying off the market, and their lack of inventory is very restrictive.

We looked at the graphs, now lets look at the numbers. Remember that I have historically used a three-month period to smooth out the daily and weekly variations in activity. For the last three months of 2020, the number of closed escrows is down 25% from 2019, But inventory is down a whopping 60%. The decrease in sales has not resulted in an increase in inventory. Instead, inventory has all but disappeared. Prices are up, 5% for the Median and 6% for the Average. And climbing.

Listening to agents over the past month, I knew the market was stronger, but I did not realize how strong until the final numbers came in.

For another good analysis, see this post by Tim Freund.

Congratulations to those learning how to do business in a pandemic, on learning how to market homes without being in the homes, on closing escrows remotely. They have adapted. And the market’s needs are being addressed.

If you have not adapted, you better get with it. We will be doing business this way for at least the end of the year. And the future will be much more virtual than what we were used to pre-Covid.

Can’t wait to see what happens next month.

Be smart, stay safe, and keep up the good work.

Chuck