There are a great many things that influence our real estate market. Changing prices, the FED, interest rates, the weather, the time of year.

Our current market is ruled by inventory, more accurately a lack of inventory.

Lack of inventory is currently affecting two measures that usually act together, but at this time are moving in different directions.

Lack of inventory is causing housing prices to move up strongly.

Lack of inventory is causing the number of homes sold to be very weak.

In 2021 and 2022, we had a lack of inventory, but housing prices and the number of homes sold both rose strongly. What is different about this year?

2021 and 2022 were an anomaly, strongly affected by Covid. Demand was very strong, and available inventory filled the demand. Owners were able to sell their current homes and buy another because mortgage rates were low. Owners could list and buy another home without changing their under-3% rates.

In 2023, owners are resisting moving because rates are now close to 7%. Supply (active listings) remains low not because buyers are scrambling to buy, but because owners are hesitant to list. They can replace their homes, but they can’t replace their mortgages.

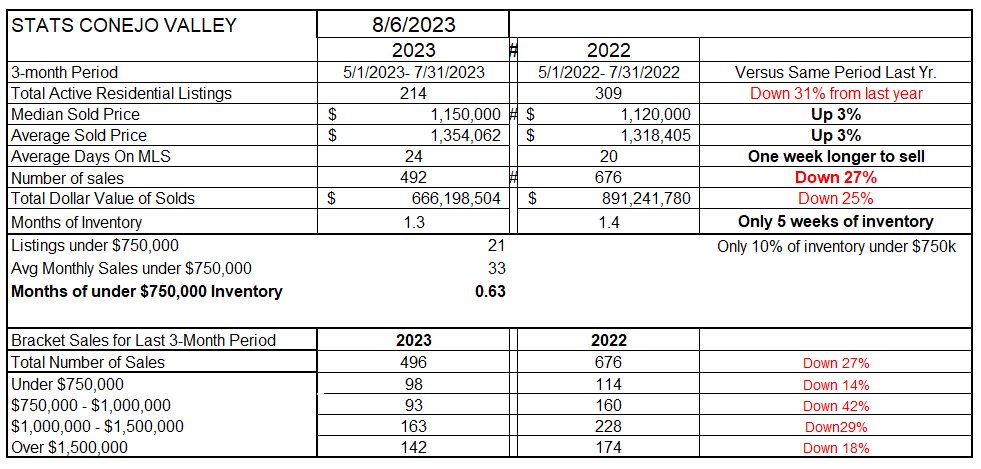

CONEJO VALLEY

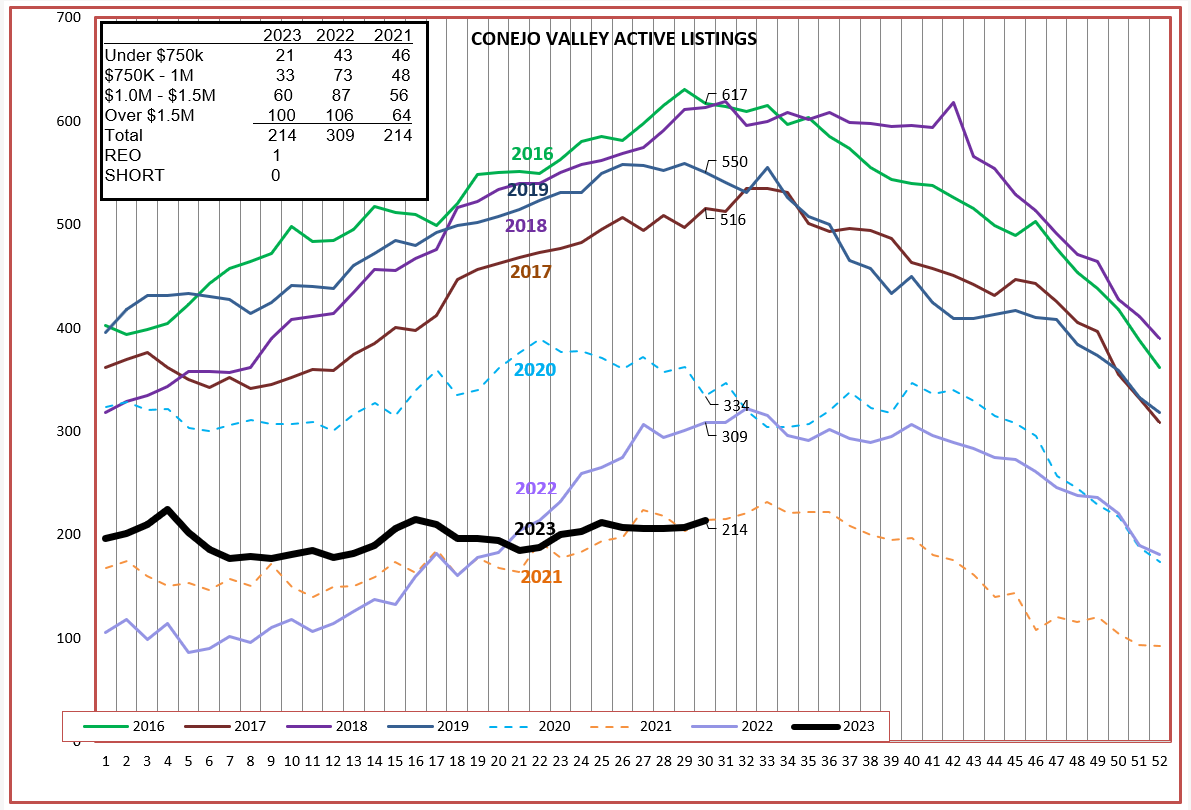

Let’s look at inventory first. Conejo has the exact same number of active listings as it did in 2021, when the market was on fire. Instead of inventory climbing as it does when the year progresses, inventory is stuck at a very low level. Comparing 2023 to 2021, the box in the graph below shows a very low inventory if you discount the number of very high priced listings. Over-$1.5 million listings now represent 50% of all Conejo listings, up from 33% last year. In mid-2022, mortgage rates began their climb, and 2023 felt the effects by turning inventory into a straight line as the year progressed.

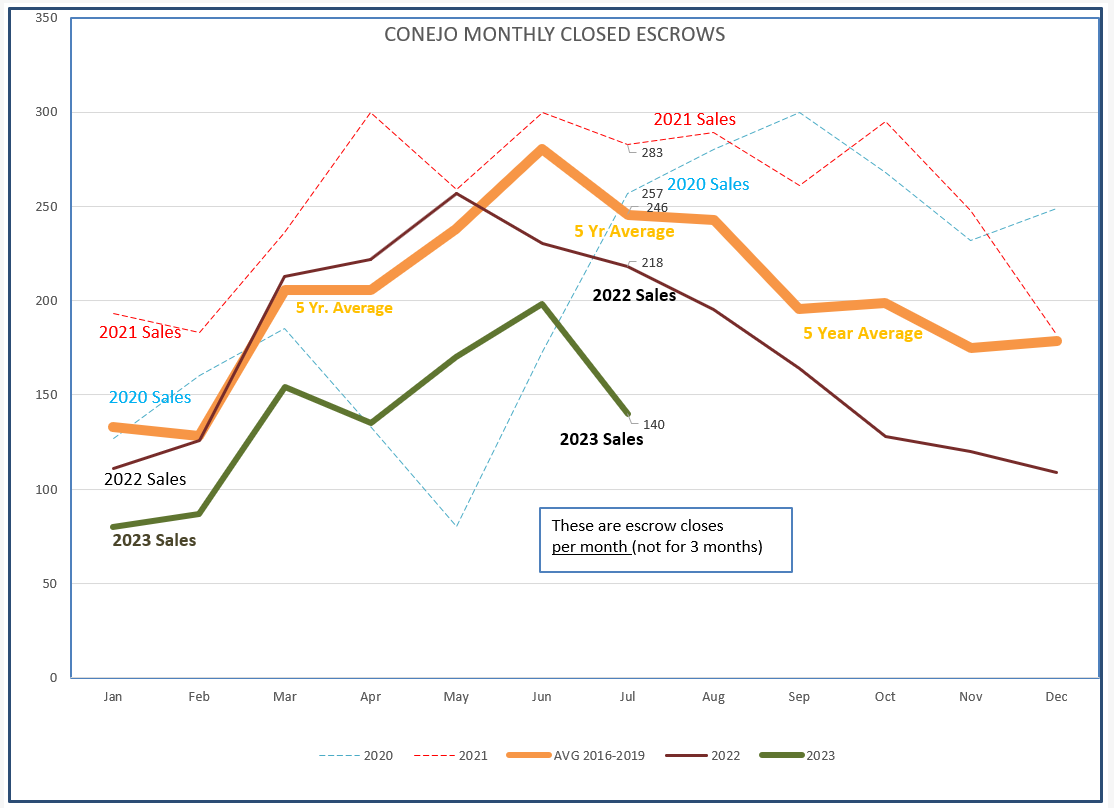

The high rate of sales began in the latter half of 2020, as Covid at first devastated sales and then surprisingly accelerated sales, and continued strong into 2021. Sales in 2021 exceeded the 5-year average in every single month. In 2022 the market returned to the normal pattern expected as the year wore on, but at a much reduced sales level.

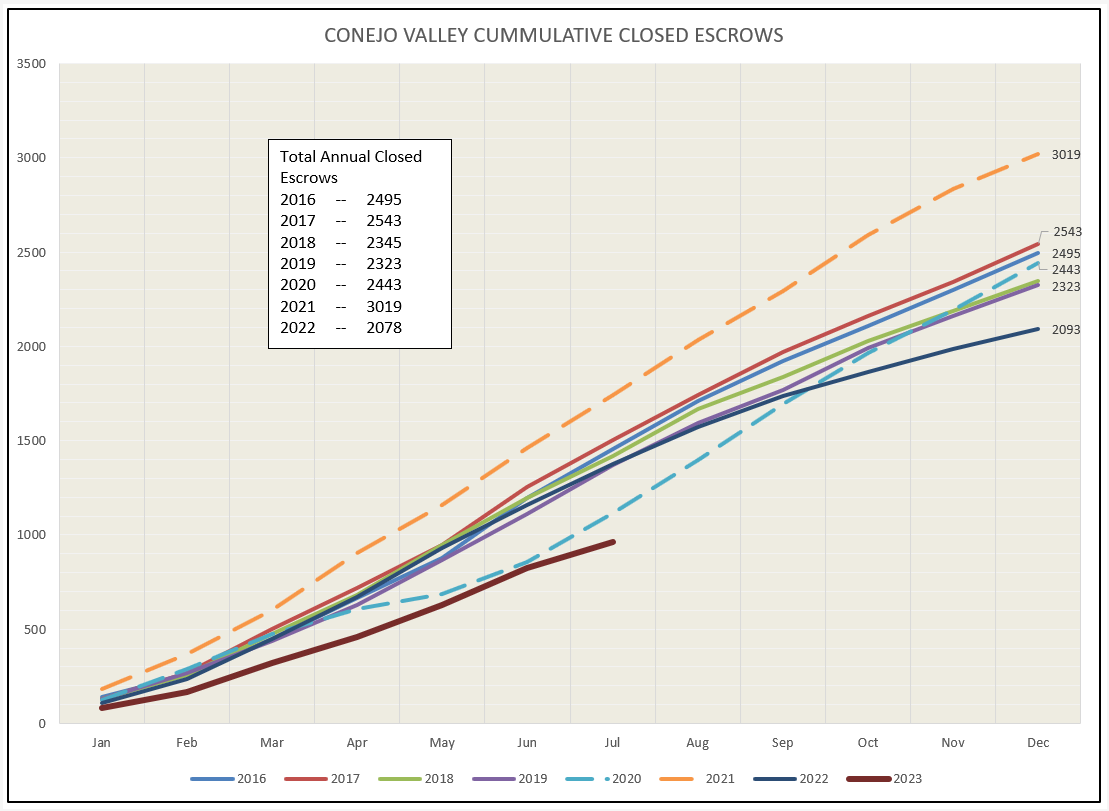

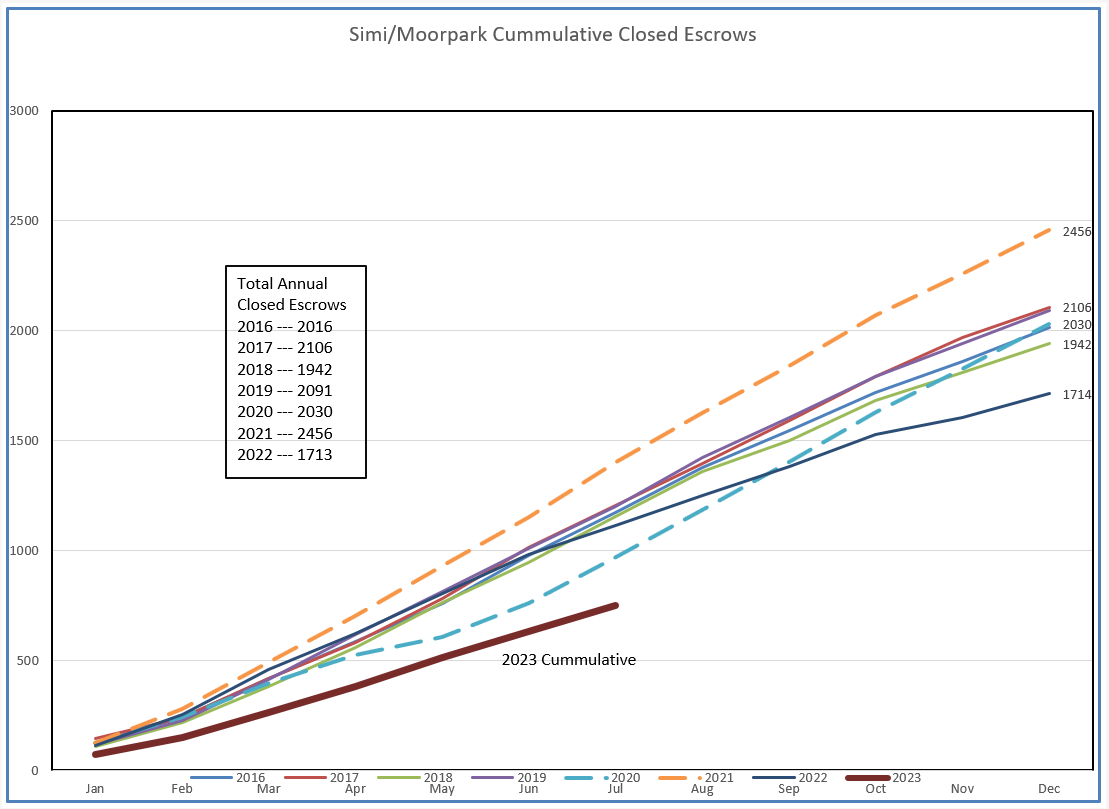

2023 is turning out to be a flat-lined year. The chart below displays the total number of sales as the year progressed. I estimate we will finish 2023 with 30% fewer closed sales. Not a bad year for homeowners because prices are rising, but a bad year for realtors.

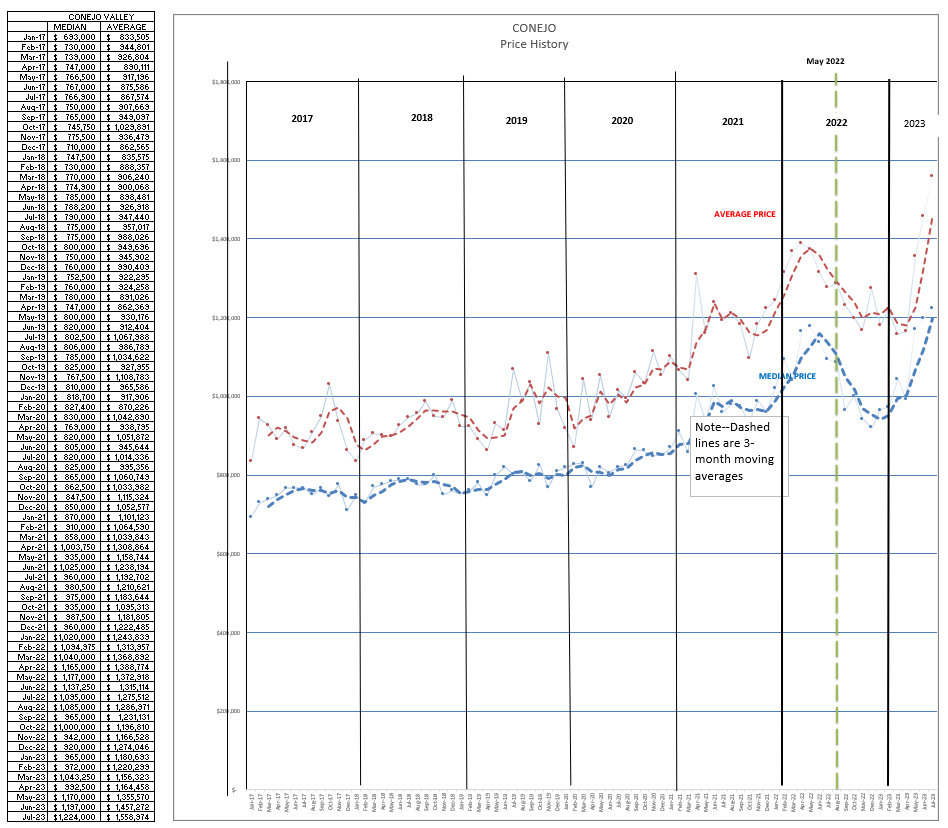

Prices have again increased strongly due to the lack of inventory, more buyers chasing fewer listings. As mortgage rates climbed in May 2022, prices began a steady decline, finishing the year at the same level as the year began. Both the median and average prices have now surpassed the highs reached in 2022 and continue their upwards climb, again due to lack of inventory.

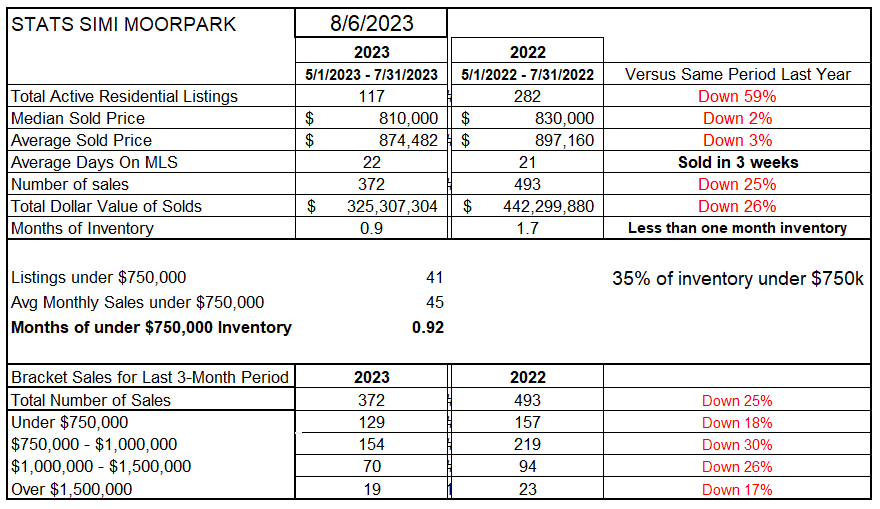

SIMI VALLEY/MOORPARK

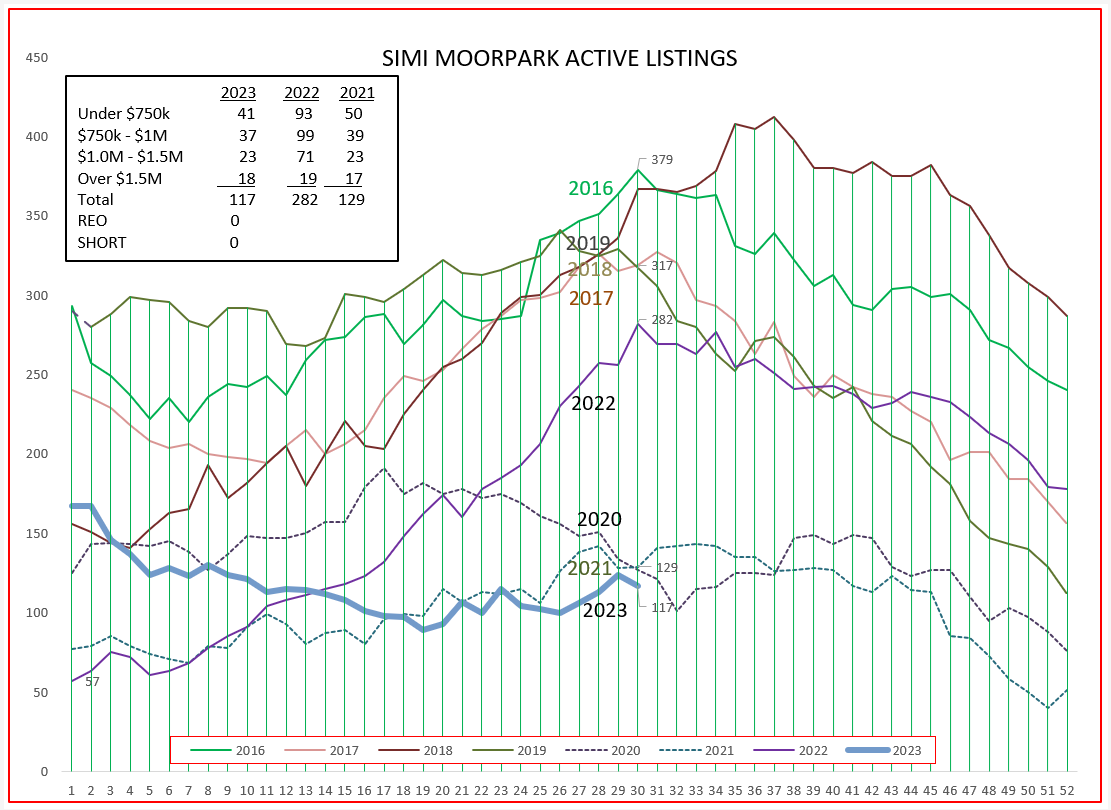

There is $200,000 difference in median pricing between Conejo and Simi/Moorpark, and a 300,000 difference in average prices. Simi/Moorpark has a different mix of prices, as you will see in the statistics tables later in this report. Inventory is currently at a record low in both valleys. Inventory generally follows a pattern of increasing into the summer months and decreasing during the fall months. 2023 has not followed the normal inventory pattern. It is more like the covid period of 2020 and 2021. In 2022, inventory returned to the more usual pattern, but at a reduced level. We thought the market was back on track, but the FED provided a new wrinkle by engineering rates that basically doubled mortgage rates. In 2023, inventory became scarce because current homeowners did not list their homes to sell and purchase another because their mortgage rates would have doubled.

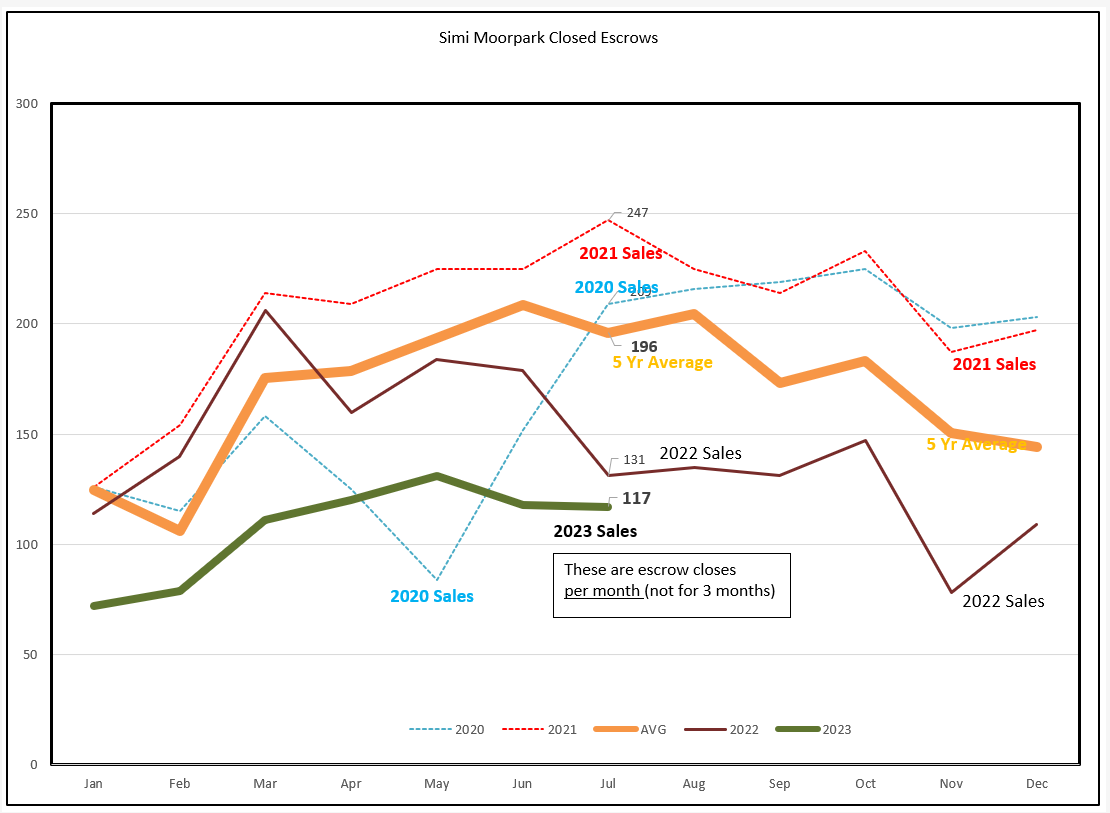

The Number of Sales then dipped to a level much reduced from the 5-year average. Mortgage rates began their climb in mid-2022, and the number of sales began to fall off.

The chart below displays the weakness in number of sales to date, much below normal years The dashed blue line shows the drop in 2020 as Covid spread, but then recovered as what we might call panic-buying ensued. A strong last half of 2020 turned a very bad year into what ended up as an average number-of-sales year. 2021 was out of sight. Panic buying is no longer occurring, and 2022 sales numbers turned out pretty average. I would like to forecast 2023 mirroring that return to normalcy, but that is not going to happen.

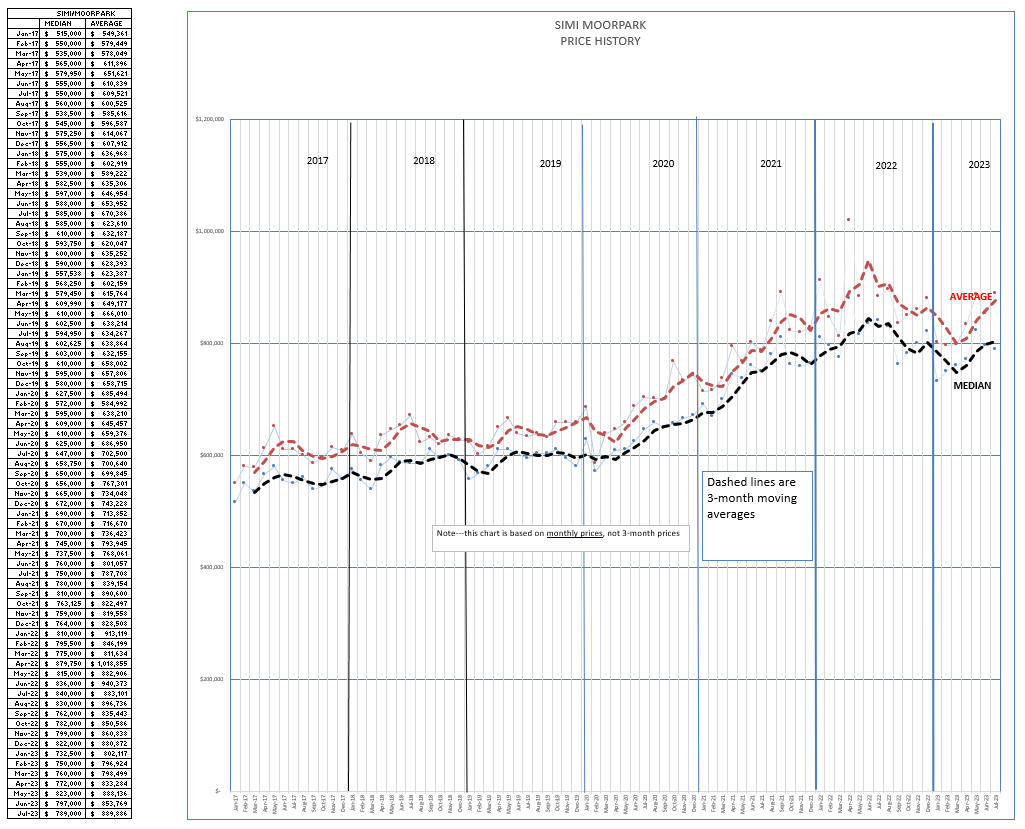

Demand remains relatively strong, even though somewhat reduced by mortgage rate increases. Reduced demand has bumped up against low inventory levels. A low listing inventory caused prices to again begin rising in early 2023, and they continue to increase. However, prices have not yet reached the level of that panic-buying in 2021 and the first half of 2022. The second half of 2022 showed a strong decline in prices as mortgage rates increased. That decline reversed in spring 2023 and continues upwards.

COMPARING THE TWO VALLEYS

Why the difference between the two valleys? It is based on the mix of housing in different price levels.

In the Conejo Valley, only 10% of the entire available inventory is priced below $750,000. Whereas in Simi Valley/Moorpark, 35% of the inventory is priced below $750,000. The comparative lack of inventory is very pronounced, with Conejo down 31% versus Simi/Moorpark down 59%. Compared to the same month a year ago, Conejo prices have risen by 3%, whereas Simi/Moorpark prices are down 2-3%. Due to historic low inventory levels, Simi/Moorpark was very much in demand by entry level buyers. But those buyers have less ability to deal with the strong price increases, and a larger percentage began dropping out of the market.

Inventory remains extremely low, only around one month-worth of sales in both areas. Once listed, the properties continue to fly off the market in less than a month. When that happens, pricing remains strong.

The harsh figure for our profession is that the number of sales is currently 25-27% lower than last year. In addition, the number of realtors licensed grew during the last few years, so more realtors are competing for less business. Things will get better, but the FED has to agree to it first. Happily, inflation appears to be less a factor, but until the FED starts lowering rates (another increase just last month) the housing market will continue to see these same results.

Chuck

Thank you for sending. Always interesting.