Every month I talk about the FED. What they do affects mortgage prices and the real estate market.

But the FED does not directly set mortgage rates, only short term rates. Mortgage rates closely follow the 10-year bond. A recent post by Joe Weisenthal on Bloomberg explained it much better than I could.

The Fed is almost certainly going to start cutting interest rates in September, and generally that’s seen as good news for individuals and businesses that seek to borrow money. You know, would-be homebuyers, real estate developers, clean energy companies, and so forth.

And of course, all things being equal, yes, the Fed cutting rates does benefit borrowers. But, a few notes of caution.

For one thing, borrowing costs have already come down substantially. The average 30-year mortgage was over 8% in late 2023. Today it’s under 7%.

Of course, one component that goes into the pricing of a mortgage (as well as any other kind of long-term borrowing) is the yield on US Treasuries. The 10-year yield has already come down a lot, from roughly 5% last October to sub-4% today.

What’s important to bear in mind is that what the Fed controls directly is the overnight cost of funding. What matters to most people and business or individuals is not the overnight cost of funding, but long-term funding costs. And the way to think about long-term funding costs is that the long-term is just a long series of short-terms. So one basic way to think about the yield on a 10-year Treasury is that it reflects what the market believes that short-term rates will average out to over the next 10 years. As for what will determine the average overnight interest rate for the next 10 years… well it’s whatever the Fed has to do to keep inflation at 2%.

If the rest of this decade is the reverse image of the 2010s, and we keep getting upside inflation surprises, then the Fed may feel that it can’t cut rates very deeply while staying consistent to its mandate. As such, the market could continue to price elevated 10-year yields (elevated, at least, relative to pre-Covid levels). If we get a recession, or a productivity boom, or some other sustained disinflationary trend, then of course the market might price lower rates.

So ultimately, if you want to see lower rates, it doesn’t matter too much if the Fed cuts 25 basis points or 50 or what it does in the next month. What matters is the general trajectory of inflation, for the lower that goes, the lower the Fed can reduce interests. And of course, if the Fed cuts too much, and causes the economy to reaccelerate and heat up again… well then one can easily imagine a scenario where today’s rate cuts mean higher yields on long-term Treasuries and higher borrowing costs for firms and individuals going forward.

Follow Bloomberg‘s Joe Weisenthal on X @TheStalwart

So all the talk about the FED and mortgage rates is not directly connected. It is attitude, expectation, consumer confidence, feelings about the future. The FED has not yet dropped interest rates, but mortgage rates have already come down. And that is good for the real estate market. We should also consider the influence of recent history, since both buyers and sellers are influenced by what happened recently. What did that house down the block sell for? Let’s look at our recent history.

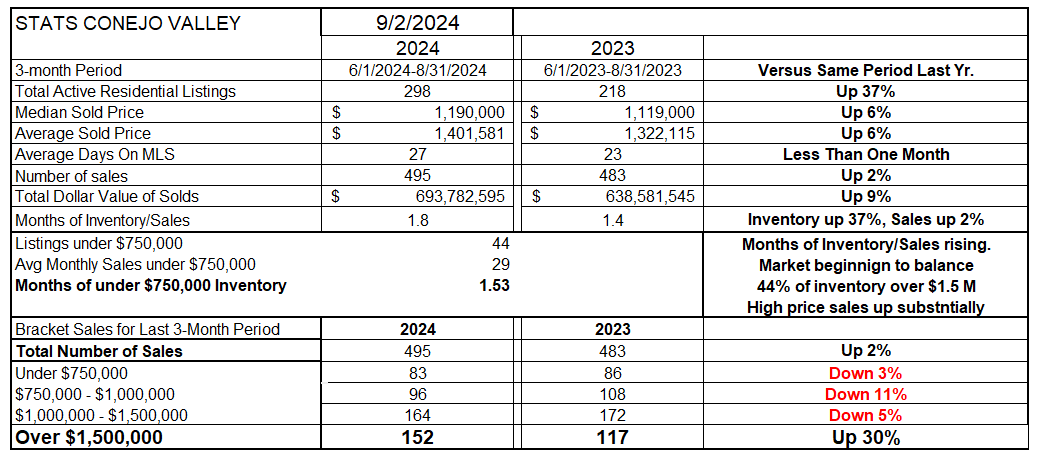

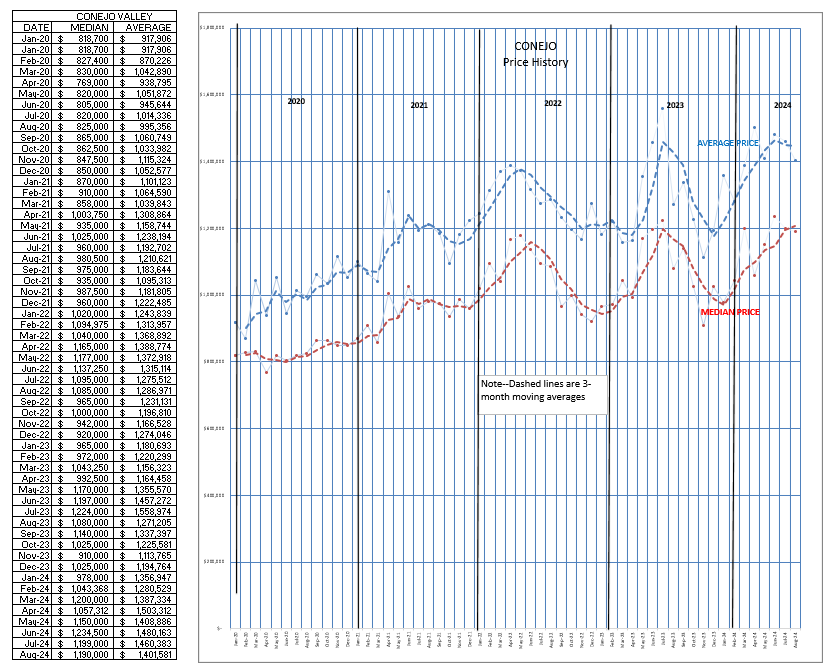

For the Conejo Valley, prices continue to rise, up 6% year over year. That is a lower than what has been happening since the beginning of the year. Inventory continues to grow versus the same period last year, up 37%. Homes are listed when homeowners feel they need to move, or maybe they decide the time to move has come. Prices have been rising because buyers have been willing to buy, even with high mortgage rates, but the hesitancy of sellers to list has kept inventory low. That is changing. The number of homes sold in the last three months, compared to the same months last year, is about the same, up slightly at 2%. Homes are still moving quickly off the market, but not as quickly as last year. Look at the bottom of this table. Home sales compared to last year are down except for the strong high-priced market. Buyers in this market are not overly concerned about mortgage rates, as they are often all-cash buyers who can finance when the time is right. The inventory in this market has been growing, and sales have been growing. The high priced contingent thinks that the time is right

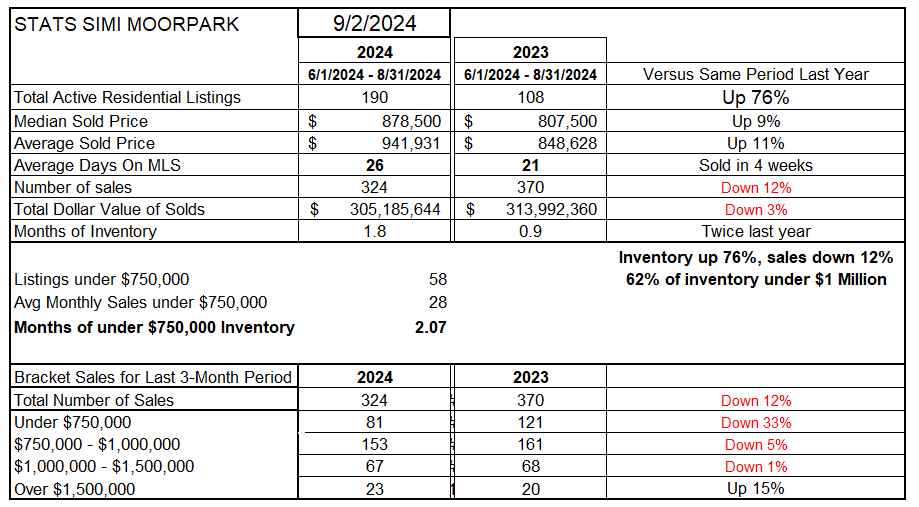

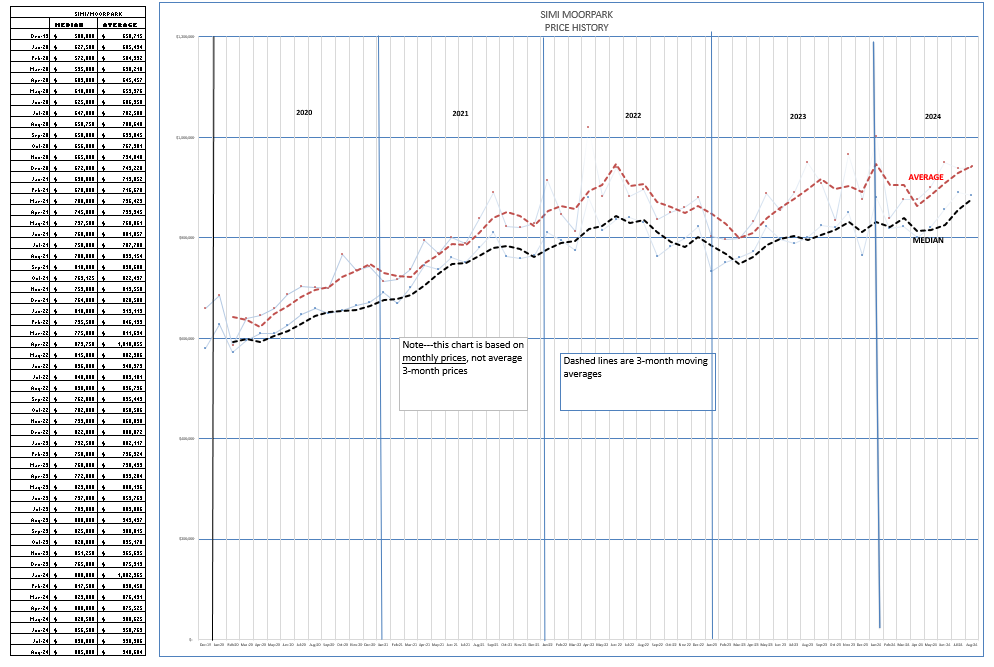

For SImi Valley and Moorpark, the market is a little different, with a majority of homes priced below $1 million. The lower priced market in Simi/Moorpark has been strong and inventory hard to find, but inventoryu is now up 76% compared to last year’s extreme shortage. Prices have risen between 9-11%, very strong. It is beginning to take a little longer to go into escrow. Even with more inventory, sales are down compared to last year. Most of these buyers are not all-cash, and are waiting for mortgage rates to decline. That is why the number of sales is actually down versus last year. Look for Simi/Moorpark sales to increase as rates decrease.

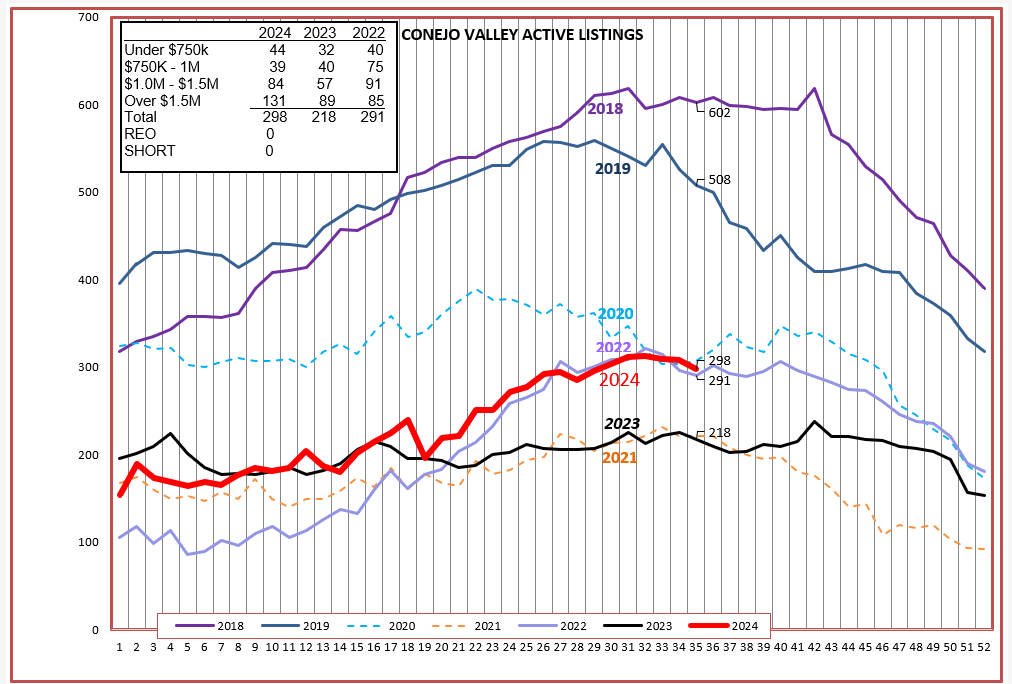

Inventory has risen strongly in both areas. Inventory is seasonal, springing upwards in the Spring and falling in the Fall. The current graph of inventory remains at an overall low level, but is following the historic seasonal pattern.

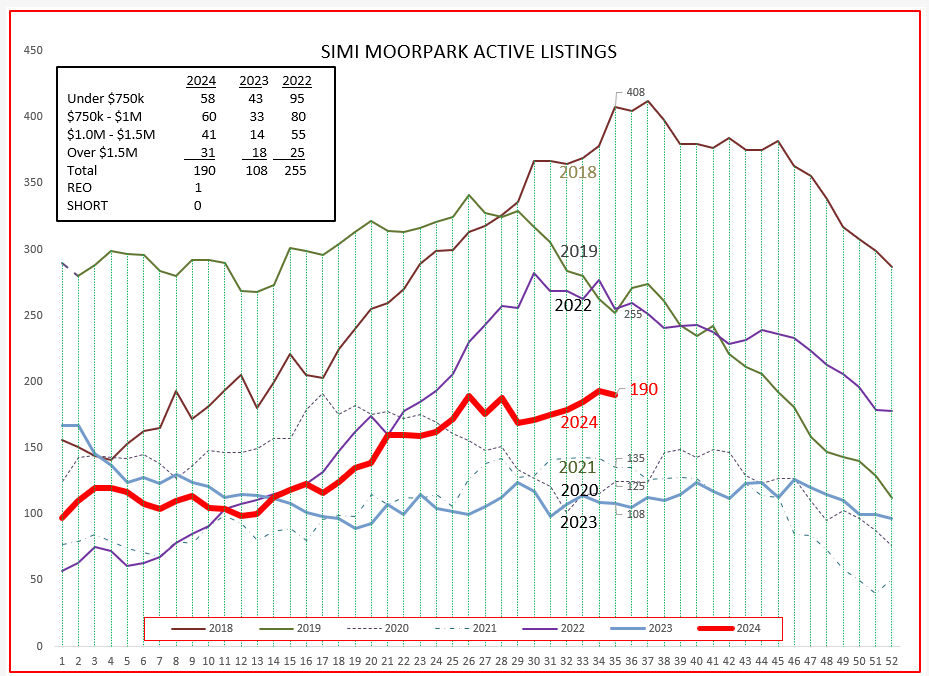

For Simi/Moorpark, the inventory rise has been muted by mortgage rates and uncertainty. As mortgage rates decline and confidence strengthens, a more reasonable inventory level will allow sales to begin to rise and this inventory will begin to decline.

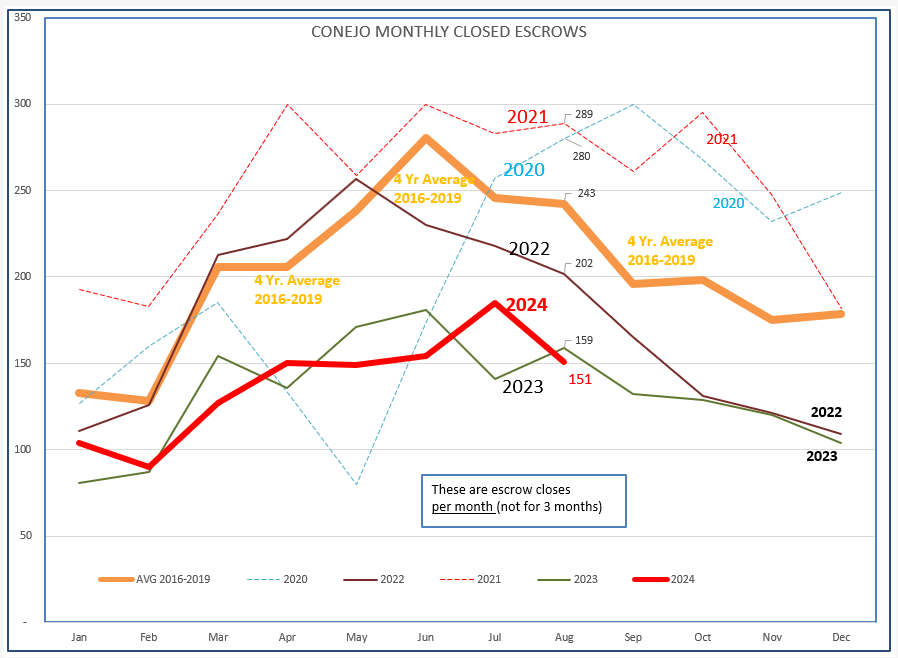

Sales in the Conejo Valley is following the seasonal heavy orange line which represenets the average of four years of pre-Covid. Just looking at this graph everything seems normal.

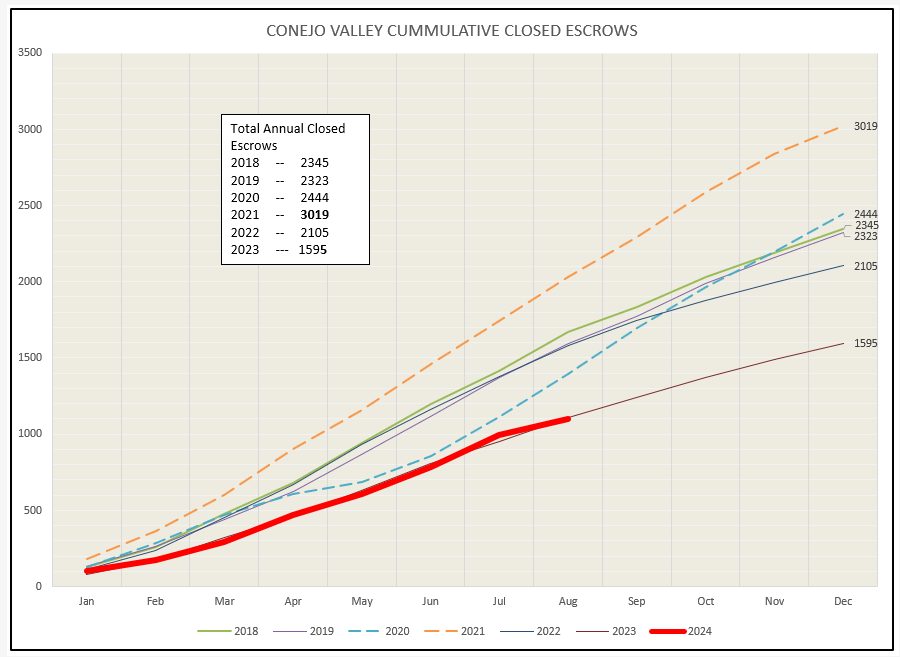

When we look at the same information in the Cummulative graph, with sales totals increasing as the year progresses, we can see that the market is following the same path it did last year, one of the lowest sales years on record. My crystal ball is in the shop, so I can’t tell you what is going to happen, but this lets you see what is happening.

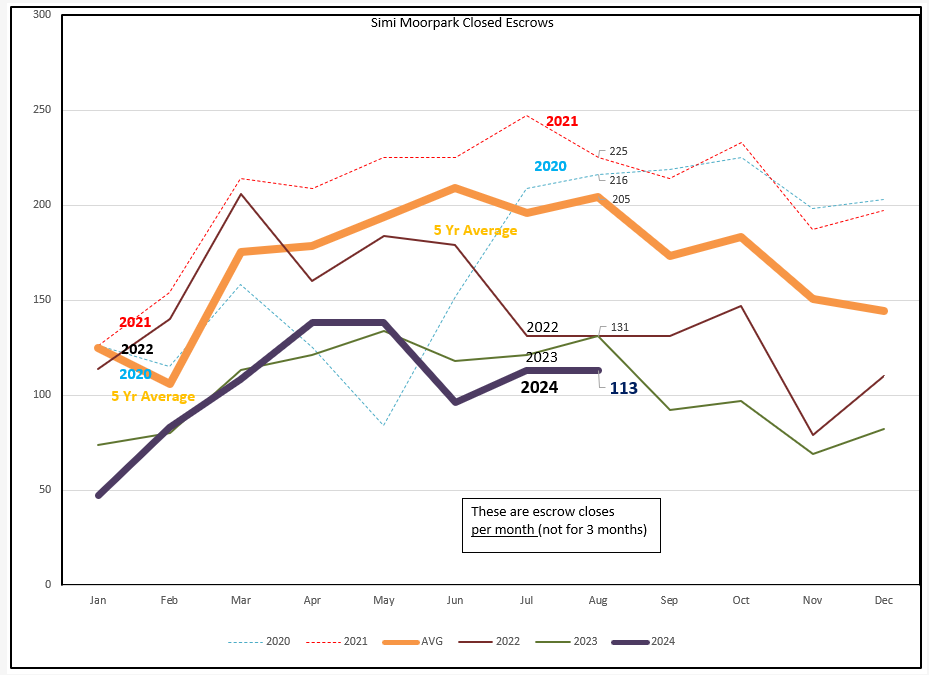

SImi Valley and Moorpark sales are more dismal, lacking Conejo’s all-cash buyers. With lower rates in the future and a decent sized inventory, SImi whould soon be on the upswing.

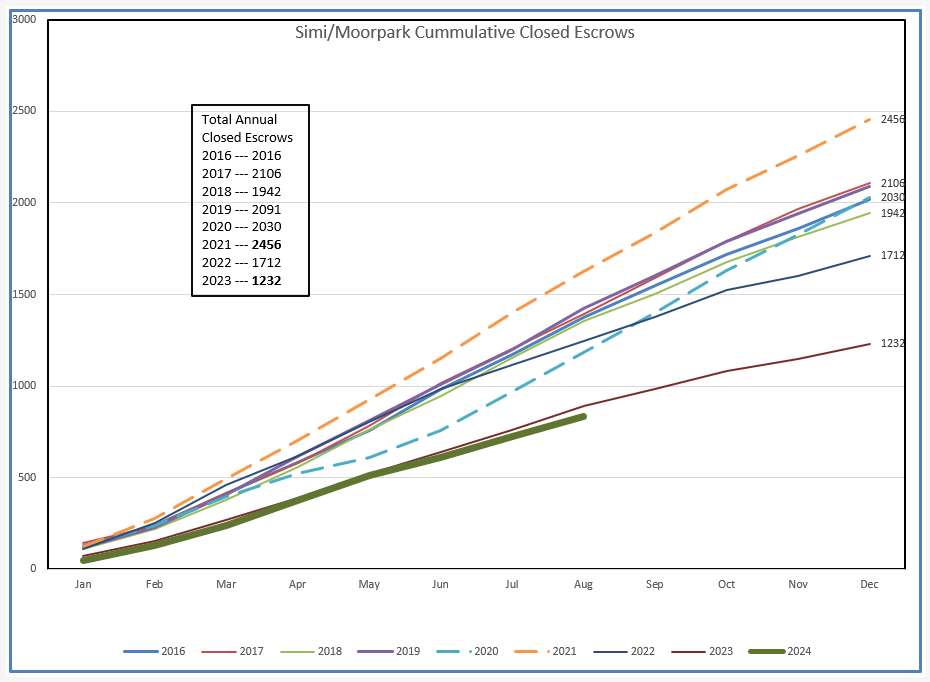

You can see the same trend for Simi/Moorpark as we saw for Conejo. Closely following 2023 sales levels, even a little lower. Let’s call it room to grow.

Finally, the brightest spot of all if you own a home, prices. We have experienced three years of strong summer prices and weaker winter prices, and this year looks to follow that pattern. Median prices for Conejo are $1.2 million, with average prices approaching $1.5 million. Makes me glad I purchased that $100,000 home in 1978.

For Simi/Moorpark, the chart is very different, but the upward trend remains strong. The pronounced seasonality is not present. Why? I don’t have that answer, but maybe one of you readers do. Please let me know your thoughts. Prices here are not as high as in Conejo, but their price increase percentage was almost twice Conejo.

That’s what happened in the last month. We have the usual, normal pressures we are facing, and the additional pressure of a major election coming before year end. Lots going on.

Be safe out there. Lots of scammers, and don’t get me started on what AI is doing for them. Stay safe and healthy.

Chuck

|

|