It seems we always use the beginning of one year to look over the past. And to plan for the future.

Planning for the future will take place this Thursday at our joint meeting with Calabasas at the Calabasas library, 10:00 to noon. This will be in place of our usual Wednesday business meeting. So remember, next week we will not meet on Wednesday, but will meet on Thursday, January 9, in Calabasas at 10:00.

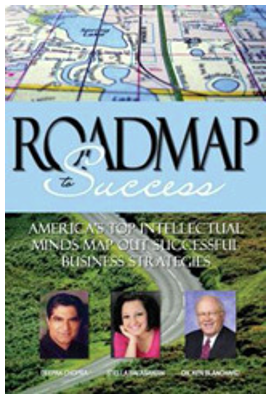

Our speaker will be Stella Balasanian. For those outside the Dilbeck family, Stella recently co-authored the book “Roadmap to Success” with Dr. Deepak Chopra and Dr. Ken Blanchard. Besides being a certified life coach, she is also an agent and Dilbeck’s Success Coach. Stella will provide insight into how to make 2014 your best year ever.

Our speaker will be Stella Balasanian. For those outside the Dilbeck family, Stella recently co-authored the book “Roadmap to Success” with Dr. Deepak Chopra and Dr. Ken Blanchard. Besides being a certified life coach, she is also an agent and Dilbeck’s Success Coach. Stella will provide insight into how to make 2014 your best year ever.

World class life coaching directed specifically to your real estate business.

It just doesn’t get any better than that.

And now to the statistics.

Prices for the year were up 19%, and the total number of sales was up 1%. Both are because we continue to have a very low inventory.

As you can see from the chart, our average price is always higher than our median price. The median is the price at which half the sales are higher and half are lower. Usually economists like the median better than the average, so we will use the median. You can see the space increase between the median and the average as more higher-priced homes are sold.

Over the past two years, prices in our area increased 49%.

When you are asked how prices are doing, don’t forget this statistic. This statistic is HUGE, so I made the type font huge. Your clients will be very happy to hear that their homes increased in value by 49%. But you have to remind them that we are reporting averages. All real estate is local. What is more important to them is what the value of their home is. And you can find that out for them. Talk about an ice breaker.

As realtors, we pay a lot of attention to the number of homes sold. 2004 and 2005 were out-of-control years, with both prices and the number of transactions pushed to very high levels. In 2013, we achieved sales numbers equivalent to 2006, a very strong year. Look at the tab marked ANNUAL COMPARISON, and you will see that we have been showing strong increases across the board in all home values. Yes, the market is very strong, and inventory remains relatively low, and with stable low interest rates prices should again increase. But most economists are forecasting increases at a lower rate than the previous two years.

Could we have sold more houses last year if we had the inventory? Probably. But then the price increase would not be as much. Supply and Demand and Price are all interrelated.

SIMI VALLEY/MOORPARK

Prices for the year were up 18%, and the total number of sales was down 5%. That is because we continue to have an extremely low inventory.

We only have one month worth of inventory. Houses coming onto the market sell very quickly.

As you can see from the chart, our average price is always higher than our median price. The median is the price at which half the sales are higher and half are lower. Usually economists like the median better than the average, so we will use the median. You can see the space increase between the median and the average as more higher-priced homes are sold.

Over the past two years, prices in our area increased 29%.

When you are asked how prices are doing, don’t forget this statistic. This statistic is HUGE, so I made the type font huge. Your clients will be very happy to hear that their homes increased in value by 29%. But you have to remind them that we are reporting averages. All real estate is local. If you don’t think so, compare the two areas in this report.

Could we have sold more houses last year if we had the inventory? Probably. But then the price increase would not be as much. Supply and Demand and Price are all interrelated.

INTEREST RATES

We know rates are going up. They already have. Remember the example from last week. It is so important, I am going to copy it here.

We know interest rates are going up, and have already gone up. The low of the market was about 3-1/2%, and the 10-year bond was about 1.6%. Now rates are a point above that, and the 10-year bond is approaching 3%. As the FED cuts back on mortgage bond purchases, rates will continue to increase.

Good information, but how do you use it? What do you tell your clients?

Compute what their payment will be at current rates, and then compute the payment at 1% higher. Use real dollars, that will mean more to your clients. Real money.

Someone buying a home for $500,000 with 20% down and a 5-1/2% mortgage would have a mortgage and interest payment of $ 2270 per month.

Therefore, it will cost them over $250 per month, or $3,000 per year, to live in the same house when mortgage rates go up (notice the word WHEN)

Ray Kay described a down payment as invested capital, and described mortgage interest as rent.

If they buy now, they will lock in their rent. For 30 years. If they buy now, they will see an increase in the return on their investment, but not in their payment.

Wouldn’t it be nice to lock in your housing cost for 30 years? Anyone know a landlord willing to do that?

You don’t convince people to buy, you are not selling them something that they don’t really want. You are their real estate investment advisor, and let them know it is time to invest in a home to lock in their rental cost. For 30 years. The time is right.

HAVE A PROSPEROUS YEAR. AND MAKE SURE IT IS PROSPEROUS BY JOINING US NEXT THURSDAY TO HEAR STELLA BELASANIAN. Need more information? Call or write me.