October ends with Halloween, and with no surprises in sight for the housing market. Nothing scary.

This morning, the Bureau of Labor statistics announced that the unemployment rate dropped to 5%, with a surprising 271,000 jobs created in October. It is now almost certain that the Fed will finally raise interest rates in December. That is great news. Their reason for raising interest rates is because the economy is performing very well. With the future of interest rates rising, many buyers may feel pressured to make the decision to make their move and lock in rates. Considering the low inventory figures, even a small amount of added buying pressure will create added strength to pricing.

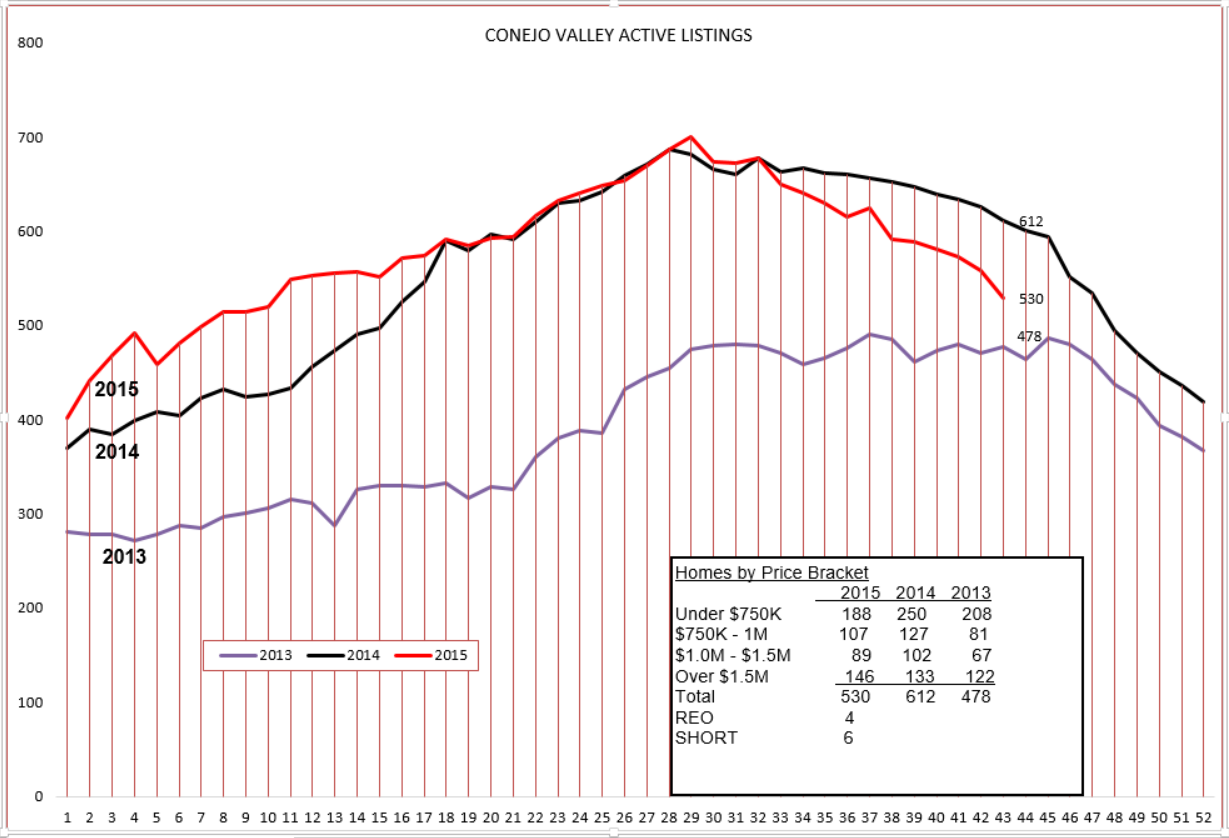

The inventory of active listings in Conejo is heading toward being as low as the 2013 inventory level, a level that was extremely low resulting in strong price increases.

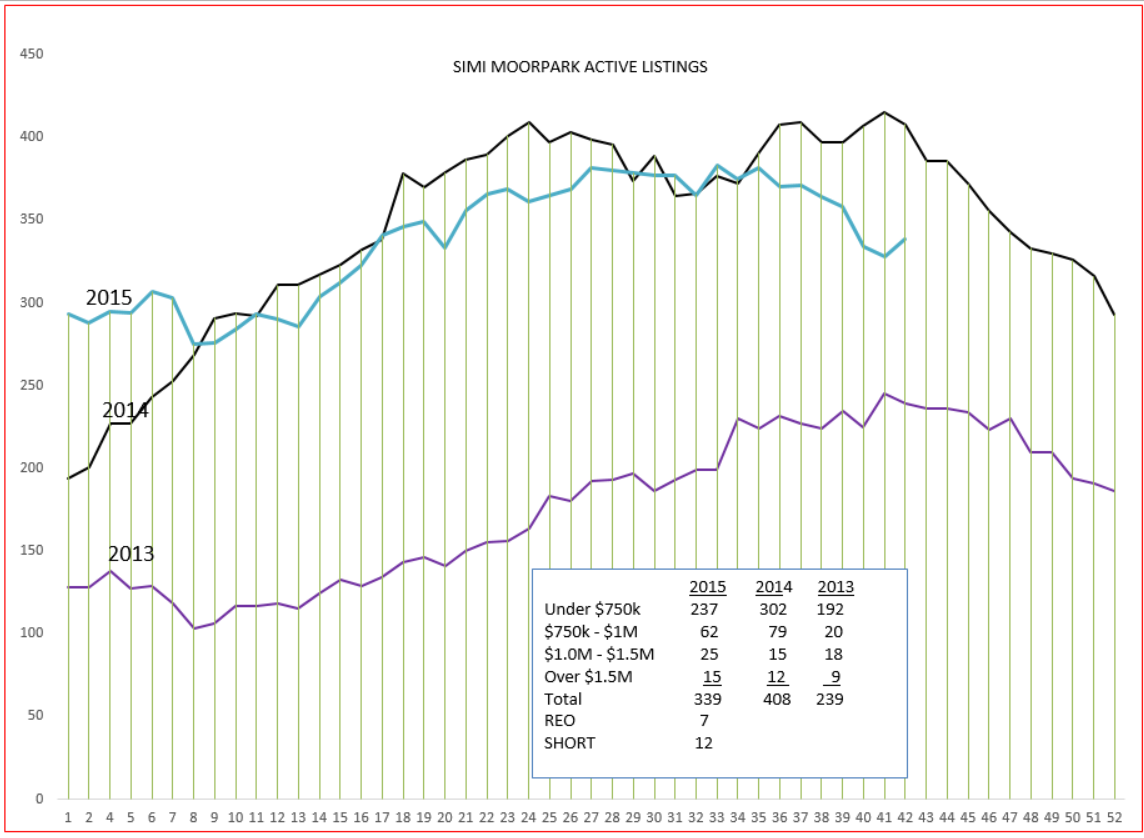

The Simi Valley/Moorpark graph takes a more tortuous route to get the same conclusion. Simi/Moorpark inventory has actually been pretty stable throughout the year, but not without it’s ups and downs. It should end the year lower, but it is not clear how much lower at this point.

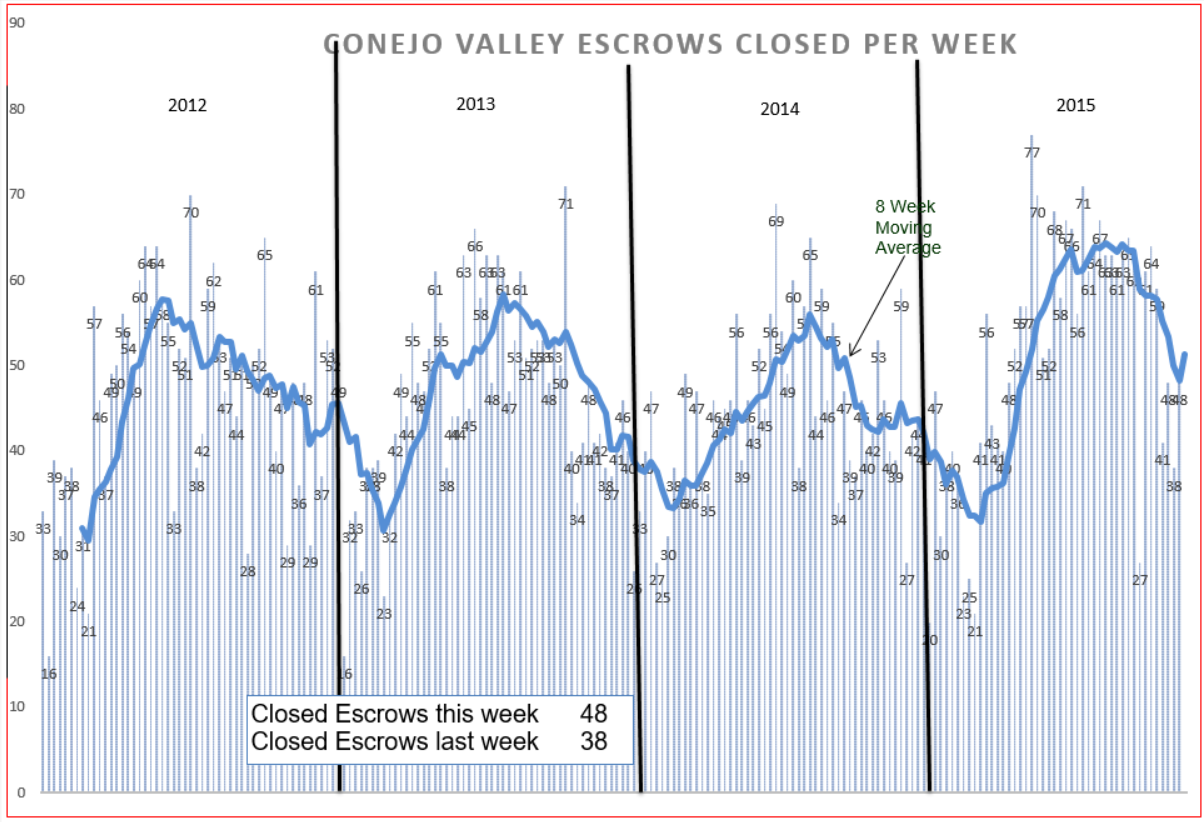

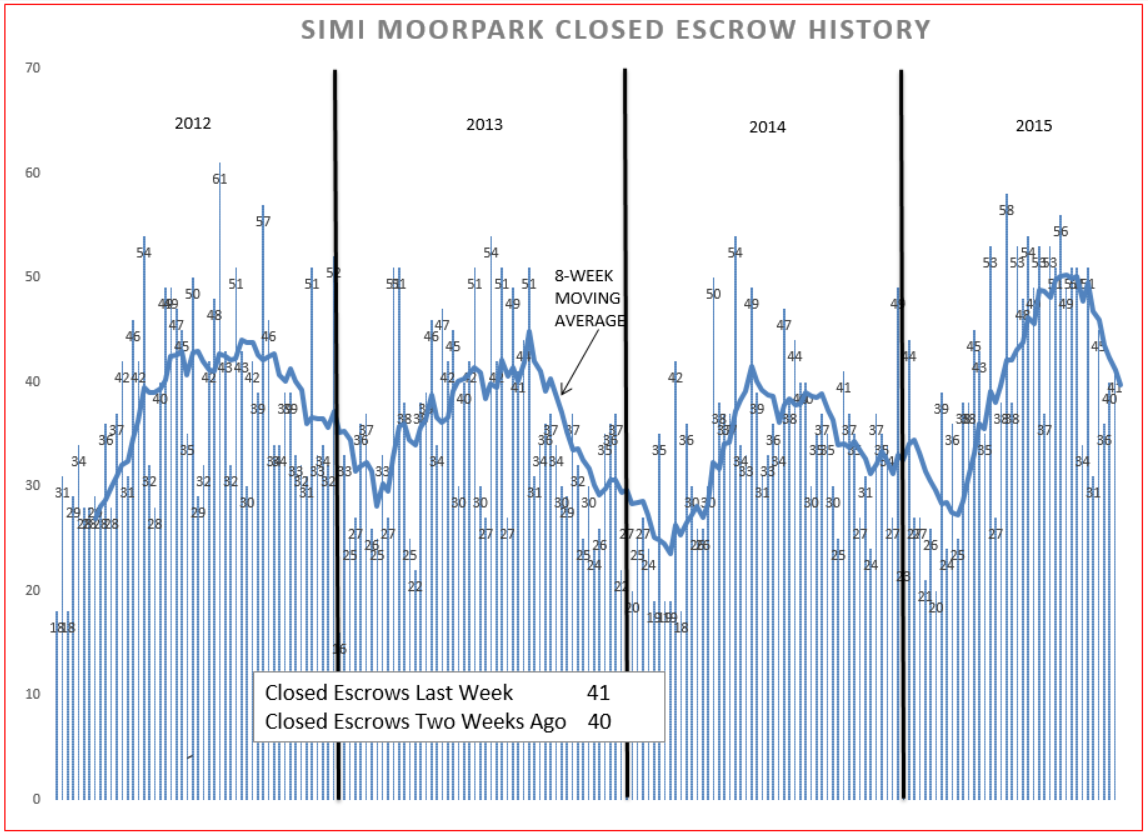

Of course inventory is not the only factor, the demand for homes is also very important. We can judge the history of demand by looking at the closed escrow charts. With interest rates now expected to increase, the optimistic view has buyers jumping off the fence and making offers. The pessimistic outlook has buyers dialing back because of higher rates. After spending such a very long time expecting rates to go up, it should come as no surprise to anyone that we will finally be entering a period of increasing interest rates. This should be built into almost everyone’s expectations. Next, let’s look at the sales charts (closed escrows).

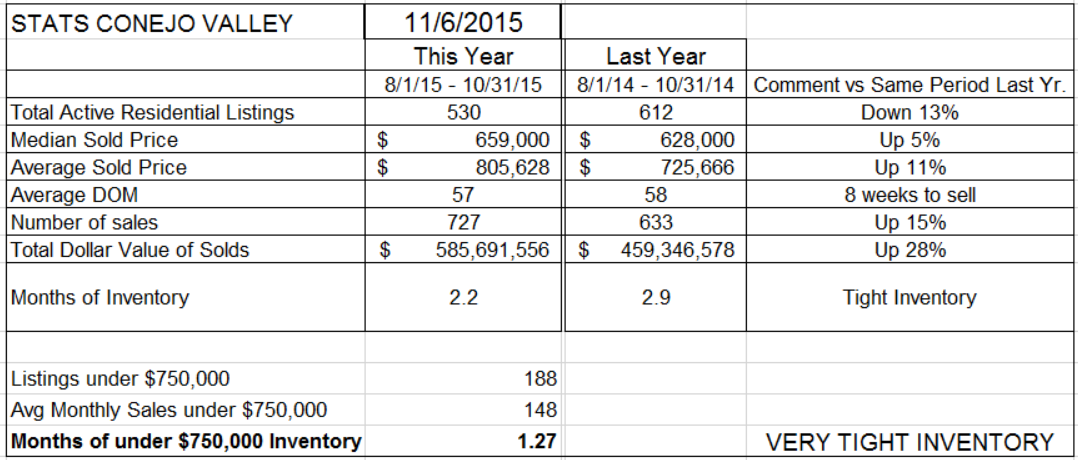

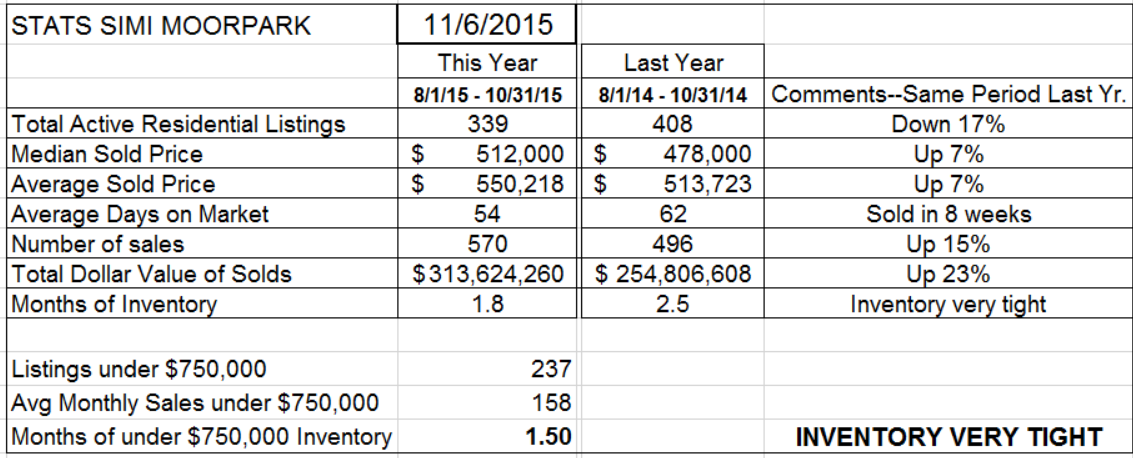

At this time of the year, we expect to see a dropoff in activity. But note that in both graphs the dropoff is taking place from a much higher level than the previous three years. Nothing in the charts shows any surprises. Let’s next look at the numbers, comparing the past three months with the same three months a year ago.

So how’s the market? This is your elevator speech if the elevator happens to be located in the Conejo Valley:

The market has been very strong. Year over year, prices are up 7%. While the number of sales is up 15% from last year, the inventory is much tighter, down 13%. The combination of these two factors computes to only 2.2 months worth of inventory. For the entire country, an inventory of about 6 months worth of inventory is generally considered balanced. In our area, I think the number should be more in the 3-4 month range. We are significantly below that. The inventory of properties offered below $750,000 is particularly tight, at only 5 weeks of inventory. Both sales numbers and prices are very strong.

So how’s the market? This is your elevator speech if the elevator happens to be located in SimiValley/Moorpark:

The market has been very strong. Year over year, prices are up 7%. While the number of sales is up 15% from last year, the inventory is much tighter, down 17%. The combination of these two factors computes to only 1.8 months worth of inventory. For the entire country, an inventory of about 6 months worth of inventory is generally considered balanced. In our area, I think the number should be more in the 3-4 month range. We are significantly below that. The inventory of properties offered below $750,000 is particularly tight, at only 6 weeks of inventory. Both sales numbers and prices are very strong.

As we enter the final two months of the year, successful agents will be doing two things. First, they will be preparing their business plans for 2016. Second, they are finishing this year strong, making the marketing effort to positively influence how they start off in January. These individual efforts, along with the overall healthy market, should provide for 2016 to be your best year ever. And we will be helping you achieve that goal.

C.A.R. came out with their annual forecast at the October meeting in San Jose. Dilbeck was provided a private presentation on October 23rd. C.A.R’s forecast is for the number of sales to increase in 2016 by 6.3%, while the value of homes increases 3.2%. If your clients ask what you think 2016 will hold, I would advise using these numbers, and referencing them to C.A.R.’s professional economists. It is a better forecast than you or I could make.

Have a prosperous month. Have a prosperous 2016.

Chuck