Merry Christmas, Happy Hannukah, Happy New Year, and wishes abound that the 2025 real estate market will recover from 2023 and 2024.

By our market, I mean the number of transactions. The real estate market has been very good for owners, not so much for brokers.

The 2025 market should improve based on the direction statistics have been moving.

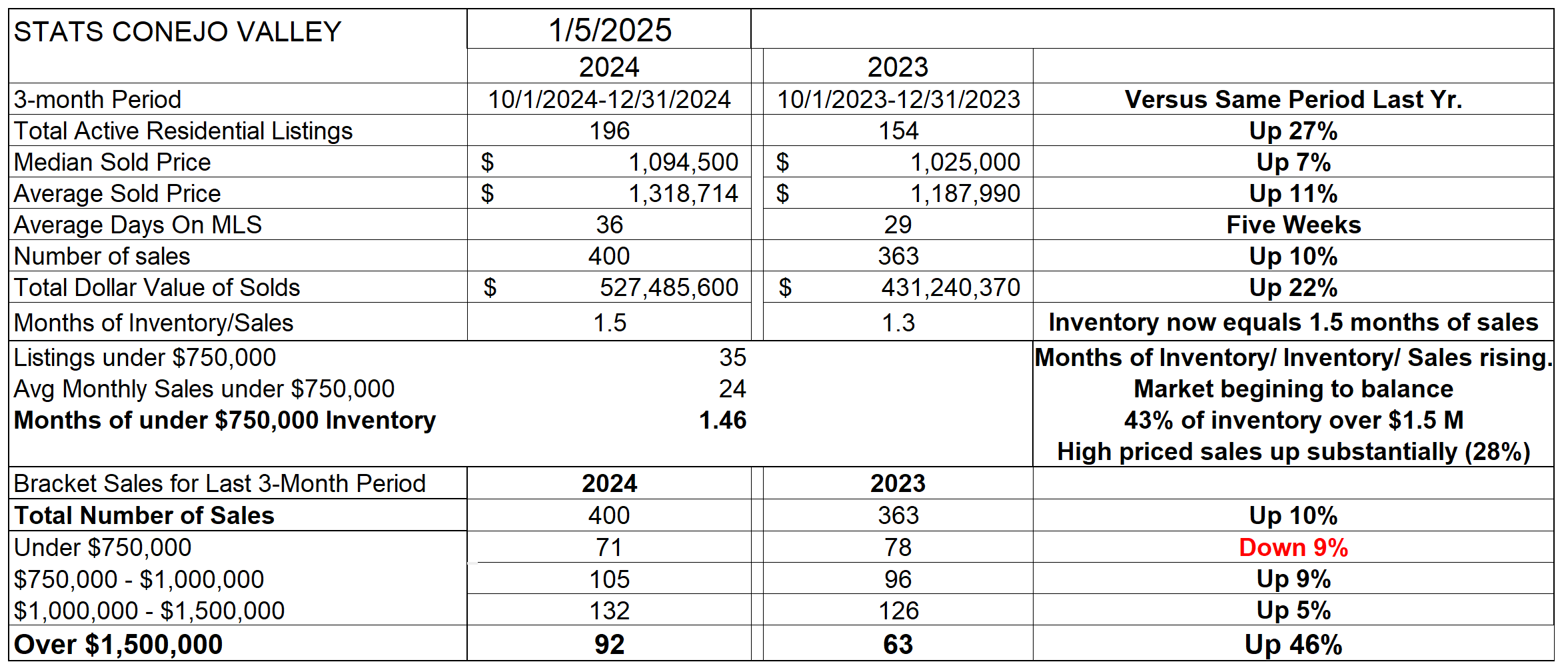

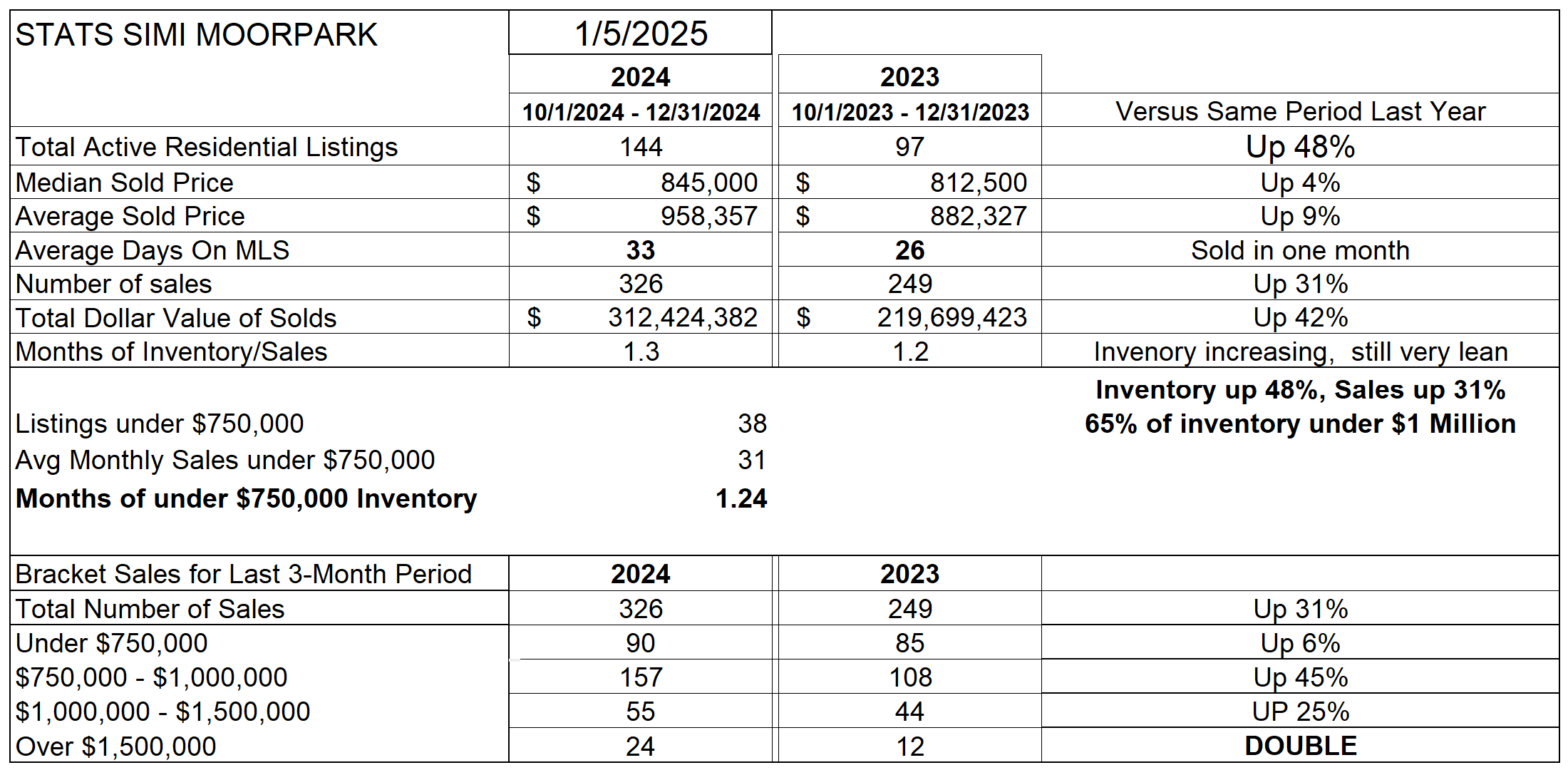

We begin by looking at how the last three months of 2024 compare to the same three months of 2023.

The main reason for optimism for 2025 is the continued increase in available listings, up 27% from 2024. This allowed the total number of sales to increase by10% in the end-of-year comparison. The highest-price segment, homes priced above $1.5 million, represents 43% of the Active inventory. Conejo prices did very well, with Median prices up 7% while Average prices were up 11%. Sales of highest-price homes strongly affected this increase, with 46% more homes sold as compared to 2024. The inventory remains somewhat tight, representing only 1.5 months of sales. A balanced market, not favoring either buyer or seller, is probably around 2 months for our area, so the inventory as compared to sales still leans toward a sellers market.

Simi Valley and Moorpark do not have the very high-priced inventory found in Conejo, and their statistics are a little different for a variety of reasons. First, inventory is up 48% from last year, the larger increase mainly due to inventory being so low over the past few years. Simi/Moorpark high-end inventory has been growing, but still is a lesser factor than Conejo. 65% of the current inventory is homes priced below $1 million. Median prices were up 4%, similar to overall inflation, but Average prices were up 9% due to the growing number of higher-priced homes. Inventory growth contributed to an increase of 31% more units sold.

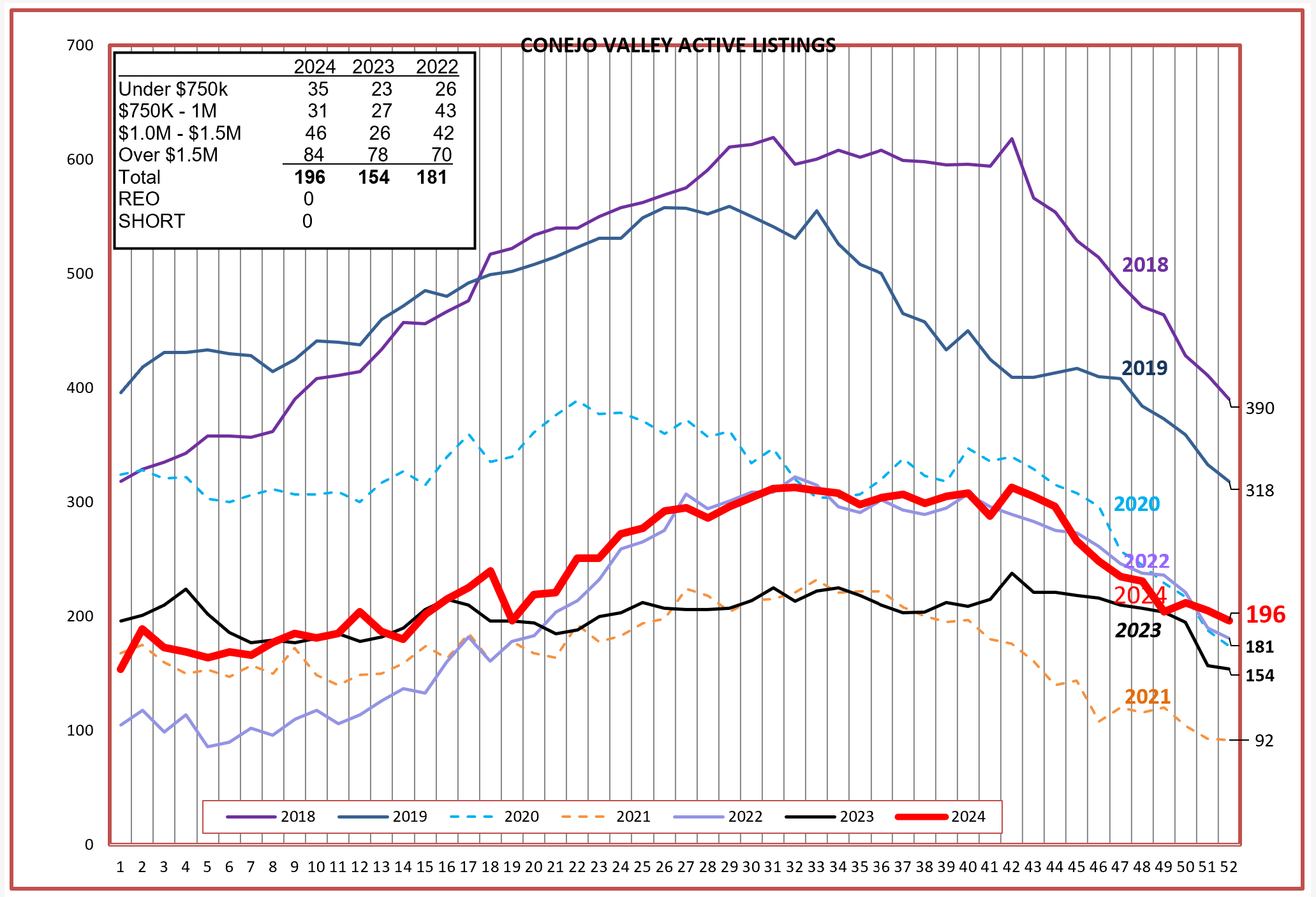

Since inventory was such a major factor contributing to both increases in value and decreases in the number of sales, let’s compare how inventory has tracked in 2024 versus prior years. The inset box below compares inventory for 2022, 2023, and 2024, with all years being reasonably similar. I have included 2018 and 2019 to show that the progress of inventory growth in 2024 followed a similar (normal) path as 2018 and 2019, but at a much lower level. 2022 had a similar track. 2023 did not follow the pattern, as we saw mortgage rates climb significantly. 2023 was one of the lowest sales years in recent history. 2024 improved only slightly, but was still a very low year for the number of transactions.

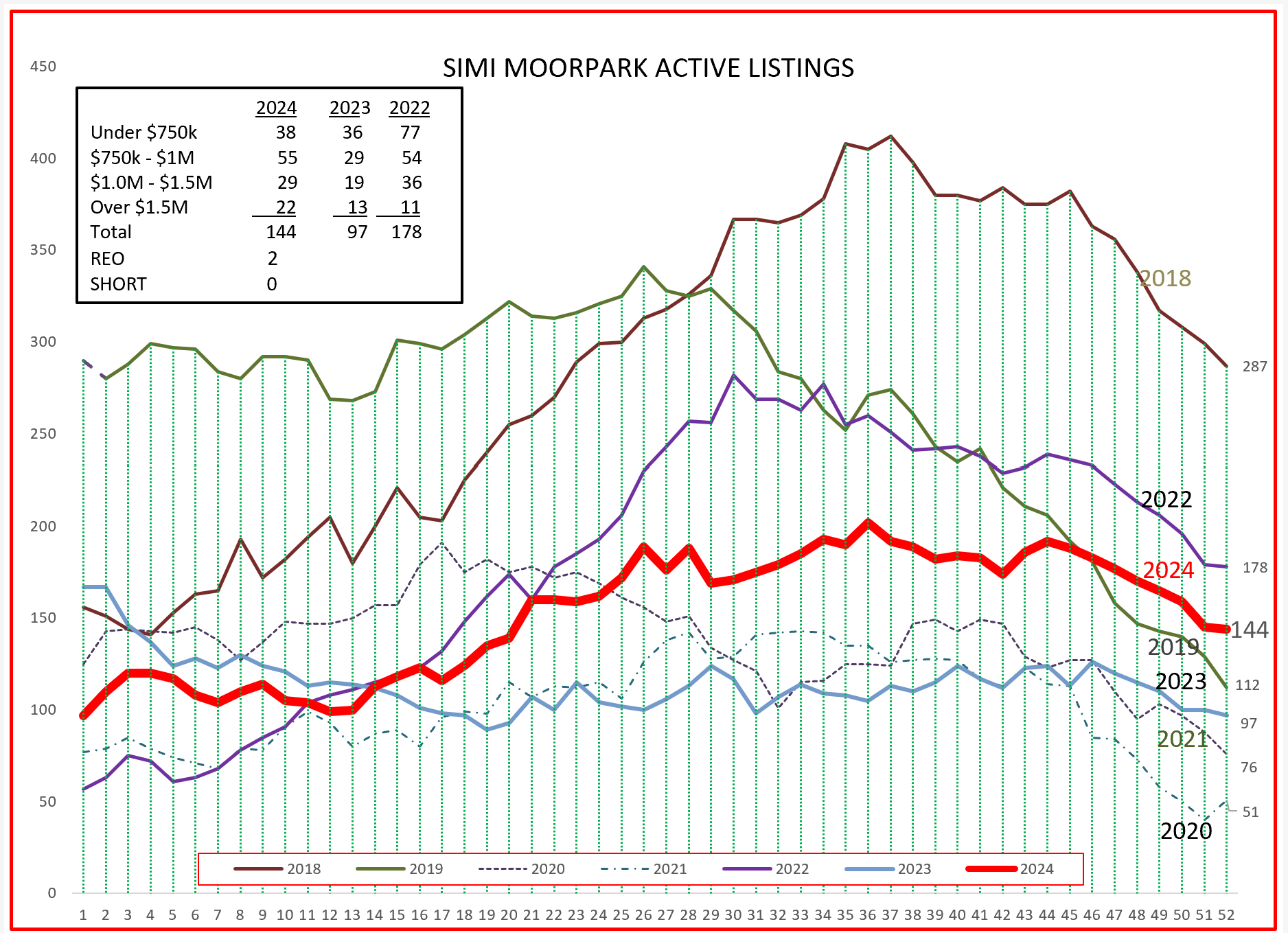

2024 Inventory for SImi/Moorpark followed a “normal” pattern. and the increase in inventory allowed for an increase in sales.

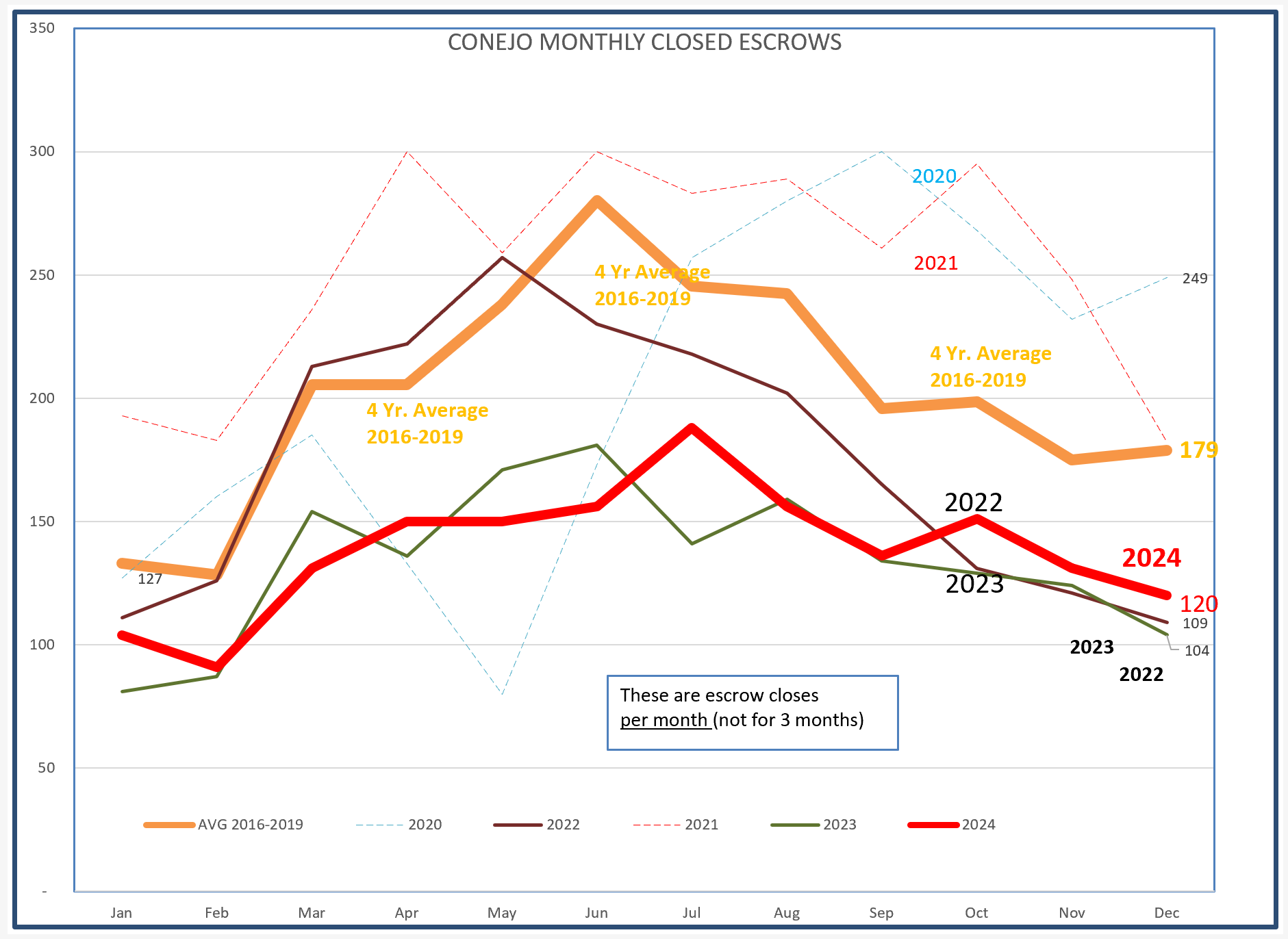

Monthly Sales charts for Conejo followed a normal pattern, one exemplified by the 4-year average gold colored line.

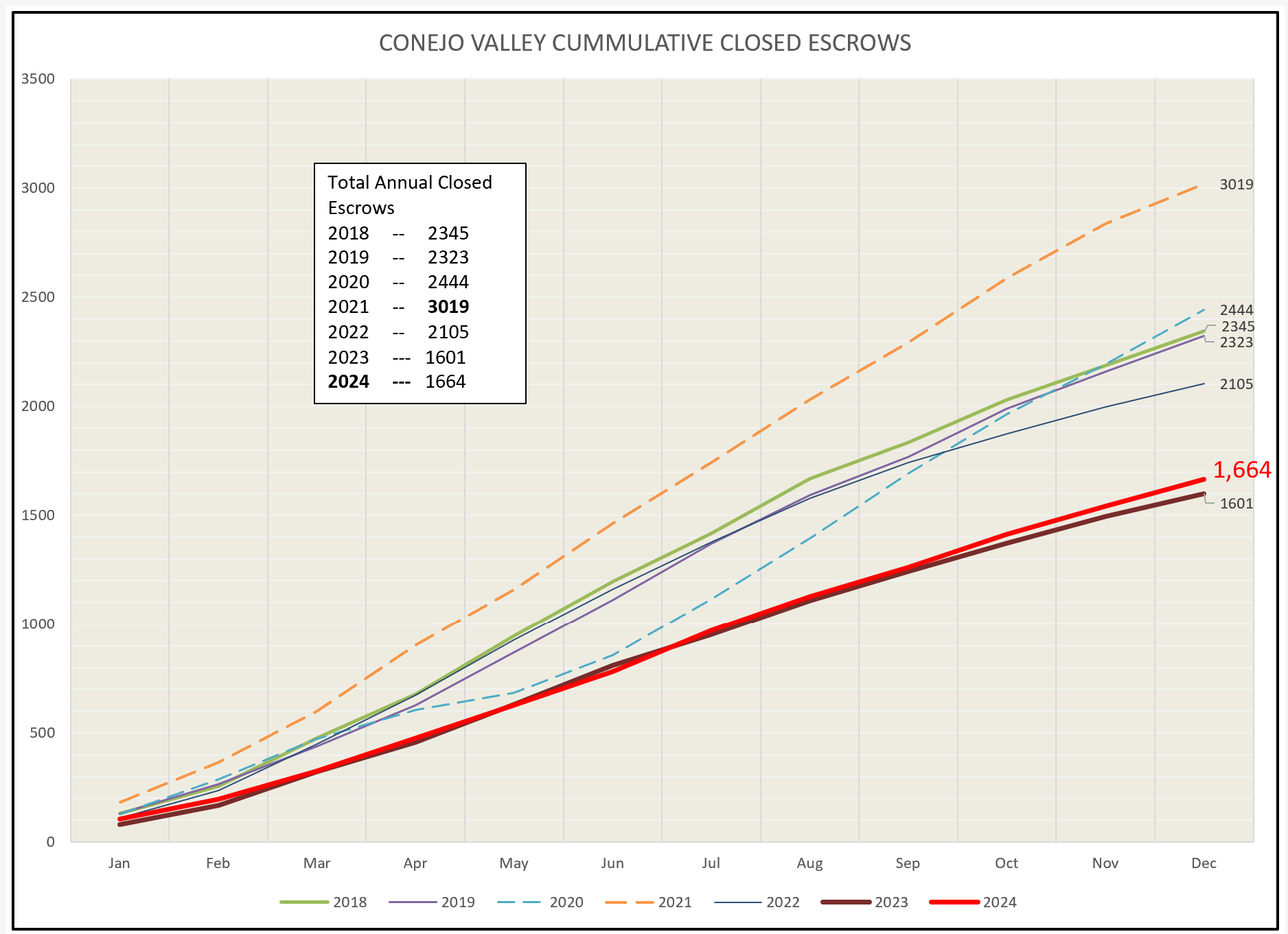

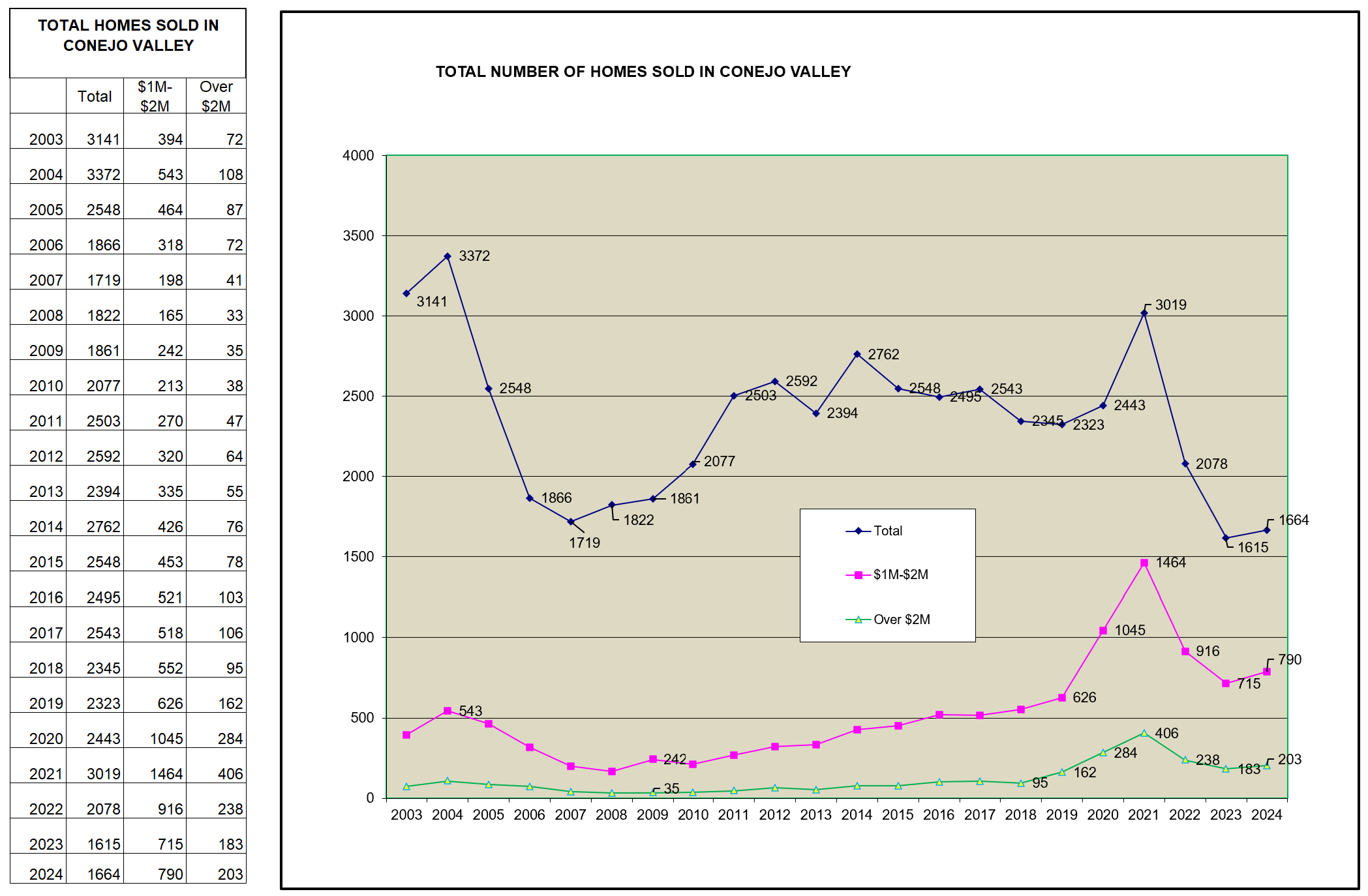

It may be easier to compare 2023 and 2024 as an accumulation of sales numbers as the year progresses. Both years ended up about half of the remarkable year 2021, and about even with the number of sales experienced during the Great Recession of 2009-2012. Very low numbers indeed. From the chart below, we could define a normal sales year as around 2,400 units sold. For the year, 2024 is only 63 units better than 2023.

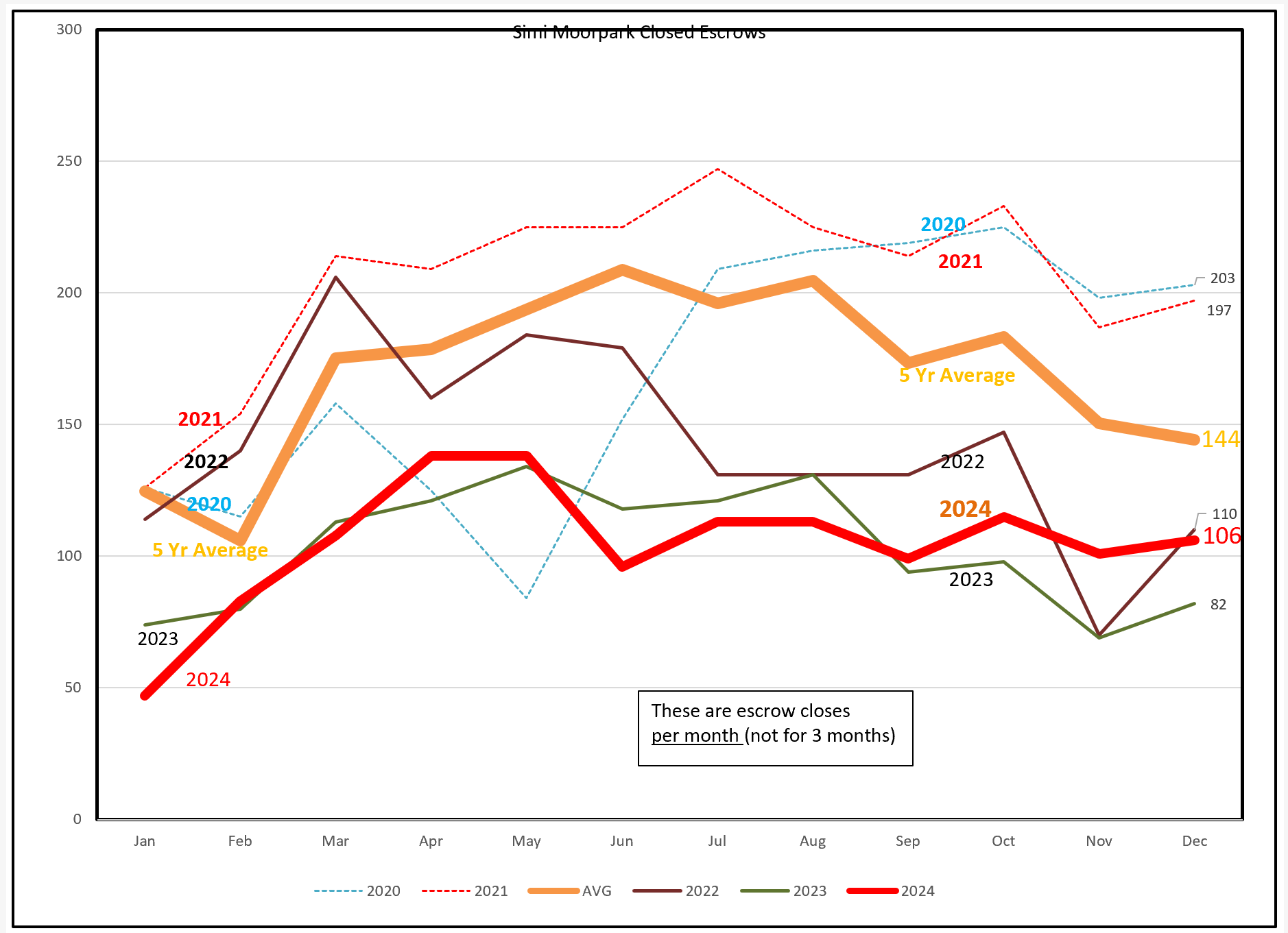

For Simi/Moorpark, the gold colored 5-year average has the same pattern as 2024, and ending the year a little stronger. A normal pattern but at a lower level every month. The final months showed a little extra strength.

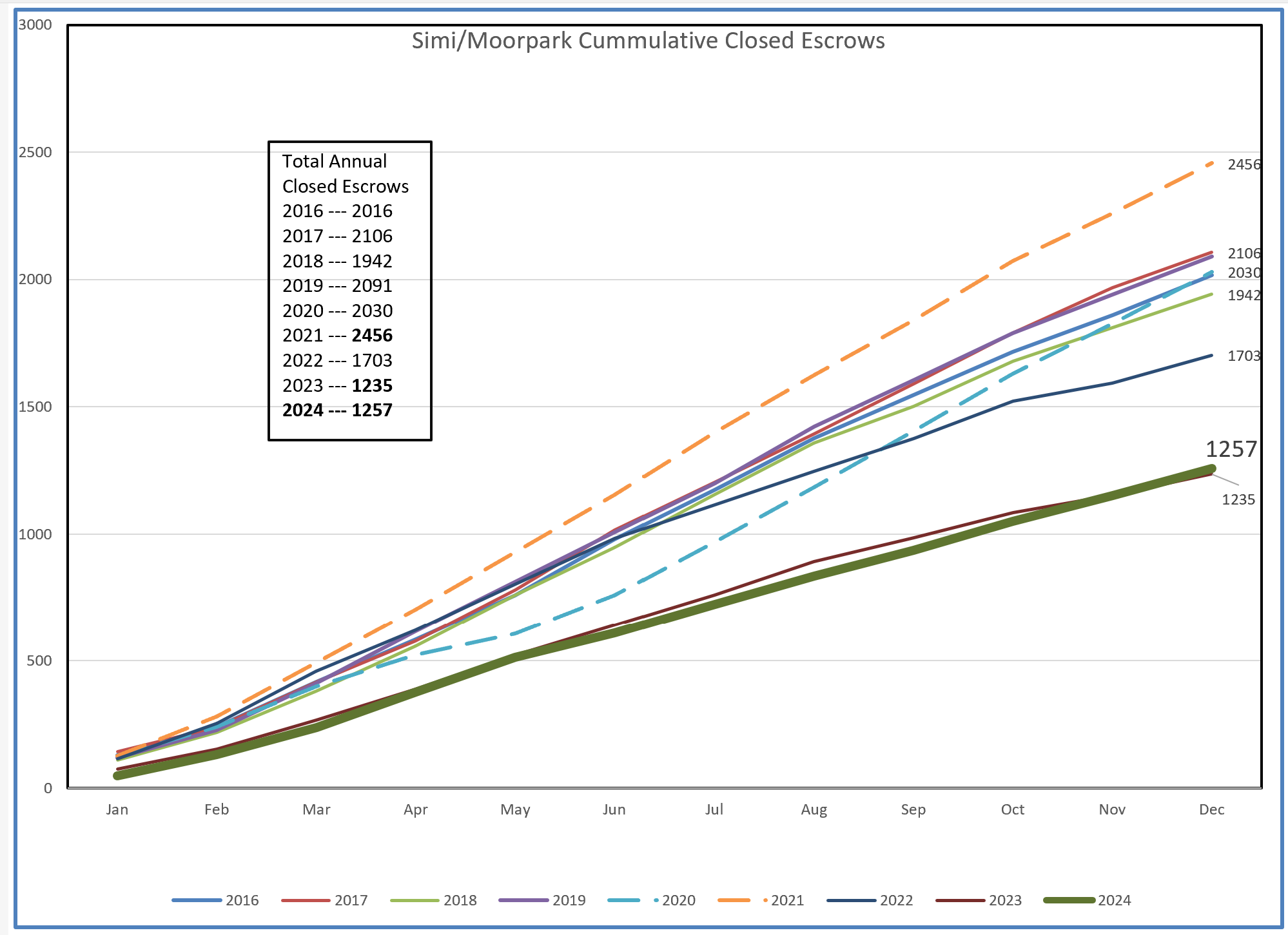

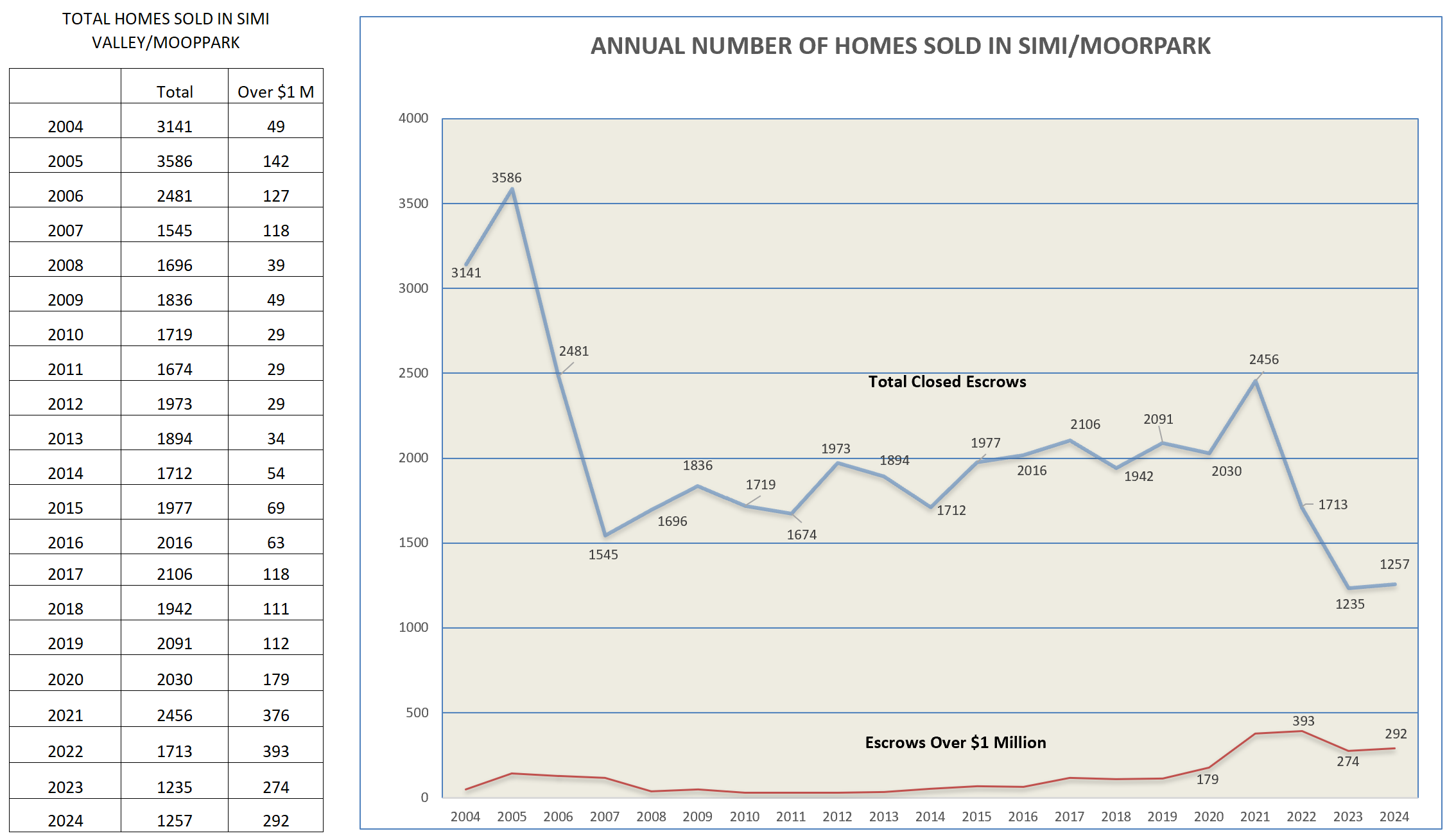

Viewing Simi/Moorpark accumulated sales as the year progressed, there was very little difference between 2023 and 2024. However, the stats table at the beginning of this blog indicates that the year 2024 ended with very strong sales compared to 2023, even though the total number of sales for the year was similar. Things have been improving as the year ended!

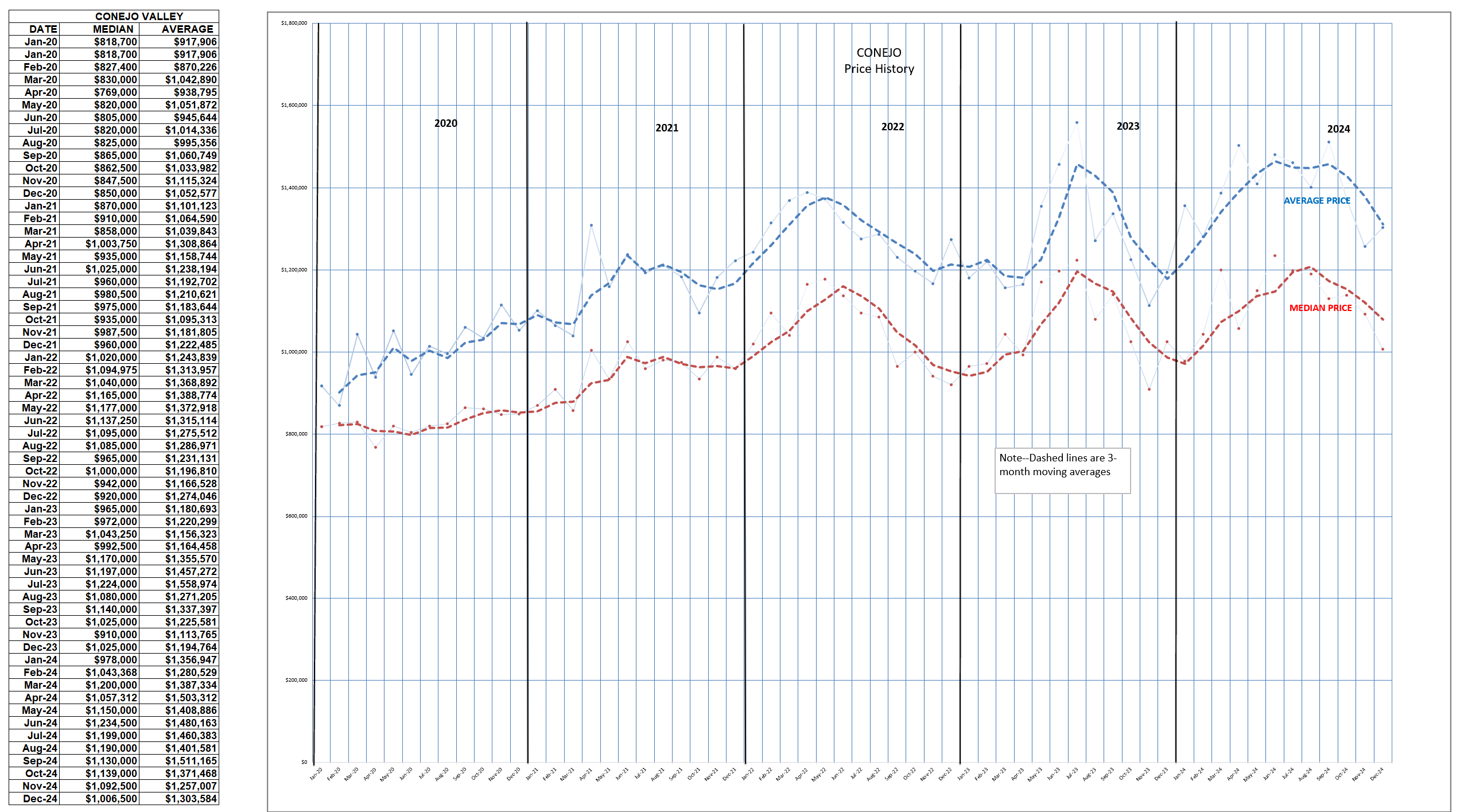

How have the inventory and sales numbers affected prices? Prices seem to be following the same pattern as inventory and sales numbers, increasing as summer approaches and decreasing as we head toward year end. This seasonality has never before been so pronounced.

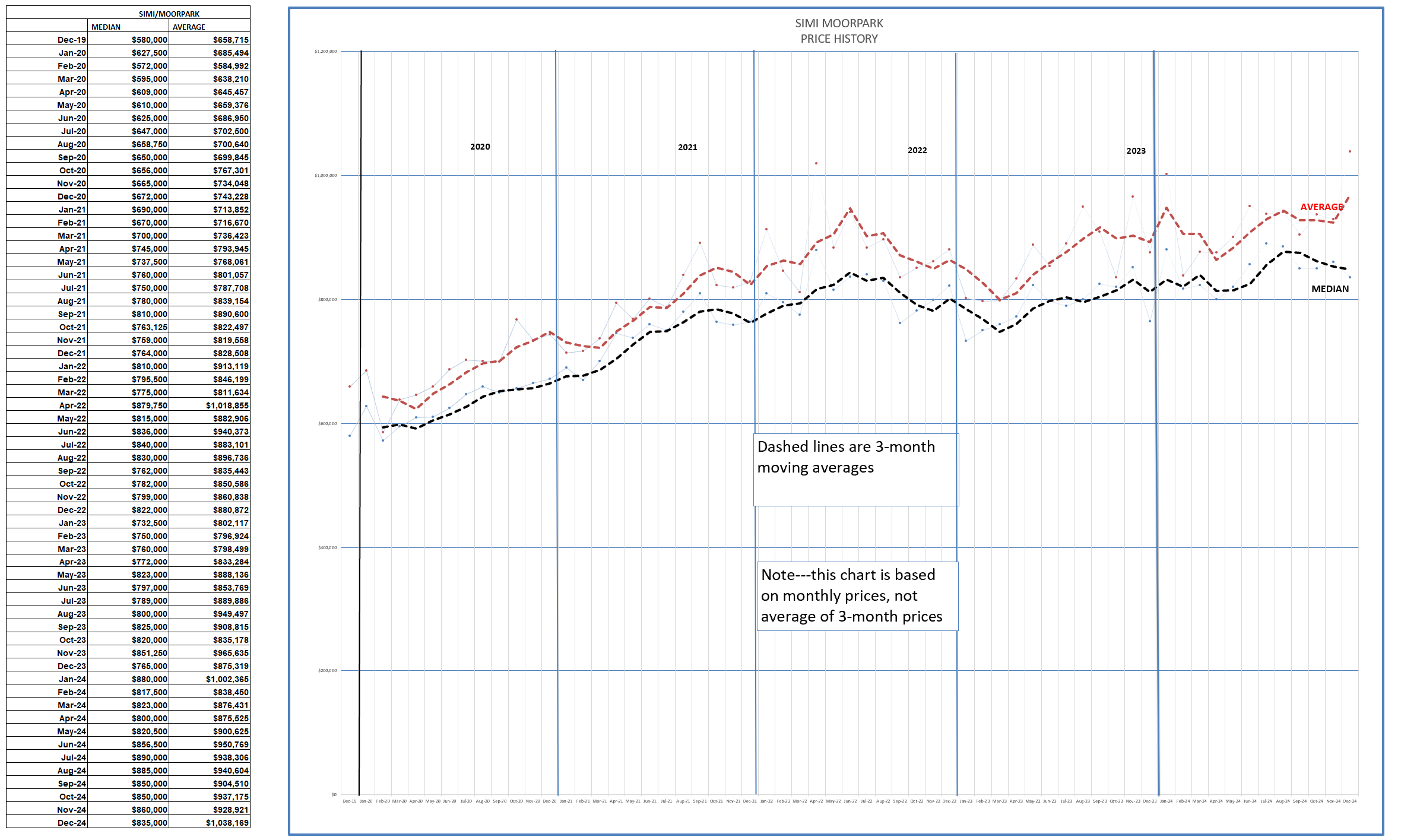

The same cannot be said for Simi/Moorpark. The vertical space between the Median and Average lines has been increasing due to the influence of higher priced sales. The pricing ups and downs is not nearly as well defined as Conejo. The behavior of this chart needs more explanation. I don’t have an explanation, do you?

Finally, let’s look at the chart of annual home sales over the past 20 years. The pink line below represents the increase in the number of sales between $1-2 million. In this chart, you can see how the total number of homes sold declined drastically entering the Great Recession, and how the number of sales compares to today. As prices increased dramatically in the past five years, home prices increased in homes priced above $1 million. Median home prices in the Conejo have remained above $1 million, with Average prices closer to $1.5 million.

The Simi/Moorpark chart is similar for total homes, and shows similar increases for homes sold over $1 million. There were 8 sales over $2 million.

That is history, the year that was.

What is the forecast for 2025?

Santa did not leave a crystal ball under my tree, but here are some highly skilled economists that shared their thoughts.

Where will mortgage rates go in 2025?

“Mortgage rates are likely to remain in the high-6% range throughout 2025, with the weekly average rate fluctuating throughout the year but averaging around 6.8%,” say the strategists at Redfin, the national brokerage.

The panel of experts at Fannie Mae and Pulsenomics, LLC says they expect “mortgage rates to remain elevated but modestly decline over the course of the year to 6.3%.”

Realtor.com forecasts a full-year average of 6.3%

Rates will average 6.4%, according to the Mortgage Bankers Association.

Will home prices rise in 2025?

Redfin expects a 4% rise in the median home-sale price.

The Fannie Mae/Pulsenomics forecast calls for a 3.8% gain.

Zillow forecasts 2.6% home value growth in 2025,

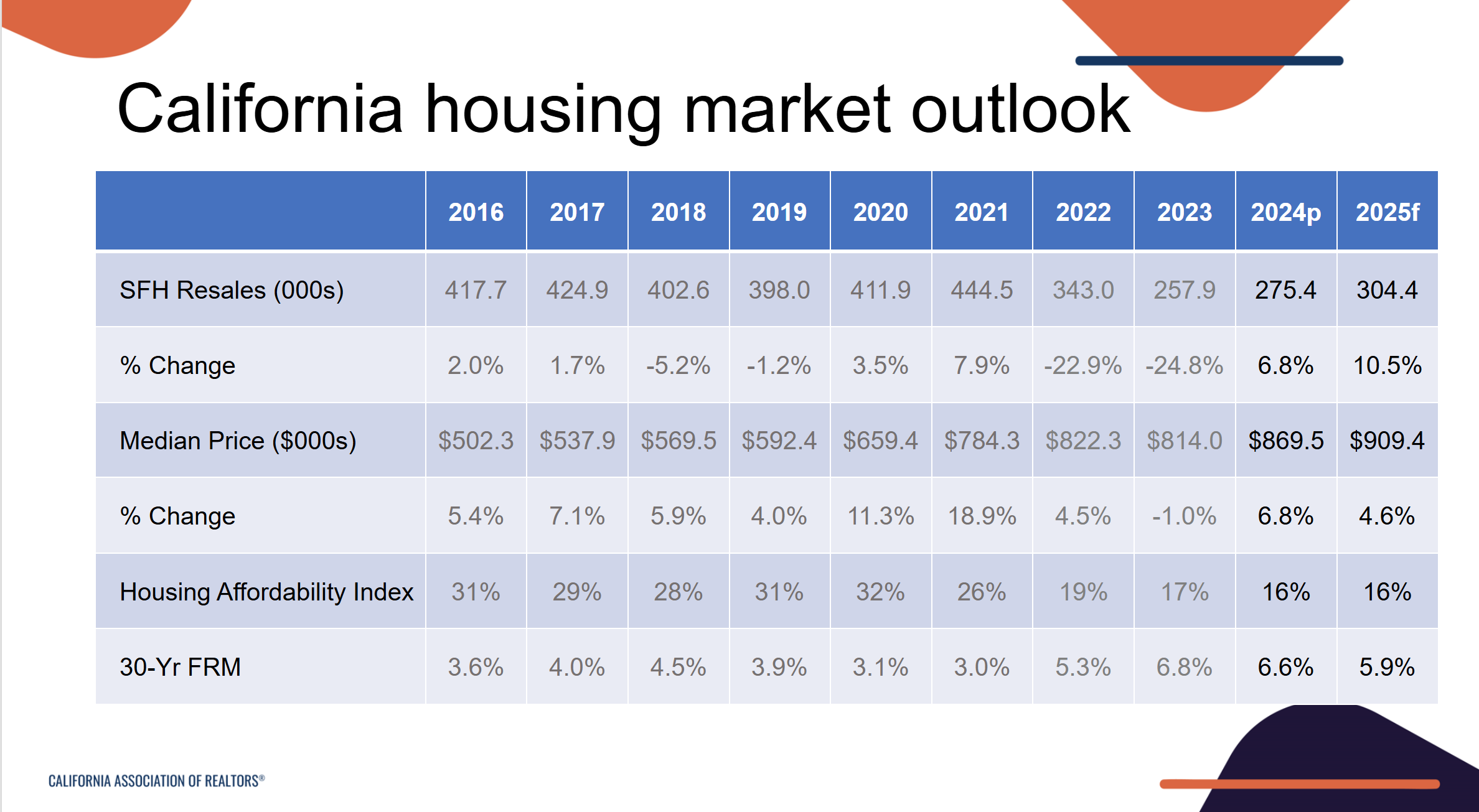

From CAR, their forecast is for prices to increase 4.6%, mortgage rates to average 5.9%, and transactions to increase 10/5%. (YAY!!!)

Finally, let’s get local. One of our most respected local economists is Dr. Matthew Fineup from CLU Economic Forecast. He is more cautions about our local numbers. Click to see his forecast. However, he has been very accurate. Many of us will be attending the CERF forecast on Feb 20th. This is a forecast of the Ventura County expected economic growth, a very low forecast. However, many of our homeowners work in Los Angeles county, where the 2025 trend is much higher. While our Ventura County economy has been constrained by things like SOAR, our real estate market has been strong due to our neighboring county.

That’s the year in review, and a compendium of what the top economists are forecasting for 2025. Doing better than 2023 and 2024 appears in the windshield, let’s not concentrate on the rear view mirror.

Stay safe and be prosperous.

Chuck